Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Note<br />

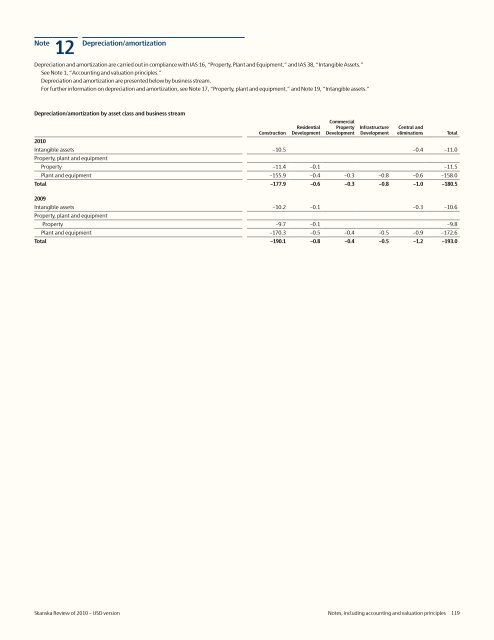

12 Depreciation/amortization<br />

Depreciation and amortization are carried out in compliance with IAS 16, “Property, Plant and Equipment,” and IAS 38, “Intangible Assets.”<br />

See Note 1, “Accounting and valuation principles.”<br />

Depreciation and amortization are presented below by business stream.<br />

For further information on depreciation and amortization, see Note 17, “Property, plant and equipment,” and Note 19, “Intangible assets.”<br />

Depreciation/amortization by asset class and business stream<br />

Construction<br />

Residential<br />

Development<br />

Commercial<br />

Property<br />

Development<br />

Infrastructure<br />

Development<br />

Central and<br />

eliminations<br />

<strong>2010</strong><br />

Intangible assets –10.5 –0.4 –11.0<br />

Property, plant and equipment<br />

Property –11.4 –0.1 –11.5<br />

Plant and equipment –155.9 –0.4 –0.3 –0.8 –0.6 –158.0<br />

Total –177.9 –0.6 –0.3 –0.8 –1.0 –180.5<br />

2009<br />

Intangible assets –10.2 –0.1 –0.3 –10.6<br />

Property, plant and equipment<br />

Property –9.7 –0.1 –9.8<br />

Plant and equipment –170.3 –0.5 –0.4 –0.5 –0.9 –172.6<br />

Total –190.1 –0.8 –0.4 –0.5 –1.2 –193.0<br />

Total<br />

<strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong> Notes, including accounting and valuation principles 119