Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note<br />

06<br />

Financial instruments and financial risk<br />

management<br />

Financial instruments are reported in compliance with IAS 39, “Financial Instruments:<br />

Recognition and Measurement,” IAS 32, “Financial Instruments: Presentation” and<br />

IFRS 7, “Financial Instruments: Disclosures.”<br />

<strong>Skanska</strong>’s gross amounts due from and to customers for contract work are not recognized<br />

as a financial instrument and the risk in these gross amounts due is thus not reported<br />

in this note.<br />

Risks in partly-owned joint venture companies in Infrastructure Development are managed<br />

in each respective company. <strong>Skanska</strong>’s aim is to ensure that financial risk management<br />

in these companies is equivalent to that which applies to the Group’s wholly owned<br />

companies. Because the contract period in many cases amounts to decades, management<br />

<strong>of</strong> the interest rate risk in financing is essential in each respective company. This risk is managed<br />

with the help <strong>of</strong> long-term interest rate swaps. These holdings are reported according<br />

to the equity method <strong>of</strong> accounting. As a result, financial instruments in each company<br />

are included in the items “Income from joint ventures and associated companies,” “Effect<br />

<strong>of</strong> cash flow hedges,” and “Investments in joint ventures and associated companies.”<br />

Disclosures on financial instruments in associated companies and joint ventures are not<br />

included in the following disclosures.<br />

FINANCIAL RISK MANAGEMENT<br />

Through its operations, aside from business risks <strong>Skanska</strong> is exposed to various financial<br />

risks such as credit risk, liquidity risk and market risk. These risks arise in the Group’s<br />

reported financial instruments such as cash and cash equivalents, interest-bearing<br />

receivables, trade accounts receivable, accounts payable, borrowings and derivatives.<br />

Objectives and policy<br />

The Group endeavors to achieve a systematic assessment <strong>of</strong> both financial and business<br />

risks. For this purpose, it uses a common risk management model. The risk management<br />

model does not imply avoidance <strong>of</strong> risks, but is instead aimed at identifying and managing<br />

these risks.<br />

Through the Group’s Financial Policy, each year the Board <strong>of</strong> Directors states guidelines,<br />

objectives and limits for financial management and administration <strong>of</strong> financial risks in the<br />

Group. This policy document regulates the allocation <strong>of</strong> responsibility among <strong>Skanska</strong>’s<br />

Board, the Senior Executive Team, <strong>Skanska</strong> Financial Services (<strong>Skanska</strong>’s internal financial<br />

unit) and the business units.<br />

Within the Group, <strong>Skanska</strong> Financial Services has operational responsibility for ensuring<br />

Group financing and for managing liquidity, financial assets and financial liabilities.<br />

A centralized financial unit enables <strong>Skanska</strong> to take advantage <strong>of</strong> economies <strong>of</strong> scale and<br />

synergies.<br />

The objectives and policy for each type <strong>of</strong> risk are described in the respective sections<br />

below.<br />

Credit risk<br />

Credit risk describes the Group’s risk from financial assets and arises if a counterparty<br />

does not fulfill its contractual payment obligation to <strong>Skanska</strong>. Credit risk is divided into<br />

financial credit risk, which refers to risk from interest-bearing assets, and customer<br />

credit risk, which refers to the risk from trade accounts receivable.<br />

Financial credit risk − risk in interest-bearing assets<br />

Financial risk is the risk that the Group runs in its relations with financial counterparties<br />

in the case <strong>of</strong> deposits <strong>of</strong> surplus funds, bank account balances and investments in<br />

financial assets. Credit risk also arises when using derivative instruments and consists<br />

<strong>of</strong> the risk that a potential gain will not be realized in case the counterparty does not<br />

fulfill its part <strong>of</strong> the contract. In order to reduce the credit risk in derivatives, <strong>Skanska</strong> has<br />

signed standardized netting (ISDA) agreements with all financial counterparties with<br />

which it enters into derivative contracts.<br />

<strong>Skanska</strong> endeavors to limit the number <strong>of</strong> financial counterparties, which must possess<br />

a rating at least equivalent to BBB+ at Standard & Poor’s or the equivalent rating at<br />

Moody’s. The permitted exposure volume per counterparty is dependent on the counterparty’s<br />

credit rating and the maturity <strong>of</strong> the exposure.<br />

Maximum exposure is equivalent to the fair value <strong>of</strong> the assets and amounted to<br />

<strong>USD</strong> 2,213.1 M. The average maturity <strong>of</strong> interest-bearing assets amounted to 0.5 (0.2)<br />

years on December 31, <strong>2010</strong>. The increase was primarily due to bridge financing in conjunction<br />

with the New Karolinska Solna project.<br />

Customer credit risk − risk in trade accounts receivable<br />

Customer credit risks are managed within the <strong>Skanska</strong> Group’s common procedures for<br />

identifying and managing risks: the <strong>Skanska</strong> Tender Approval Procedure (STAP) and the<br />

Operational Risk Assessment (ORA).<br />

<strong>Skanska</strong>’s credit risk with regard to trade receivables has a high degree <strong>of</strong> risk diversification,<br />

due to the large number <strong>of</strong> projects <strong>of</strong> varying sizes and types with numerous different<br />

customer categories in a large number <strong>of</strong> geographic markets.<br />

The portion <strong>of</strong> <strong>Skanska</strong>’s operations related to construction projects extends only limited<br />

credit, since projects are invoiced in advanced as much as possible. In other operations,<br />

the extension <strong>of</strong> credit is limited to customary invoicing periods.<br />

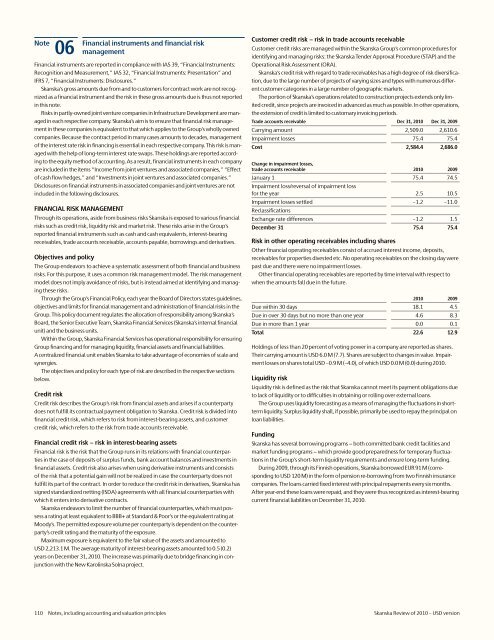

Trade accounts receivable Dec 31, <strong>2010</strong> Dec 31, 2009<br />

Carrying amount 2,509.0 2,610.6<br />

Impairment losses 75.4 75.4<br />

Cost 2,584.4 2,686.0<br />

Change in impairment losses,<br />

trade accounts receivable <strong>2010</strong> 2009<br />

January 1 75.4 74.5<br />

Impairment loss/reversal <strong>of</strong> impairment loss<br />

for the year 2.5 10.5<br />

Impairment losses settled –1.2 –11.0<br />

Reclassifications<br />

Exchange rate differences –1.2 1.5<br />

December 31 75.4 75.4<br />

Risk in other operating receivables including shares<br />

Other financial operating receivables consist <strong>of</strong> accrued interest income, deposits,<br />

receivables for properties divested etc. No operating receivables on the closing day were<br />

past due and there were no impairment losses.<br />

Other financial operating receivables are reported by time interval with respect to<br />

when the amounts fall due in the future.<br />

<strong>2010</strong> 2009<br />

Due within 30 days 18.1 4.5<br />

Due in over 30 days but no more than one year 4.6 8.3<br />

Due in more than 1 year 0.0 0.1<br />

Total 22.6 12.9<br />

Holdings <strong>of</strong> less than 20 percent <strong>of</strong> voting power in a company are reported as shares.<br />

Their carrying amount is <strong>USD</strong> 6.0 M (7.7). Shares are subject to changes in value. Impairment<br />

losses on shares total <strong>USD</strong> –0.9 M (–4.0), <strong>of</strong> which <strong>USD</strong> 0.0 M (0.0) during <strong>2010</strong>.<br />

Liquidity risk<br />

Liquidity risk is defined as the risk that <strong>Skanska</strong> cannot meet its payment obligations due<br />

to lack <strong>of</strong> liquidity or to difficulties in obtaining or rolling over external loans.<br />

The Group uses liquidity forecasting as a means <strong>of</strong> managing the fluctuations in shortterm<br />

liquidity. Surplus liquidity shall, if possible, primarily be used to repay the principal on<br />

loan liabilities.<br />

Funding<br />

<strong>Skanska</strong> has several borrowing programs − both committed bank credit facilities and<br />

market funding programs − which provide good preparedness for temporary fluctuations<br />

in the Group’s short-term liquidity requirements and ensure long-term funding.<br />

During 2009, through its Finnish operations, <strong>Skanska</strong> borrowed EUR 91 M (corresponding<br />

to <strong>USD</strong> 120 M) in the form <strong>of</strong> pension re-borrowing from two Finnish insurance<br />

companies. The loans carried fixed interest with principal repayments every six months.<br />

After year-end these loans were repaid, and they were thus recognized as interest-bearing<br />

current financial liabilities on December 31, <strong>2010</strong>.<br />

110 Notes, including accounting and valuation principles <strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong>