Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note<br />

03<br />

Effects <strong>of</strong> changes in accounting principles<br />

New segment reporting and new accounting principles for the<br />

<strong>Skanska</strong> Group<br />

Starting in <strong>2010</strong>, changes in the accounting rules in the International Financial Reporting<br />

Standards (IFRSs) affect the Residential Development (IFRIC 15), Commercial Property<br />

Development (IFRIC 15) and Infrastructure Development (IFRIC 12) segments.<br />

Under the new rules, capital gains in Residential and Commercial Property Development<br />

are recognized only when the purchaser takes possession <strong>of</strong> the property, which<br />

is generally later than the date when a binding contract is signed. In the accounting<br />

method applied to date, capital gains have been recognized successively after the signing<br />

<strong>of</strong> the sales contract and according to the percentage <strong>of</strong> completion.<br />

Since the new accounting method (IFRIC 15) does not reflect the way that the Senior<br />

Executive Team and the Board <strong>of</strong> Directors monitor operations, a new segment reporting<br />

method has been presented, in which recognition <strong>of</strong> capital gains is based on the<br />

date when a binding sales contract is signed. The previous percentage <strong>of</strong> completion<br />

method for these two business streams will thus disappear entirely in the future.<br />

As a result <strong>of</strong> the new accounting rules, cooperative housing associations are also<br />

included in their entirety in <strong>Skanska</strong>’s accounts, implying an increase in current-asset<br />

properties and financial current liabilities compared to earlier.<br />

To further increase the transparency <strong>of</strong> its accounting, <strong>Skanska</strong> has transferred residential<br />

development and commercial property development operations that have been<br />

carried out as part <strong>of</strong> Construction in the Nordic countries to the Residential and Com-<br />

mercial Property Development segments. These two segments now include all <strong>of</strong> the<br />

Group’s operations in these segments.<br />

As for Infrastructure Development, the new IFRIC 12-compliant accounting method<br />

means that income from joint ventures and associated companies is reported earlier<br />

than previously, with the added result that the carrying amount <strong>of</strong> these investments<br />

increases. The difference compared to market value thus decreases.<br />

Since the new IFRIC 12-compliant accounting method reflects the way that the<br />

Senior Executive Team and the Board <strong>of</strong> Directors monitor operations, the previous<br />

accounting method has disappeared entirely. Estimated market value figures are presented<br />

in Note 20.<br />

The new accounting rules do not change the way that <strong>Skanska</strong> reports its Construction<br />

operations. The effects <strong>of</strong> the new rules on cash flow and financial position are<br />

marginal, which means that these reports follow the new rules.<br />

To summarize, <strong>Skanska</strong> presents two income statements: one in which capital gains<br />

are recognized according to the segment reporting method in Residential and Commercial<br />

Property Development, and one in compliance with the new IFRS rules. The income<br />

statement based on segment reporting is primarily used by the Board <strong>of</strong> Directors and<br />

the Senior Executive Team to monitor operations. The Group’s incentive programs are<br />

also primarily based on segment reporting and provide guidance for the Board’s dividend<br />

decisions.<br />

The Group’s financial reports for 2009 have been restated. The effects on the Group’s<br />

financial statements for the full year 2009 and the opening balance for 2009 are presented<br />

in the following tables. Segment reporting for 2009 is also presented in Note 4.<br />

For more detailed accounting principles according to IFRIC 12 and 15, see Note 1.<br />

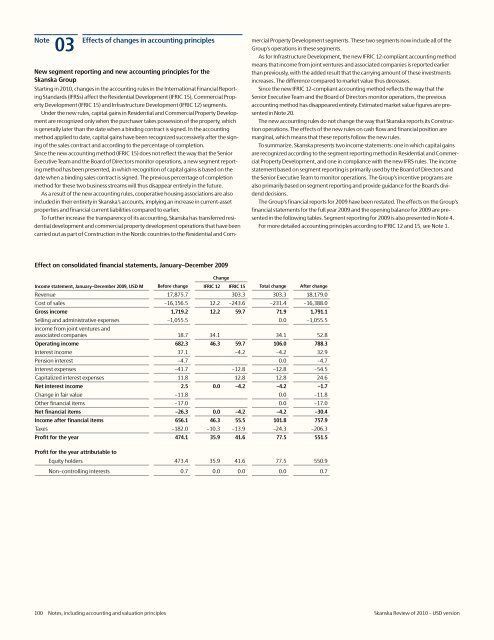

Effect on consolidated financial statements, January–December 2009<br />

Change<br />

Income statement, January–December 2009, <strong>USD</strong> M Before change IFRIC 12 IFRIC 15 Total change After change<br />

Revenue 17,875.7 303.3 303.3 18,179.0<br />

Cost <strong>of</strong> sales –16,156.5 12.2 –243.6 –231.4 –16,388.0<br />

Gross income 1,719.2 12.2 59.7 71.9 1,791.1<br />

Selling and administrative expenses –1,055.5 0.0 –1,055.5<br />

Income from joint ventures and<br />

associated companies 18.7 34.1 34.1 52.8<br />

Operating income 682.3 46.3 59.7 106.0 788.3<br />

Interest income 37.1 –4.2 –4.2 32.9<br />

Pension interest –4.7 0.0 –4.7<br />

Interest expenses –41.7 –12.8 –12.8 –54.5<br />

Capitalized interest expenses 11.8 12.8 12.8 24.6<br />

Net interest income 2.5 0.0 –4.2 –4.2 –1.7<br />

Change in fair value –11.8 0.0 –11.8<br />

Other financial items –17.0 0.0 –17.0<br />

Net financial items –26.3 0.0 –4.2 –4.2 –30.4<br />

Income after financial items 656.1 46.3 55.5 101.8 757.9<br />

Taxes –182.0 –10.3 –13.9 –24.3 –206.3<br />

Pr<strong>of</strong>it for the year 474.1 35.9 41.6 77.5 551.5<br />

Pr<strong>of</strong>it for the year attributable to<br />

Equity holders 473.4 35.9 41.6 77.5 550.9<br />

Non–controlling interests 0.7 0.0 0.0 0.0 0.7<br />

100 Notes, including accounting and valuation principles <strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong>