Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note<br />

37 Continued<br />

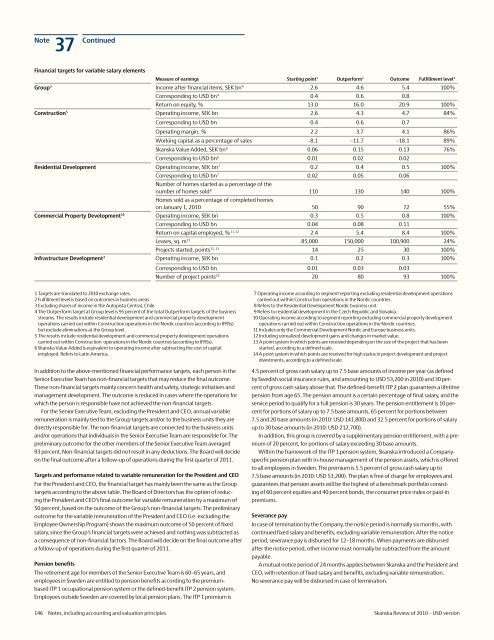

Financial targets for variable salary elements<br />

Measure <strong>of</strong> earnings Starting point 1 Outperform 1 Outcome Fulfillment level 2<br />

Group 3 Income after financial items, SEK bn 4 2.6 4.6 5.4 100%<br />

Corresponding to <strong>USD</strong> bn 4 0.4 0.6 0.8<br />

Return on equity, % 13.0 16.0 20.9 100%<br />

Construction 5 Operating income, SEK bn 2.6 4.3 4.7 84%<br />

Corresponding to <strong>USD</strong> bn 0.4 0.6 0.7<br />

Operating margin, % 2.2 3.7 4.1 86%<br />

Working capital as a percentage <strong>of</strong> sales –8.1 –11.7 –18.1 89%<br />

<strong>Skanska</strong> Value Added, SEK bn 6 0.06 0.15 0.13 76%<br />

Corresponding to <strong>USD</strong> bn 6 0.01 0.02 0.02<br />

Residential Development Operating income, SEK bn 7 0.2 0.4 0.5 100%<br />

Corresponding to <strong>USD</strong> bn 7 0.02 0.05 0.06<br />

Number <strong>of</strong> homes started as a percentage <strong>of</strong> the<br />

number <strong>of</strong> homes sold 8 110 130 140 100%<br />

Homes sold as a percentage <strong>of</strong> completed homes<br />

on January 1, <strong>2010</strong> 50 90 72 55%<br />

Commercial Property Development 10 Operating income, SEK bn 0.3 0.5 0.8 100%<br />

Corresponding to <strong>USD</strong> bn 0.04 0.08 0.11<br />

Return on capital employed, % 11, 12 2.4 5.4 8.4 100%<br />

Leases, sq. m 11 85,000 150,000 100,900 24%<br />

Projects started, points 11, 13 14 25 30 100%<br />

Infrastructure Development 3 Operating income, SEK bn 0.1 0.2 0.3 100%<br />

Corresponding to <strong>USD</strong> bn 0.01 0.03 0.03<br />

Number <strong>of</strong> project points 14 20 80 93 100%<br />

1 Targets are translated to <strong>2010</strong> exchange rates.<br />

2 Fulfillment level is based on outcomes in business areas.<br />

3 Excluding shares <strong>of</strong> income in the Autopista Central, Chile.<br />

4 The Outperform target at Group level is 95 percent <strong>of</strong> the total Outperform targets <strong>of</strong> the business<br />

streams. The results include residential development and commercial property development<br />

operations carried out within Construction operations in the Nordic countries (according to IFRSs)<br />

but exclude eliminations at the Group level.<br />

5 The results include residential development and commercial property development operations<br />

carried out within Construction operations in the Nordic countries (according to IFRSs).<br />

6 <strong>Skanska</strong> Value Added is equivalent to operating income after subtracting the cost <strong>of</strong> capital<br />

employed. Refers to Latin America.<br />

In addition to the above-mentioned financial performance targets, each person in the<br />

Senior Executive Team has non-financial targets that may reduce the final outcome.<br />

These non-financial targets mainly concern health and safety, strategic initiatives and<br />

management development. The outcome is reduced in cases where the operations for<br />

which the person is responsible have not achieved the non-financial targets.<br />

For the Senior Executive Team, excluding the President and CEO, annual variable<br />

remuneration is mainly tied to the Group targets and/or to the business units they are<br />

directly responsible for. The non-financial targets are connected to the business units<br />

and/or operations that individuals in the Senior Executive Team are responsible for. The<br />

preliminary outcome for the other members <strong>of</strong> the Senior Executive Team averaged<br />

93 percent. Non-financial targets did not result in any deductions. The Board will decide<br />

on the final outcome after a follow-up <strong>of</strong> operations during the first quarter <strong>of</strong> 2011.<br />

Targets and performance related to variable remuneration for the President and CEO<br />

For the President and CEO, the financial target has mainly been the same as the Group<br />

targets according to the above table. The Board <strong>of</strong> Directors has the option <strong>of</strong> reducing<br />

the President and CEO’s final outcome for variable remuneration by a maximum <strong>of</strong><br />

50 percent, based on the outcome <strong>of</strong> the Group’s non-financial targets. The preliminary<br />

outcome for the variable remuneration <strong>of</strong> the President and CEO (i.e. excluding the<br />

Employee Ownership Program) shows the maximum outcome <strong>of</strong> 50 percent <strong>of</strong> fixed<br />

salary, since the Group’s financial targets were achieved and nothing was subtracted as<br />

a consequence <strong>of</strong> non-financial factors. The Board will decide on the final outcome after<br />

a follow-up <strong>of</strong> operations during the first quarter <strong>of</strong> 2011.<br />

Pension benefits<br />

The retirement age for members <strong>of</strong> the Senior Executive Team is 60–65 years, and<br />

employees in Sweden are entitled to pension benefits according to the premiumbased<br />

ITP 1 occupational pension system or the defined-benefit ITP 2 pension system.<br />

Employees outside Sweden are covered by local pension plans. The ITP 1 premium is<br />

7 Operating income according to segment reporting excluding residential development operations<br />

carried out within Construction operations in the Nordic countries.<br />

8 Refers to the Residential Development Nordic business unit.<br />

9 Refers to residential development in the Czech Republic and Slovakia.<br />

10 Operating income according to segment reporting excluding commercial property development<br />

operations carried out within Construction operations in the Nordic countries.<br />

11 Includes only the Commercial Development Nordic and Europe business units.<br />

12 Including unrealized development gains and changes in market value.<br />

13 A point system in which points are received depending on the size <strong>of</strong> the project that has been<br />

started, according to a defined scale.<br />

14 A point system in which points are received for high status in project development and project<br />

divestments, according to a defined scale.<br />

4.5 percent <strong>of</strong> gross cash salary up to 7.5 base amounts <strong>of</strong> income per year (as defined<br />

by Swedish social insurance rules, and amounting to <strong>USD</strong> 53,200 in <strong>2010</strong>) and 30 percent<br />

<strong>of</strong> gross cash salary above that. The defined-benefit ITP 2 plan guarantees a lifetime<br />

pension from age 65. The pension amount is a certain percentage <strong>of</strong> final salary, and the<br />

service period to qualify for a full pension is 30 years. The pension entitlement is 10 percent<br />

for portions <strong>of</strong> salary up to 7.5 base amounts, 65 percent for portions between<br />

7.5 and 20 base amounts (in <strong>2010</strong>: <strong>USD</strong> 141,800) and 32.5 percent for portions <strong>of</strong> salary<br />

up to 30 base amounts (in <strong>2010</strong>: <strong>USD</strong> 212,700).<br />

In addition, this group is covered by a supplementary pension entitlement, with a premium<br />

<strong>of</strong> 20 percent, for portions <strong>of</strong> salary exceeding 30 base amounts.<br />

Within the framework <strong>of</strong> the ITP 1 pension system, <strong>Skanska</strong> introduced a Companyspecific<br />

pension plan with in-house management <strong>of</strong> the pension assets, which is <strong>of</strong>fered<br />

to all employees in Sweden. The premium is 5.5 percent <strong>of</strong> gross cash salary up to<br />

7.5 base amounts (in <strong>2010</strong>: <strong>USD</strong> 53,200). The plan is free <strong>of</strong> charge for employees and<br />

guarantees that pension assets will be the highest <strong>of</strong> a benchmark portfolio consisting<br />

<strong>of</strong> 60 percent equities and 40 percent bonds, the consumer price index or paid-in<br />

premiums.<br />

Severance pay<br />

In case <strong>of</strong> termination by the Company, the notice period is normally six months, with<br />

continued fixed salary and benefits, excluding variable remuneration. After the notice<br />

period, severance pay is disbursed for 12–18 months. When payments are disbursed<br />

after the notice period, other income must normally be subtracted from the amount<br />

payable.<br />

A mutual notice period <strong>of</strong> 24 months applies between <strong>Skanska</strong> and the President and<br />

CEO, with retention <strong>of</strong> fixed salary and benefits, excluding variable remuneration.<br />

No severance pay will be disbursed in case <strong>of</strong> termination.<br />

146 Notes, including accounting and valuation principles <strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong>