Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The <strong>2010</strong> Annual Meeting approved the introduction <strong>of</strong> a new <strong>Skanska</strong><br />

Employee Ownership Plan for 2011–2013 that is essentially identical to the<br />

2008–<strong>2010</strong> plan.<br />

Long-term Share Award Plan (SAP), 2005–2007<br />

The <strong>Skanska</strong> Share Award Plan (SAP) applied during 2005–2007, with<br />

disbursement in the form <strong>of</strong> <strong>Skanska</strong> shares during 2009–2011. The Plan<br />

covers about 300 managers.<br />

To ensure the delivery <strong>of</strong> shares to those who are covered by the plan,<br />

300,000 Series D shares held by the Company were converted into Series<br />

B shares during <strong>2010</strong>. A total <strong>of</strong> 352,202 Series B shares were transferred to<br />

participants in the 2006 program.<br />

<strong>Skanska</strong> Employee Ownership Program, 2008–<strong>2010</strong> (SEOP)<br />

The purpose <strong>of</strong> the program is to strengthen the Group’s ability to retain<br />

and recruit qualified personnel and to align employees more closely to the<br />

Company and its shareholders.<br />

The program gives employees the opportunity to invest in <strong>Skanska</strong><br />

shares while receiving incentives in the form <strong>of</strong> possible allocation <strong>of</strong> additional<br />

share awards. This allocation is predominantly performance-based.<br />

The program runs for three years, 2008–<strong>2010</strong>, with allotment <strong>of</strong> shares<br />

earned by the employees not taking place until after a three year vesting<br />

(or “lock-up”) period, i.e. during the years 2011–2013. To be able to earn<br />

matching shares and performance shares, a person must be employed<br />

during the entire vesting period and have retained the shares purchased<br />

within the framework <strong>of</strong> the program.<br />

At present, 19 percent <strong>of</strong> the Group’s permanent employees are participating<br />

in the program.<br />

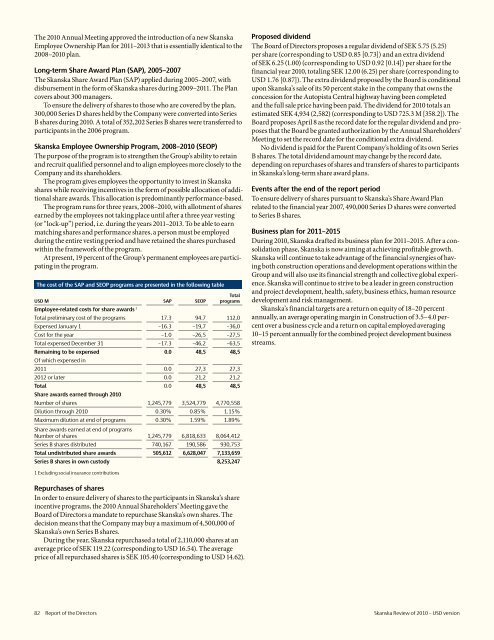

The cost <strong>of</strong> the SAP and SEOP programs are presented in the following table<br />

<strong>USD</strong> M SAP SEOP<br />

Employee-related costs for share awards 1<br />

Total<br />

programs<br />

Total preliminary cost <strong>of</strong> the programs 17.3 94.7 112,0<br />

Expensed January 1 –16.3 –19,7 –36,0<br />

Cost for the year –1.0 –26,5 –27,5<br />

Total expensed December 31 –17.3 –46,2 –63,5<br />

Remaining to be expensed 0.0 48,5 48,5<br />

Of which expensed in<br />

2011 0.0 27,3 27,3<br />

2012 or later 0.0 21,2 21,2<br />

Total 0.0 48,5 48,5<br />

Share awards earned through <strong>2010</strong><br />

Number <strong>of</strong> shares 1,245,779 3,524,779 4,770,558<br />

Dilution through <strong>2010</strong> 0.30% 0.85% 1.15%<br />

Maximum dilution at end <strong>of</strong> programs 0.30% 1.59% 1.89%<br />

Share awards earned at end <strong>of</strong> programs<br />

Number <strong>of</strong> shares 1,245,779 6,818,633 8,064,412<br />

Series B shares distributed 740,167 190,586 930,753<br />

Total undistributed share awards 505,612 6,628,047 7,133,659<br />

Series B shares in own custody 8,253,247<br />

Proposed dividend<br />

The Board <strong>of</strong> Directors proposes a regular dividend <strong>of</strong> SEK 5.75 (5.25)<br />

per share (corresponding to <strong>USD</strong> 0.85 [0.73]) and an extra dividend<br />

<strong>of</strong> SEK 6.25 (1.00) (corresponding to <strong>USD</strong> 0.92 [0.14]) per share for the<br />

financial year <strong>2010</strong>, totaling SEK 12.00 (6.25) per share (corresponding to<br />

<strong>USD</strong> 1.76 [0.87]). The extra dividend proposed by the Board is conditional<br />

upon <strong>Skanska</strong>’s sale <strong>of</strong> its 50 percent stake in the company that owns the<br />

concession for the Autopista Central highway having been completed<br />

and the full sale price having been paid. The dividend for <strong>2010</strong> totals an<br />

estimated SEK 4,934 (2,582) (corresponding to <strong>USD</strong> 725.3 M [358.2]). The<br />

Board proposes April 8 as the record date for the regular dividend and proposes<br />

that the Board be granted authorization by the Annual Shareholders’<br />

Meeting to set the record date for the conditional extra dividend.<br />

No dividend is paid for the Parent Company’s holding <strong>of</strong> its own Series<br />

B shares. The total dividend amount may change by the record date,<br />

depending on repurchases <strong>of</strong> shares and transfers <strong>of</strong> shares to participants<br />

in <strong>Skanska</strong>’s long-term share award plans.<br />

Events after the end <strong>of</strong> the report period<br />

To ensure delivery <strong>of</strong> shares pursuant to <strong>Skanska</strong>’s Share Award Plan<br />

related to the financial year 2007, 490,000 Series D shares were converted<br />

to Series B shares.<br />

Business plan for 2011–2015<br />

During <strong>2010</strong>, <strong>Skanska</strong> drafted its business plan for 2011–2015. After a consolidation<br />

phase, <strong>Skanska</strong> is now aiming at achieving pr<strong>of</strong>itable growth.<br />

<strong>Skanska</strong> will continue to take advantage <strong>of</strong> the financial synergies <strong>of</strong> having<br />

both construction operations and development operations within the<br />

Group and will also use its financial strength and collective global experience.<br />

<strong>Skanska</strong> will continue to strive to be a leader in green construction<br />

and project development, health, safety, business ethics, human resource<br />

development and risk management.<br />

<strong>Skanska</strong>’s financial targets are a return on equity <strong>of</strong> 18–20 percent<br />

annually, an average operating margin in Construction <strong>of</strong> 3.5–4.0 percent<br />

over a business cycle and a return on capital employed averaging<br />

10–15 percent annually for the combined project development business<br />

streams.<br />

1 Excluding social insurance contributions<br />

Repurchases <strong>of</strong> shares<br />

In order to ensure delivery <strong>of</strong> shares to the participants in <strong>Skanska</strong>’s share<br />

incentive programs, the <strong>2010</strong> Annual Shareholders’ Meeting gave the<br />

Board <strong>of</strong> Directors a mandate to repurchase <strong>Skanska</strong>’s own shares. The<br />

decision means that the Company may buy a maximum <strong>of</strong> 4,500,000 <strong>of</strong><br />

<strong>Skanska</strong>’s own Series B shares.<br />

During the year, <strong>Skanska</strong> repurchased a total <strong>of</strong> 2,110,000 shares at an<br />

average price <strong>of</strong> SEK 119.22 (corresponding to <strong>USD</strong> 16.54). The average<br />

price <strong>of</strong> all repurchased shares is SEK 105.40 (corresponding to <strong>USD</strong> 14.62).<br />

82 Report <strong>of</strong> the Directors <strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong>