Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Note<br />

06 Continued<br />

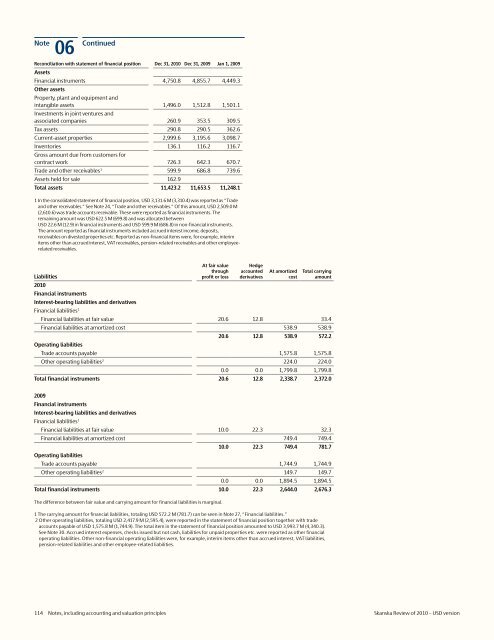

Reconciliation with statement <strong>of</strong> financial position Dec 31, <strong>2010</strong> Dec 31, 2009 Jan 1, 2009<br />

Assets<br />

Financial instruments 4,750.8 4,855.7 4,449.3<br />

Other assets<br />

Property, plant and equipment and<br />

intangible assets 1,496.0 1,512.8 1,501.1<br />

Investments in joint ventures and<br />

associated companies 260.9 353.5 309.5<br />

Tax assets 290.8 290.5 362.6<br />

Current-asset properties 2,999.6 3,195.6 3,098.7<br />

Inventories 136.1 116.2 116.7<br />

Gross amount due from customers for<br />

contract work 726.3 642.3 670.7<br />

Trade and other receivables 1 599.9 686.8 739.6<br />

Assets held for sale 162.9<br />

Total assets 11,423.2 11,653.5 11,248.1<br />

1 In the consolidated statement <strong>of</strong> financial position, <strong>USD</strong> 3,131.6 M (3,310.4) was reported as “Trade<br />

and other receivables.” See Note 24, “Trade and other receivables.” Of this amount, <strong>USD</strong> 2,509.0 M<br />

(2,610.6) was trade accounts receivable. These were reported as financial instruments. The<br />

remaining amount was <strong>USD</strong> 622.5 M (699.8) and was allocated between<br />

<strong>USD</strong> 22.6 M (12.9) in financial instruments and <strong>USD</strong> 599.9 M (686.8) in non-financial instruments.<br />

The amount reported as financial instruments included accrued interest income, deposits,<br />

receivables on divested properties etc. Reported as non-financial items were, for example, interim<br />

items other than accrued interest, VAT receivables, pension-related receivables and other employeerelated<br />

receivables.<br />

Liabilities<br />

At fair value<br />

through<br />

pr<strong>of</strong>it or loss<br />

Hedge<br />

accounted<br />

derivatives<br />

At amortized<br />

cost<br />

Total carrying<br />

amount<br />

<strong>2010</strong><br />

Financial instruments<br />

Interest-bearing liabilities and derivatives<br />

Financial liabilities 1<br />

Financial liabilities at fair value 20.6 12.8 33.4<br />

Financial liabilities at amortized cost 538.9 538.9<br />

Operating liabilities<br />

20.6 12.8 538.9 572.2<br />

Trade accounts payable 1,575.8 1,575.8<br />

Other operating liabilities 2 224.0 224.0<br />

0.0 0.0 1,799.8 1,799.8<br />

Total financial instruments 20.6 12.8 2,338.7 2,372.0<br />

2009<br />

Financial instruments<br />

Interest-bearing liabilities and derivatives<br />

Financial liabilities 1<br />

Financial liabilities at fair value 10.0 22.3 32.3<br />

Financial liabilities at amortized cost 749.4 749.4<br />

Operating liabilities<br />

10.0 22.3 749.4 781.7<br />

Trade accounts payable 1,744.9 1,744.9<br />

Other operating liabilities 2 149.7 149.7<br />

0.0 0.0 1,894.5 1,894.5<br />

Total financial instruments 10.0 22.3 2,644.0 2,676.3<br />

The difference between fair value and carrying amount for financial liabilities is marginal.<br />

1 The carrying amount for financial liabilities, totaling <strong>USD</strong> 572.2 M (781.7) can be seen in Note 27, “Financial liabilities.”<br />

2 Other operating liabilities, totaling <strong>USD</strong> 2,417.9 M (2,595.4), were reported in the statement <strong>of</strong> financial position together with trade<br />

accounts payable <strong>of</strong> <strong>USD</strong> 1,575.8 M (1,744.9). The total item in the statement <strong>of</strong> financial position amounted to <strong>USD</strong> 3,993.7 M (4,340.3).<br />

See Note 30. Accrued interest expenses, checks issued but not cash, liabilities for unpaid properties etc. were reported as other financial<br />

operating liabilities. Other non-financial operating liabilities were, for example, interim items other than accrued interest, VAT liabilities,<br />

pension-related liabilities and other employee-related liabilities.<br />

114 Notes, including accounting and valuation principles <strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong>