Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

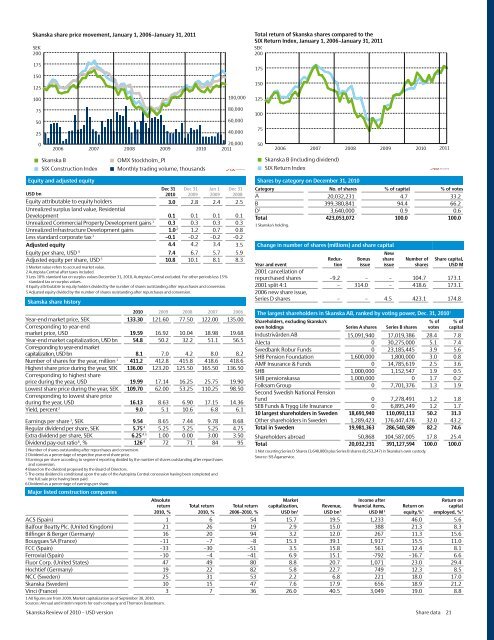

<strong>Skanska</strong> share price movement, January 1, 2006–January 31, 2011<br />

SEK<br />

200<br />

Total return <strong>of</strong> <strong>Skanska</strong> shares compared to the<br />

SIX Return Index, January 1, 2006–January 31, 2011<br />

SEK<br />

200<br />

175<br />

150<br />

125<br />

100<br />

75<br />

50<br />

25<br />

0<br />

Equity and adjusted equity<br />

<strong>USD</strong> bn<br />

2006<br />

• <strong>Skanska</strong> B<br />

SIX Construction Index<br />

Major listed construction companies<br />

The largest shareholders in <strong>Skanska</strong> AB, ranked by voting power, Dec. 31, <strong>2010</strong> 1<br />

Shareholders, excluding <strong>Skanska</strong>’s<br />

own holdings Series A shares Series B shares<br />

<strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong> Share data 21<br />

% <strong>of</strong><br />

votes<br />

% <strong>of</strong><br />

capital<br />

Industrivärden AB 15,091,940 17,019,386 28.4 7.8<br />

Alecta 0 30,275,000 5.1 7.4<br />

Swedbank Robur Funds 0 23,185,445 3.9 5.6<br />

SHB Pension Foundation 1,600,000 1,800,000 3.0 0.8<br />

AMF Insurance & Funds 0 14,785,619 2.5 3.6<br />

SHB 1,000,000 1,152,547 1.9 0.5<br />

SHB pensionskassa 1,000,000 0 1.7 0.2<br />

Folksam Group 0 7,701,376 1.3 1.9<br />

Second Swedish National Pension<br />

Fund 0 7,278,491 1.2 1.8<br />

SEB Funds & Trygg Life Insurance 0 6,895,249 1.2 1.7<br />

10 largest shareholders in Sweden 18,691,940 110,093,113 50.2 31.3<br />

Other shareholders in Sweden 1,289,423 176,447,476 32.0 43.2<br />

Total in Sweden 19,981,363 286,540,589 82.2 74.6<br />

Shareholders abroad 50,868 104,587,005 17.8 25.4<br />

Total 20,032,231 391,127,594 100.0 100.0<br />

1 Not counting Series D Shares (3,640,000) plus Series B shares (8,253,247) in <strong>Skanska</strong>’s own custody.<br />

Source: SIS Ägarservice.<br />

Absolute<br />

return Total return Total return<br />

Market<br />

capitalization, Revenue,<br />

Income after<br />

financial items, Return on<br />

Return on<br />

capital<br />

<strong>2010</strong>, % <strong>2010</strong>, % 2006–<strong>2010</strong>, % <strong>USD</strong> bn 1 <strong>USD</strong> bn 1 <strong>USD</strong> M 1 equity,% 1 employed, % 1<br />

ACS (Spain) 1 6 54 15.7 19.5 1,233 46.0 5.6<br />

Balfour Beatty Plc. (United Kingdom) 21 26 19 2.9 15.0 388 21.3 8.3<br />

Bilfinger & Berger (Germany) 16 20 94 3.2 12.0 267 11.3 15.6<br />

Bouygues SA (France) –11 –7 –8 15.3 39.1 1,917 15.5 11.0<br />

FCC (Spain) –33 –30 –51 3.5 15.8 561 12.4 8.1<br />

Ferrovial (Spain) –10 –4 –41 6.9 15.1 -792 –16.7 6.6<br />

Fluor Corp. (United States) 47 49 80 8.8 20.7 1,071 23.0 29.4<br />

Hochtief (Germany) 19 22 82 5.8 22.7 749 12.3 8.5<br />

NCC (Sweden) 25 31 53 2.2 6.8 221 18.0 17.0<br />

<strong>Skanska</strong> (Sweden) 10 15 47 7.6 17.9 656 18.9 21.2<br />

Vinci (France) 3 7 36 26.0 40.5 3,049 19.0 8.8<br />

1 All figures are from 2009, Market capitalization as <strong>of</strong> September 30, <strong>2010</strong>.<br />

Sources: Annual and interim reports for each company and Thomson Datastream.<br />

Dec 31<br />

<strong>2010</strong><br />

Dec 31<br />

2009<br />

Jan 1<br />

2009<br />

Dec 31<br />

2008<br />

Equity attributable to equity holders 3.0 2.8 2.4 2.5<br />

Unrealized surplus land value, Residential<br />

Development 0.1 0.1 0.1 0.1<br />

Unrealized Commercial Property Development gains 1 0.3 0.3 0.3 0.3<br />

Unrealized Infrastructure Development gains 1.0 2 1.2 0.7 0.8<br />

Less standard corporate tax 3 –0.1 –0.2 –0.2 –0.2<br />

Adjusted equity 4.4 4.2 3.4 3.5<br />

Equity per share, <strong>USD</strong> 4 7.4 6.7 5.7 5.9<br />

Adjusted equity per share, <strong>USD</strong> 5 10.8 10.1 8.1 8.3<br />

1 Market value refers to accrued market value.<br />

2 Autopista Central after taxes included.<br />

3 Less 10% standard tax on surplus values December 31, <strong>2010</strong>, Autopista Central excluded. For other periods less 15%<br />

standard tax on surplus values.<br />

4 Equity attributable to equity holders divided by the number <strong>of</strong> shares outstanding after repurchases and con<strong>version</strong>.<br />

5 Adjusted equity divided by the number <strong>of</strong> shares outstanding after repurchases and con<strong>version</strong>.<br />

<strong>Skanska</strong> share history<br />

2007<br />

20,000 50<br />

2008<br />

2009<br />

<strong>2010</strong> 2011<br />

OMX Stockholm_PI<br />

• Monthly trading volume, thousands<br />

<strong>2010</strong> 2009 2008 2007 2006<br />

Year-end market price, SEK 133.30 121.60 77.50 122.00 135.00<br />

Corresponding to year-end<br />

market price, <strong>USD</strong> 19.59 16.92 10.04 18.98 19.68<br />

Year-end market capitalization, <strong>USD</strong> bn 54.8 50.2 32.2 51.1 56.5<br />

Corresponding to year-end market<br />

capitalization, <strong>USD</strong> bn 8.1 7.0 4.2 8.0 8.2<br />

Number <strong>of</strong> shares for the year, million 1 411.2 412.8 415.8 418.6 418.6<br />

Highest share price during the year, SEK 136.00 123.20 125.50 165.50 136.50<br />

Corresponding to highest share<br />

price during the year, <strong>USD</strong> 19.99 17.14 16.25 25.75 19.90<br />

Lowest share price during the year, SEK 109.70 62.00 53.25 110.25 98.50<br />

Corresponding to lowest share price<br />

during the year, <strong>USD</strong> 16.13 8.63 6.90 17.15 14.36<br />

Yield, percent 2 9.0 5.1 10.6 6.8 6.1<br />

Earnings per share 3 , SEK 9.54 8.65 7.44 9.78 8.68<br />

Regular dividend per share, SEK 5.75 4 5.25 5.25 5.25 4.75<br />

Extra dividend per share, SEK 6.25 4.5 1.00 0.00 3.00 3.50<br />

Dividend pay-out ratio 6 , % 126 4 72 71 84 95<br />

1 Number <strong>of</strong> shares outstanding after repurchases and con<strong>version</strong>.<br />

2 Dividend as a percentage <strong>of</strong> respective year-end share price.<br />

3 Earnings per share according to segment reporting divided by the number <strong>of</strong> shares outstanding after repurchases<br />

and con<strong>version</strong>.<br />

4 Based on the dividend proposed by the Board <strong>of</strong> Directors.<br />

5 The extra dividend is conditional upon the sale <strong>of</strong> the Autopista Central concession having been completed and<br />

the full sale price having been paid.<br />

6 Dividend as a percentage <strong>of</strong> earnings per share.<br />

100,000<br />

80,000<br />

60,000<br />

40,000<br />

175<br />

150<br />

125<br />

100<br />

75<br />

<strong>Skanska</strong> B (including dividend)<br />

• SIX Return Index<br />

Shares by category on December 31, <strong>2010</strong><br />

Category No. <strong>of</strong> shares % <strong>of</strong> capital % <strong>of</strong> votes<br />

A 20,032,231 4.7 33.2<br />

B 399,380,841 94.4 66.2<br />

D 1 3,640,000 0.9 0.6<br />

Total 423,053,072 100.0 100.0<br />

1 <strong>Skanska</strong>’s holding.<br />

2006 2007<br />

2008<br />

2009<br />

<strong>2010</strong> 2011<br />

Change in number <strong>of</strong> shares (millions) and share capital<br />

Reduction<br />

Bonus<br />

issue<br />

New<br />

share<br />

issue<br />

Number <strong>of</strong><br />

shares<br />

Share capital,<br />

<strong>USD</strong> M<br />

Year and event<br />

2001 cancellation <strong>of</strong><br />

repurchased shares –9.2 – – 104.7 173.1<br />

2001 split 4:1 – 314.0 – 418.6 173.1<br />

2006 new share issue,<br />

Series D shares – – 4.5 423.1 174.8