Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Note<br />

06 Continued<br />

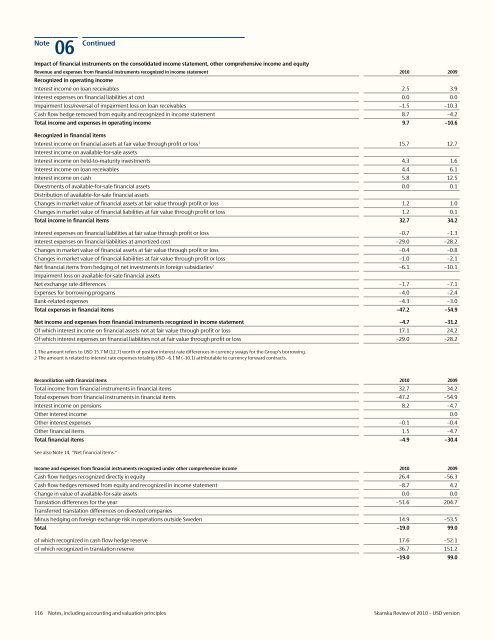

Impact <strong>of</strong> financial instruments on the consolidated income statement, other comprehensive income and equity<br />

Revenue and expenses from financial instruments recognized in income statement <strong>2010</strong> 2009<br />

Recognized in operating income<br />

Interest income on loan receivables 2.5 3.9<br />

Interest expenses on financial liabilities at cost 0.0 0.0<br />

Impairment loss/reversal <strong>of</strong> impairment loss on loan receivables –1.5 –10.3<br />

Cash flow hedge removed from equity and recognized in income statement 8.7 –4.2<br />

Total income and expenses in operating income 9.7 –10.6<br />

Recognized in financial items<br />

Interest income on financial assets at fair value through pr<strong>of</strong>it or loss 1 15.7 12.7<br />

Interest income on available-for-sale assets<br />

Interest income on held-to-maturity investments 4.3 1.6<br />

Interest income on loan receivables 4.4 6.1<br />

Interest income on cash 5.8 12.5<br />

Divestments <strong>of</strong> available-for-sale financial assets 0.0 0.1<br />

Distribution <strong>of</strong> available-for-sale financial assets<br />

Changes in market value <strong>of</strong> financial assets at fair value through pr<strong>of</strong>it or loss 1.2 1.0<br />

Changes in market value <strong>of</strong> financial liabilities at fair value through pr<strong>of</strong>it or loss 1.2 0.1<br />

Total income in financial items 32.7 34.2<br />

Interest expenses on financial liabilities at fair value through pr<strong>of</strong>it or loss –0.7 –1.3<br />

Interest expenses on financial liabilities at amortized cost –29.0 –28.2<br />

Changes in market value <strong>of</strong> financial assets at fair value through pr<strong>of</strong>it or loss –0.4 –0.8<br />

Changes in market value <strong>of</strong> financial liabilities at fair value through pr<strong>of</strong>it or loss –1.0 –2.1<br />

Net financial items from hedging <strong>of</strong> net investments in foreign subsidiaries 2 –6.1 –10.1<br />

Impairment loss on available-for-sale financial assets<br />

Net exchange rate differences –1.7 –7.1<br />

Expenses for borrowing programs –4.0 –2.4<br />

Bank-related expenses –4.3 –3.0<br />

Total expenses in financial items –47.2 –54.9<br />

Net income and expenses from financial instruments recognized in income statement –4.7 –31.2<br />

Of which interest income on financial assets not at fair value through pr<strong>of</strong>it or loss 17.1 24.2<br />

Of which interest expenses on financial liabilities not at fair value through pr<strong>of</strong>it or loss –29.0 –28.2<br />

1 The amount refers to <strong>USD</strong> 15.7 M (12.7) worth <strong>of</strong> positive interest rate differences in currency swaps for the Group's borrowing.<br />

2 The amount is related to interest rate expenses totaling <strong>USD</strong> –6.1 M (–10.1) attributable to currency forward contracts.<br />

Reconciliation with financial items <strong>2010</strong> 2009<br />

Total income from financial instruments in financial items 32.7 34.2<br />

Total expenses from financial instruments in financial items –47.2 –54.9<br />

Interest income on pensions 8.2 –4.7<br />

Other interest income 0.0<br />

Other interest expenses –0.1 –0.4<br />

Other financial items 1.5 –4.7<br />

Total financial items –4.9 –30.4<br />

See also Note 14, "Net financial items."<br />

Income and expenses from financial instruments recognized under other comprehensive income <strong>2010</strong> 2009<br />

Cash flow hedges recognized directly in equity 26.4 –56.3<br />

Cash flow hedges removed from equity and recognized in income statement –8.7 4.2<br />

Change in value <strong>of</strong> available-for-sale assets 0.0 0.0<br />

Translation differences for the year –51.6 204.7<br />

Transferred translation differences on divested companies<br />

Minus hedging on foreign exchange risk in operations outside Sweden 14.9 –53.5<br />

Total –19.0 99.0<br />

<strong>of</strong> which recognized in cash flow hedge reserve 17.6 –52.1<br />

<strong>of</strong> which recognized in translation reserve –36.7 151.2<br />

–19.0 99.0<br />

116 Notes, including accounting and valuation principles <strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong>