Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note<br />

16<br />

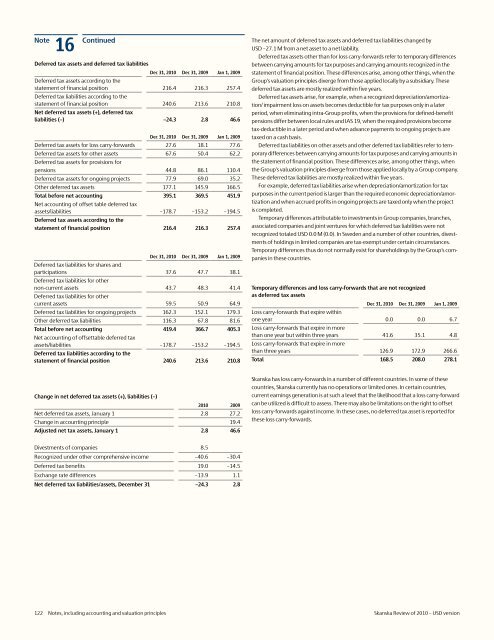

Continued The net amount <strong>of</strong> deferred tax assets and deferred tax liabilities changed by<br />

<strong>USD</strong> –27.1 M from a net asset to a net liability.<br />

Deferred tax assets and deferred tax liabilities<br />

Dec 31, <strong>2010</strong> Dec 31, 2009 Jan 1, 2009<br />

Deferred tax assets according to the<br />

statement <strong>of</strong> financial position 216.4 216.3 257.4<br />

Deferred tax liabilities according to the<br />

statement <strong>of</strong> financial position 240.6 213.6 210.8<br />

Net deferred tax assets (+), deferred tax<br />

liabilities (–) –24.3 2.8 46.6<br />

Dec 31, <strong>2010</strong> Dec 31, 2009 Jan 1, 2009<br />

Deferred tax assets for loss carry-forwards 27.6 18.1 77.6<br />

Deferred tax assets for other assets 67.6 50.4 62.2<br />

Deferred tax assets for provisions for<br />

pensions 44.8 86.1 110.4<br />

Deferred tax assets for ongoing projects 77.9 69.0 35.2<br />

Other deferred tax assets 177.1 145.9 166.5<br />

Total before net accounting 395.1 369.5 451.9<br />

Net accounting <strong>of</strong> <strong>of</strong>fset table deferred tax<br />

assets/liabilities –178.7 –153.2 –194.5<br />

Deferred tax assets according to the<br />

statement <strong>of</strong> financial position 216.4 216.3 257.4<br />

Dec 31, <strong>2010</strong> Dec 31, 2009 Jan 1, 2009<br />

Deferred tax liabilities for shares and<br />

participations 37.6 47.7 38.1<br />

Deferred tax liabilities for other<br />

non-current assets 43.7 48.3 41.4<br />

Deferred tax liabilities for other<br />

current assets 59.5 50.9 64.9<br />

Deferred tax liabilities for ongoing projects 162.3 152.1 179.3<br />

Other deferred tax liabilities 116.3 67.8 81.6<br />

Total before net accounting 419.4 366.7 405.3<br />

Net accounting <strong>of</strong> <strong>of</strong>fsettable deferred tax<br />

assets/liabilities –178.7 –153.2 –194.5<br />

Deferred tax liabilities according to the<br />

statement <strong>of</strong> financial position 240.6 213.6 210.8<br />

Deferred tax assets other than for loss carry-forwards refer to temporary differences<br />

between carrying amounts for tax purposes and carrying amounts recognized in the<br />

statement <strong>of</strong> financial position. These differences arise, among other things, when the<br />

Group’s valuation principles diverge from those applied locally by a subsidiary. These<br />

deferred tax assets are mostly realized within five years.<br />

Deferred tax assets arise, for example, when a recognized depreciation/amortization/<br />

impairment loss on assets becomes deductible for tax purposes only in a later<br />

period, when eliminating intra-Group pr<strong>of</strong>its, when the provisions for defined-benefit<br />

pensions differ between local rules and IAS 19, when the required provisions become<br />

tax-deductible in a later period and when advance payments to ongoing projects are<br />

taxed on a cash basis.<br />

Deferred tax liabilities on other assets and other deferred tax liabilities refer to temporary<br />

differences between carrying amounts for tax purposes and carrying amounts in<br />

the statement <strong>of</strong> financial position. These differences arise, among other things, when<br />

the Group’s valuation principles diverge from those applied locally by a Group company.<br />

These deferred tax liabilities are mostly realized within five years.<br />

For example, deferred tax liabilities arise when depreciation/amortization for tax<br />

purposes in the current period is larger than the required economic depreciation/amortization<br />

and when accrued pr<strong>of</strong>its in ongoing projects are taxed only when the project<br />

is completed.<br />

Temporary differences attributable to investments in Group companies, branches,<br />

associated companies and joint ventures for which deferred tax liabilities were not<br />

recognized totaled <strong>USD</strong> 0.0 M (0.0). In Sweden and a number <strong>of</strong> other countries, divestments<br />

<strong>of</strong> holdings in limited companies are tax-exempt under certain circumstances.<br />

Temporary differences thus do not normally exist for shareholdings by the Group’s companies<br />

in these countries.<br />

Temporary differences and loss carry-forwards that are not recognized<br />

as deferred tax assets<br />

Dec 31, <strong>2010</strong> Dec 31, 2009 Jan 1, 2009<br />

Loss carry-forwards that expire within<br />

one year 0.0 0.0 6.7<br />

Loss carry-forwards that expire in more<br />

than one year but within three years 41.6 35.1 4.8<br />

Loss carry-forwards that expire in more<br />

than three years 126.9 172.9 266.6<br />

Total 168.5 208.0 278.1<br />

Change in net deferred tax assets (+), liabilities (–)<br />

<strong>2010</strong> 2009<br />

Net deferred tax assets, January 1 2.8 27.2<br />

Change in accounting principle 19.4<br />

Adjusted net tax assets, January 1 2.8 46.6<br />

<strong>Skanska</strong> has loss carry-forwards in a number <strong>of</strong> different countries. In some <strong>of</strong> these<br />

countries, <strong>Skanska</strong> currently has no operations or limited ones. In certain countries,<br />

current earnings generation is at such a level that the likelihood that a loss carry-forward<br />

can be utilized is difficult to assess. There may also be limitations on the right to <strong>of</strong>fset<br />

loss carry-forwards against income. In these cases, no deferred tax asset is reported for<br />

these loss carry-forwards.<br />

Divestments <strong>of</strong> companies 8.5<br />

Recognized under other comprehensive income –40.6 –30.4<br />

Deferred tax benefits 19.0 –14.5<br />

Exchange rate differences –13.9 1.1<br />

Net deferred tax liabilities/assets, December 31 –24.3 2.8<br />

122 Notes, including accounting and valuation principles <strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong>