Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Construction in conjunction with the financial close <strong>of</strong> New Karolinska<br />

Solna added <strong>USD</strong> 7.8 M to income. In Finland, a goodwill impairment<br />

loss <strong>of</strong> <strong>USD</strong> 15.1 M in civil construction operations was charged to earnings.<br />

In <strong>Skanska</strong> USA Civil, a provision for estimated costs in conjunction<br />

with ongoing litigation was charged to earnings.<br />

Residential Development<br />

In Residential Development, operating income totaled <strong>USD</strong> 77.6 M<br />

(–2.1). The operating margin in the business stream amounted to<br />

7.4 (neg) percent. The number <strong>of</strong> project start-ups also developed<br />

satisfactorily, though at a somewhat slower pace than project start-ups.<br />

Impairment losses on current assets (land) were charged to earnings in<br />

the amount <strong>of</strong> <strong>USD</strong> 4.9 M (3.7).<br />

Commercial Property Development<br />

Operating income in Commercial Property Development totaled<br />

<strong>USD</strong> 127.6 M (101.9). During the year, the business stream carried out<br />

divestments worth <strong>USD</strong> 546.9 M (465.0). Its operating income included<br />

capital gains from property divestments amounting <strong>USD</strong> 109.7 M (98.5).<br />

Infrastructure Development<br />

Operating income in Infrastructure Development totaled <strong>USD</strong> 41.2 M<br />

(24.4). Income was favorably affected in the amount <strong>of</strong> <strong>USD</strong> 13.5 M by the<br />

business stream’s divestment <strong>of</strong> its stake in the Orkdalsvegen E39 road in<br />

Norway. The financial close <strong>of</strong> New Karolinska Solna had an impact on<br />

earnings, in the form <strong>of</strong> recovered bidding costs totaling <strong>USD</strong> 1.7 M. Additional<br />

earnings from divestments in previous years totaled <strong>USD</strong> 11.9 M.<br />

Central<br />

Central expenses including businesses that are being closed down<br />

totaled <strong>USD</strong> –109.9 M (–88.9). Units being closed down were charged to<br />

earnings in the amount <strong>of</strong> <strong>USD</strong> –18.0 M (–2.4). Of this, <strong>USD</strong> 14.4 M was<br />

related to closing-down expenses, mainly impairment losses on land for<br />

<strong>Skanska</strong>’s previous residential operations in Denmark.<br />

Eliminations <strong>of</strong> intra-Group pr<strong>of</strong>its<br />

Eliminations <strong>of</strong> intra-Group pr<strong>of</strong>its amounted to <strong>USD</strong> –4.6 M (4.1). At<br />

the Group level, this included elimination <strong>of</strong> pr<strong>of</strong>its in Construction<br />

operations related to property projects. Eliminations are reversed when<br />

the projects are divested.<br />

Income according to IFRSs<br />

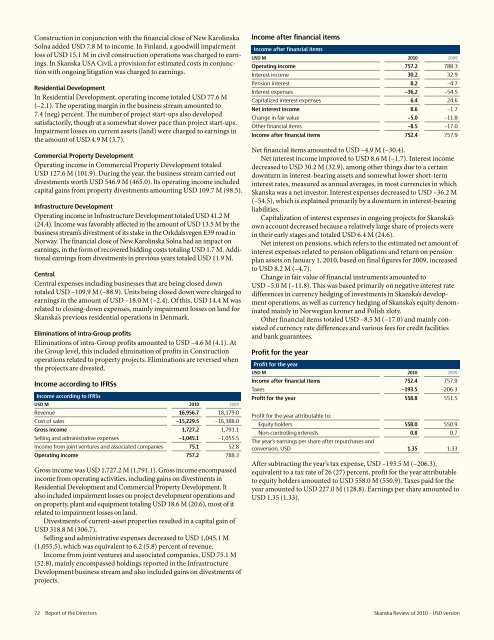

Income according to IFRSs<br />

<strong>USD</strong> M <strong>2010</strong> 2009<br />

Revenue 16,956.7 18,179.0<br />

Cost <strong>of</strong> sales –15,229.5 –16,388.0<br />

Gross income 1,727.2 1,791.1<br />

Selling and administrative expenses –1,045.1 –1,055.5<br />

Income from joint ventures and associated companies 75.1 52.8<br />

Operating income 757.2 788.3<br />

Gross income was <strong>USD</strong> 1,727.2 M (1,791.1). Gross income encompassed<br />

income from operating activities, including gains on divestments in<br />

Residential Development and Commercial Property Development. It<br />

also included impairment losses on project development operations and<br />

on property, plant and equipment totaling <strong>USD</strong> 18.6 M (20.6), most <strong>of</strong> it<br />

related to impairment losses on land.<br />

Divestments <strong>of</strong> current-asset properties resulted in a capital gain <strong>of</strong><br />

<strong>USD</strong> 318.8 M (306.7).<br />

Selling and administrative expenses decreased to <strong>USD</strong> 1,045.1 M<br />

(1,055.5), which was equivalent to 6.2 (5.8) percent <strong>of</strong> revenue.<br />

Income from joint ventures and associated companies, <strong>USD</strong> 75.1 M<br />

(52.8), mainly encompassed holdings reported in the Infrastructure<br />

Development business stream and also included gains on divestments <strong>of</strong><br />

projects.<br />

Income after financial items<br />

Income after financial items<br />

<strong>USD</strong> M <strong>2010</strong> 2009<br />

Operating income 757.2 788.3<br />

Interest income 30.2 32.9<br />

Pension interest 8.2 –4.7<br />

Interest expenses –36.2 –54.5<br />

Capitalized interest expenses 6.4 24.6<br />

Net interest income 8.6 –1.7<br />

Change in fair value –5.0 –11.8<br />

Other financial items –8.5 –17.0<br />

Income after financial items 752.4 757.9<br />

Net financial items amounted to <strong>USD</strong> –4.9 M (–30.4).<br />

Net interest income improved to <strong>USD</strong> 8.6 M (–1.7). Interest income<br />

decreased to <strong>USD</strong> 30.2 M (32.9), among other things due to a certain<br />

downturn in interest-bearing assets and somewhat lower short-term<br />

interest rates, measured as annual averages, in most currencies in which<br />

<strong>Skanska</strong> was a net investor. Interest expenses decreased to <strong>USD</strong> –36.2 M<br />

(–54.5), which is explained primarily by a downturn in interest-bearing<br />

liabilities.<br />

Capitalization <strong>of</strong> interest expenses in ongoing projects for <strong>Skanska</strong>’s<br />

own account decreased because a relatively large share <strong>of</strong> projects were<br />

in their early stages and totaled <strong>USD</strong> 6.4 M (24.6).<br />

Net interest on pensions, which refers to the estimated net amount <strong>of</strong><br />

interest expenses related to pension obligations and return on pension<br />

plan assets on January 1, <strong>2010</strong>, based on final figures for 2009, increased<br />

to <strong>USD</strong> 8.2 M (–4.7).<br />

Change in fair value <strong>of</strong> financial instruments amounted to<br />

<strong>USD</strong> –5.0 M (–11.8). This was based primarily on negative interest rate<br />

differences in currency hedging <strong>of</strong> investments in <strong>Skanska</strong>’s development<br />

operations, as well as currency hedging <strong>of</strong> <strong>Skanska</strong>’s equity denominated<br />

mainly in Norwegian kroner and Polish zloty.<br />

Other financial items totaled <strong>USD</strong> –8.5 M (–17.0) and mainly consisted<br />

<strong>of</strong> currency rate differences and various fees for credit facilities<br />

and bank guarantees.<br />

Pr<strong>of</strong>it for the year<br />

Pr<strong>of</strong>it for the year<br />

<strong>USD</strong> M <strong>2010</strong> 2009<br />

Income after financial items 752.4 757.9<br />

Taxes –193.5 –206.3<br />

Pr<strong>of</strong>it for the year 558.8 551.5<br />

Pr<strong>of</strong>it for the year attributable to:<br />

Equity holders 558.0 550.9<br />

Non-controlling interests 0.8 0.7<br />

The year’s earnings per share after repurchases and<br />

con<strong>version</strong>, <strong>USD</strong> 1.35 1.33<br />

After subtracting the year’s tax expense, <strong>USD</strong> –193.5 M (–206.3),<br />

equivalent to a tax rate <strong>of</strong> 26 (27) percent, pr<strong>of</strong>it for the year attributable<br />

to equity holders amounted to <strong>USD</strong> 558.0 M (550.9). Taxes paid for the<br />

year amounted to <strong>USD</strong> 227.0 M (128.8). Earnings per share amounted to<br />

<strong>USD</strong> 1.35 (1.33).<br />

72 Report <strong>of</strong> the Directors <strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong>