Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

North America and Latin America<br />

During <strong>2010</strong> <strong>Skanska</strong> USA Civil was awarded assignments that included<br />

port renovations at the U.S. Navy facility in Portsmouth, Virginia, with<br />

a contract amount <strong>of</strong> about <strong>USD</strong> 0.2 billion. <strong>Skanska</strong> USA Building<br />

received two construction management assignments in Ontario, Canada<br />

with a total contract value <strong>of</strong> about <strong>USD</strong> 0.4 billion; two construction<br />

management assignments related to a hospital in Florida and a large<br />

industrial facility in Arizona, with a total contract amount <strong>of</strong> about<br />

<strong>USD</strong> 0.2 billion; and two major healthcare projects in California with a<br />

total contract amount <strong>of</strong> about <strong>USD</strong> 0.3 billion. During <strong>2010</strong> <strong>Skanska</strong>’s<br />

two American construction business areas received a joint contract<br />

related to the new PATH commuter train station in the World Trade<br />

Center area <strong>of</strong> New York City, where <strong>Skanska</strong>’s share <strong>of</strong> the total order<br />

amount was about <strong>USD</strong> 0.4 billion. In Latin America, <strong>Skanska</strong> Latin<br />

America’s orders included an assignment at an oil refinery in Brazil,<br />

where <strong>Skanska</strong>’s share <strong>of</strong> the total contract amount is about <strong>USD</strong> 0.2 billion.<br />

<strong>Skanska</strong> Latin America also received the assignment to carry out a<br />

highway project in Ant<strong>of</strong>agasta, Chile with a contract amount <strong>of</strong> about<br />

<strong>USD</strong> 0.2 billion. The project is being carried out as a public-private partnership,<br />

in which <strong>Skanska</strong> Infrastructure Development owns the concession<br />

and is responsible for financing.<br />

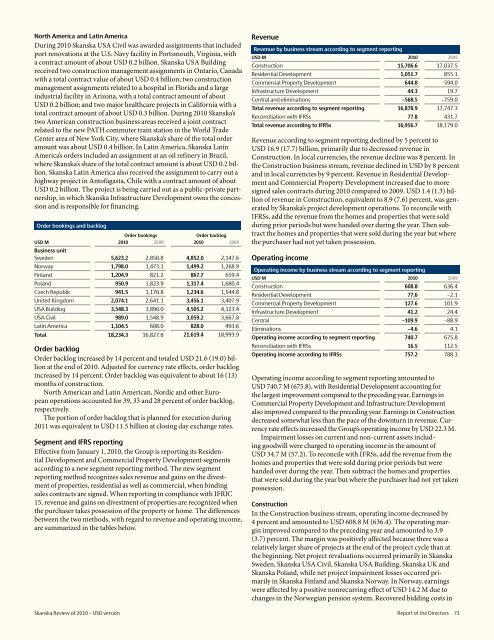

Order bookings and backlog<br />

Order bookings Order backlog<br />

<strong>USD</strong> M <strong>2010</strong> 2009 <strong>2010</strong> 2009<br />

Business unit<br />

Sweden 5,623.2 2,850.8 4,852.0 2,147.6<br />

Norway 1,798.0 1,473.1 1,499.2 1,268.9<br />

Finland 1,204.9 821.2 867.7 659.4<br />

Poland 950.9 1,823.9 1,317.4 1,680.4<br />

Czech Republic 941.5 1,170.8 1,234.6 1,544.8<br />

United Kingdom 2,074.1 2,641.1 3,456.1 3,407.9<br />

USA Building 3,548.3 3,890.0 4,505.2 4,123.4<br />

USA Civil 989.0 1,548.9 3,059.2 3,667.8<br />

Latin America 1,104.5 608.0 828.0 493.6<br />

Total 18,234.3 16,827.8 21,619.4 18,993.9<br />

Order backlog<br />

Order backlog increased by 14 percent and totaled <strong>USD</strong> 21.6 (19.0) billion<br />

at the end <strong>of</strong> <strong>2010</strong>. Adjusted for currency rate effects, order backlog<br />

increased by 14 percent. Order backlog was equivalent to about 16 (13)<br />

months <strong>of</strong> construction.<br />

North American and Latin American, Nordic and other European<br />

operations accounted for 39, 33 and 28 percent <strong>of</strong> order backlog,<br />

respectively.<br />

The portion <strong>of</strong> order backlog that is planned for execution during<br />

2011 was equivalent to <strong>USD</strong> 11.5 billion at closing day exchange rates.<br />

Segment and IFRS reporting<br />

Effective from January 1, <strong>2010</strong>, the Group is reporting its Residential<br />

Development and Commercial Property Development segments<br />

according to a new segment reporting method. The new segment<br />

reporting method recognizes sales revenue and gains on the divestment<br />

<strong>of</strong> properties, residential as well as commercial, when binding<br />

sales contracts are signed. When reporting in compliance with IFRIC<br />

15, revenue and gains on divestment <strong>of</strong> properties are recognized when<br />

the purchaser takes possession <strong>of</strong> the property or home. The differences<br />

between the two methods, with regard to revenue and operating income,<br />

are summarized in the tables below.<br />

Revenue<br />

Revenue by business stream according to segment reporting<br />

<strong>USD</strong> M <strong>2010</strong> 2009<br />

Construction 15,706.6 17,037.5<br />

Residential Development 1,051.7 855.1<br />

Commercial Property Development 644.8 594.0<br />

Infrastructure Development 44.3 19.7<br />

Central and eliminations –568.5 –759.0<br />

Total revenue according to segment reporting 16,878.9 17,747.3<br />

Reconciliation with IFRSs 77.8 431.7<br />

Total revenue according to IFRSs 16,956.7 18,179.0<br />

Revenue according to segment reporting declined by 5 percent to<br />

<strong>USD</strong> 16.9 (17.7) billion, primarily due to decreased revenue in<br />

Construction. In local currencies, the revenue decline was 8 percent. In<br />

the Construction business stream, revenue declined in <strong>USD</strong> by 8 percent<br />

and in local currencies by 9 percent. Revenue in Residential Development<br />

and Commercial Property Development increased due to more<br />

signed sales contracts during <strong>2010</strong> compared to 2009. <strong>USD</strong> 1.4 (1.3) billion<br />

<strong>of</strong> revenue in Construction, equivalent to 8.9 (7.6) percent, was generated<br />

by <strong>Skanska</strong>’s project development operations. To reconcile with<br />

IFRSs, add the revenue from the homes and properties that were sold<br />

during prior periods but were handed over during the year. Then subtract<br />

the homes and properties that were sold during the year but where<br />

the purchaser had not yet taken possession.<br />

Operating income<br />

Operating income by business stream according to segment reporting<br />

<strong>USD</strong> M <strong>2010</strong> 2009<br />

Construction 608.8 636.4<br />

Residential Development 77.6 –2.1<br />

Commercial Property Development 127.6 101.9<br />

Infrastructure Development 41.2 24.4<br />

Central –109.9 –88.9<br />

Eliminations –4.6 4.1<br />

Operating income according to segment reporting 740.7 675.8<br />

Reconciliation with IFRSs 16.5 112.5<br />

Operating income according to IFRSs 757.2 788.3<br />

Operating income according to segment reporting amounted to<br />

<strong>USD</strong> 740.7 M (675.8), with Residential Development accounting for<br />

the largest improvement compared to the preceding year. Earnings in<br />

Commercial Property Development and Infrastructure Development<br />

also improved compared to the preceding year. Earnings in Construction<br />

decreased somewhat less than the pace <strong>of</strong> the downturn in revenue. Currency<br />

rate effects increased the Group’s operating income by <strong>USD</strong> 22.3 M.<br />

Impairment losses on current and non-current assets including<br />

goodwill were charged to operating income in the amount <strong>of</strong><br />

<strong>USD</strong> 34.7 M (57.2). To reconcile with IFRSs, add the revenue from the<br />

homes and properties that were sold during prior periods but were<br />

handed over during the year. Then subtract the homes and properties<br />

that were sold during the year but where the purchaser had not yet taken<br />

possession.<br />

Construction<br />

In the Construction business stream, operating income decreased by<br />

4 percent and amounted to <strong>USD</strong> 608.8 M (636.4). The operating margin<br />

improved compared to the preceding year and amounted to 3.9<br />

(3.7) percent. The margin was positively affected because there was a<br />

relatively larger share <strong>of</strong> projects at the end <strong>of</strong> the project cycle than at<br />

the beginning. Net project revaluations occurred primarily in <strong>Skanska</strong><br />

Sweden, <strong>Skanska</strong> USA Civil, <strong>Skanska</strong> USA Building, <strong>Skanska</strong> UK and<br />

<strong>Skanska</strong> Poland, while net project impairment losses occurred primarily<br />

in <strong>Skanska</strong> Finland and <strong>Skanska</strong> Norway. In Norway, earnings<br />

were affected by a positive nonrecurring effect <strong>of</strong> <strong>USD</strong> 14.2 M due to<br />

changes in the Norwegian pension system. Recovered bidding costs in<br />

<strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong> Report <strong>of</strong> the Directors 71