Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note<br />

33<br />

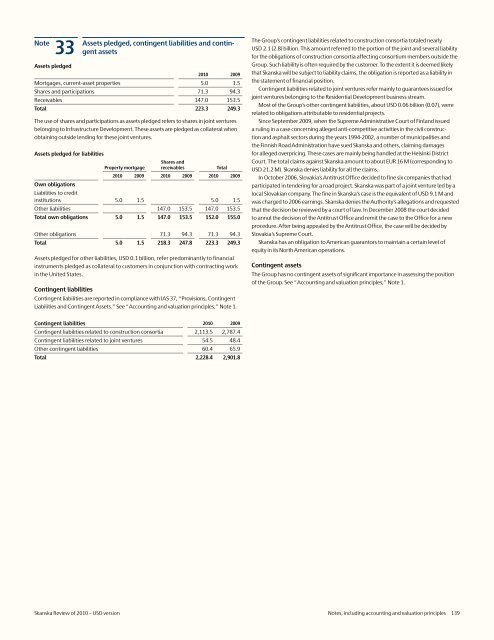

Assets pledged<br />

Assets pledged, contingent liabilities and contingent<br />

assets<br />

<strong>2010</strong> 2009<br />

Mortgages, current-asset properties 5.0 1.5<br />

Shares and participations 71.3 94.3<br />

Receivables 147.0 153.5<br />

Total 223.3 249.3<br />

The use <strong>of</strong> shares and participations as assets pledged refers to shares in joint ventures<br />

belonging to Infrastructure Development. These assets are pledged as collateral when<br />

obtaining outside lending for these joint ventures.<br />

Assets pledged for liabilities<br />

Property mortgage<br />

Shares and<br />

receivables Total<br />

<strong>2010</strong> 2009 <strong>2010</strong> 2009 <strong>2010</strong> 2009<br />

Own obligations<br />

Liabilities to credit<br />

institutions 5.0 1.5 5.0 1.5<br />

Other liabilities 147.0 153.5 147.0 153.5<br />

Total own obligations 5.0 1.5 147.0 153.5 152.0 155.0<br />

Other obligations 71.3 94.3 71.3 94.3<br />

Total 5.0 1.5 218.3 247.8 223.3 249.3<br />

Assets pledged for other liabilities, <strong>USD</strong> 0.1 billion, refer predominantly to financial<br />

instruments pledged as collateral to customers in conjunction with contracting work<br />

in the United States.<br />

Contingent liabilities<br />

Contingent liabilities are reported in compliance with IAS 37, “Provisions, Contingent<br />

Liabilities and Contingent Assets.” See “Accounting and valuation principles,” Note 1.<br />

The Group’s contingent liabilities related to construction consortia totaled nearly<br />

<strong>USD</strong> 2.1 (2.8) billion. This amount referred to the portion <strong>of</strong> the joint and several liability<br />

for the obligations <strong>of</strong> construction consortia affecting consortium members outside the<br />

Group. Such liability is <strong>of</strong>ten required by the customer. To the extent it is deemed likely<br />

that <strong>Skanska</strong> will be subject to liability claims, the obligation is reported as a liability in<br />

the statement <strong>of</strong> financial position.<br />

Contingent liabilities related to joint ventures refer mainly to guarantees issued for<br />

joint ventures belonging to the Residential Development business stream.<br />

Most <strong>of</strong> the Group’s other contingent liabilities, about <strong>USD</strong> 0.06 billion (0.07), were<br />

related to obligations attributable to residential projects.<br />

Since September 2009, when the Supreme Administrative Court <strong>of</strong> Finland issued<br />

a ruling in a case concerning alleged anti-competitive activities in the civil construction<br />

and asphalt sectors during the years 1994-2002, a number <strong>of</strong> municipalities and<br />

the Finnish Road Administration have sued <strong>Skanska</strong> and others, claiming damages<br />

for alleged overpricing. These cases are mainly being handled at the Helsinki District<br />

Court. The total claims against <strong>Skanska</strong> amount to about EUR 16 M (corresponding to<br />

<strong>USD</strong> 21.2 M). <strong>Skanska</strong> denies liability for all the claims.<br />

In October 2006, Slovakia’s Antitrust Office decided to fine six companies that had<br />

participated in tendering for a road project. <strong>Skanska</strong> was part <strong>of</strong> a joint venture led by a<br />

local Slovakian company. The fine in <strong>Skanska</strong>’s case is the equivalent <strong>of</strong> <strong>USD</strong> 9.1 M and<br />

was charged to 2006 earnings. <strong>Skanska</strong> denies the Authority’s allegations and requested<br />

that the decision be reviewed by a court <strong>of</strong> law. In December 2008 the court decided<br />

to annul the decision <strong>of</strong> the Antitrust Office and remit the case to the Office for a new<br />

procedure. After being appealed by the Antitrust Office, the case will be decided by<br />

Slovakia’s Supreme Court.<br />

<strong>Skanska</strong> has an obligation to American guarantors to maintain a certain level <strong>of</strong><br />

equity in its North American operations.<br />

Contingent assets<br />

The Group has no contingent assets <strong>of</strong> significant importance in assessing the position<br />

<strong>of</strong> the Group. See “Accounting and valuation principles,” Note 1.<br />

Contingent liabilities <strong>2010</strong> 2009<br />

Contingent liabilities related to construction consortia 2,113.5 2,787.4<br />

Contingent liabilities related to joint ventures 54.5 48.4<br />

Other contingent liabilities 60.4 65.9<br />

Total 2,228.4 2,901.8<br />

<strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong> Notes, including accounting and valuation principles 139