Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note<br />

Not<br />

16<br />

Income taxes<br />

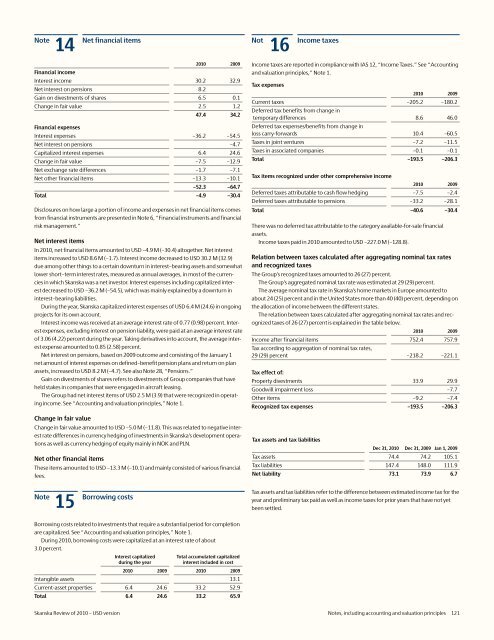

14 Net financial items <strong>2010</strong> 2009<br />

Financial income<br />

Interest income 30.2 32.9<br />

Net interest on pensions 8.2<br />

Gain on divestments <strong>of</strong> shares 6.5 0.1<br />

Change in fair value 2.5 1.2<br />

47.4 34.2<br />

Financial expenses<br />

Interest expenses –36.2 –54.5<br />

Net interest on pensions –4.7<br />

Capitalized interest expenses 6.4 24.6<br />

Change in fair value –7.5 –12.9<br />

Net exchange rate differences –1.7 –7.1<br />

Net other financial items –13.3 –10.1<br />

–52.3 –64.7<br />

Total –4.9 –30.4<br />

Disclosures on how large a portion <strong>of</strong> income and expenses in net financial items comes<br />

from financial instruments are presented in Note 6, “Financial instruments and financial<br />

risk management.”<br />

Net interest items<br />

In <strong>2010</strong>, net financial items amounted to <strong>USD</strong> –4.9 M (–30.4) altogether. Net interest<br />

items increased to <strong>USD</strong> 8.6 M (–1.7). Interest income decreased to <strong>USD</strong> 30.2 M (32.9)<br />

due among other things to a certain downturn in interest–bearing assets and somewhat<br />

lower short–term interest rates, measured as annual averages, in most <strong>of</strong> the currencies<br />

in which <strong>Skanska</strong> was a net investor. Interest expenses including capitalized interest<br />

decreased to <strong>USD</strong> –36.2 M (–54.5), which was mainly explained by a downturn in<br />

interest–bearing liabilities.<br />

During the year, <strong>Skanska</strong> capitalized interest expenses <strong>of</strong> <strong>USD</strong> 6.4 M (24.6) in ongoing<br />

projects for its own account.<br />

Interest income was received at an average interest rate <strong>of</strong> 0.77 (0.98) percent. Interest<br />

expenses, excluding interest on pension liability, were paid at an average interest rate<br />

<strong>of</strong> 3.06 (4.22) percent during the year. Taking derivatives into account, the average interest<br />

expense amounted to 0.85 (2.58) percent.<br />

Net interest on pensions, based on 2009 outcome and consisting <strong>of</strong> the January 1<br />

net amount <strong>of</strong> interest expenses on defined–benefit pension plans and return on plan<br />

assets, increased to <strong>USD</strong> 8.2 M (–4.7). See also Note 28, “Pensions.”<br />

Gain on divestments <strong>of</strong> shares refers to divestments <strong>of</strong> Group companies that have<br />

held stakes in companies that were engaged in aircraft leasing.<br />

The Group had net interest items <strong>of</strong> <strong>USD</strong> 2.5 M (3.9) that were recognized in operating<br />

income. See “Accounting and valuation principles,” Note 1.<br />

Change in fair value<br />

Change in fair value amounted to <strong>USD</strong> –5.0 M (–11.8). This was related to negative interest<br />

rate differences in currency hedging <strong>of</strong> investments in <strong>Skanska</strong>’s development operations<br />

as well as currency hedging <strong>of</strong> equity mainly in NOK and PLN.<br />

Net other financial items<br />

These items amounted to <strong>USD</strong> –13.3 M (–10.1) and mainly consisted <strong>of</strong> various financial<br />

fees.<br />

Income taxes are reported in compliance with IAS 12, “Income Taxes.” See “Accounting<br />

and valuation principles,” Note 1.<br />

Tax expenses<br />

<strong>2010</strong> 2009<br />

Current taxes –205.2 –180.2<br />

Deferred tax benefits from change in<br />

temporary differences 8.6 46.0<br />

Deferred tax expenses/benefits from change in<br />

loss carry-forwards 10.4 –60.5<br />

Taxes in joint ventures –7.2 –11.5<br />

Taxes in associated companies –0.1 –0.1<br />

Total –193.5 –206.3<br />

Tax items recognized under other comprehensive income<br />

<strong>2010</strong> 2009<br />

Deferred taxes attributable to cash flow hedging –7.5 –2.4<br />

Deferred taxes attributable to pensions –33.2 –28.1<br />

Total –40.6 –30.4<br />

There was no deferred tax attributable to the category available-for-sale financial<br />

assets.<br />

Income taxes paid in <strong>2010</strong> amounted to <strong>USD</strong> –227.0 M (–128.8).<br />

Relation between taxes calculated after aggregating nominal tax rates<br />

and recognized taxes<br />

The Group’s recognized taxes amounted to 26 (27) percent.<br />

The Group’s aggregated nominal tax rate was estimated at 29 (29) percent.<br />

The average nominal tax rate in <strong>Skanska</strong>’s home markets in Europe amounted to<br />

about 24 (25) percent and in the United States more than 40 (40) percent, depending on<br />

the allocation <strong>of</strong> income between the different states.<br />

The relation between taxes calculated after aggregating nominal tax rates and recognized<br />

taxes <strong>of</strong> 26 (27) percent is explained in the table below.<br />

<strong>2010</strong> 2009<br />

Income after financial items 752.4 757.9<br />

Tax according to aggregation <strong>of</strong> nominal tax rates,<br />

29 (29) percent –218.2 –221.1<br />

Tax effect <strong>of</strong>:<br />

Property divestments 33.9 29.9<br />

Goodwill impairment loss –7.7<br />

Other items –9.2 –7.4<br />

Recognized tax expenses –193.5 –206.3<br />

Tax assets and tax liabilities<br />

Dec 31, <strong>2010</strong> Dec 31, 2009 Jan 1, 2009<br />

Tax assets 74.4 74.2 105.1<br />

Tax liabilities 147.4 148.0 111.9<br />

Net liability 73.1 73.9 6.7<br />

Note<br />

15<br />

Borrowing costs<br />

Tax assets and tax liabilities refer to the difference between estimated income tax for the<br />

year and preliminary tax paid as well as income taxes for prior years that have not yet<br />

been settled.<br />

Borrowing costs related to investments that require a substantial period for completion<br />

are capitalized. See “Accounting and valuation principles,” Note 1.<br />

During <strong>2010</strong>, borrowing costs were capitalized at an interest rate <strong>of</strong> about<br />

3.0 percent.<br />

Interest capitalized<br />

during the year<br />

Total accumulated capitalized<br />

interest included in cost<br />

<strong>2010</strong> 2009 <strong>2010</strong> 2009<br />

Intangible assets 13.1<br />

Current-asset properties 6.4 24.6 33.2 52.9<br />

Total 6.4 24.6 33.2 65.9<br />

<strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong> Notes, including accounting and valuation principles 121