Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note<br />

06 Continued<br />

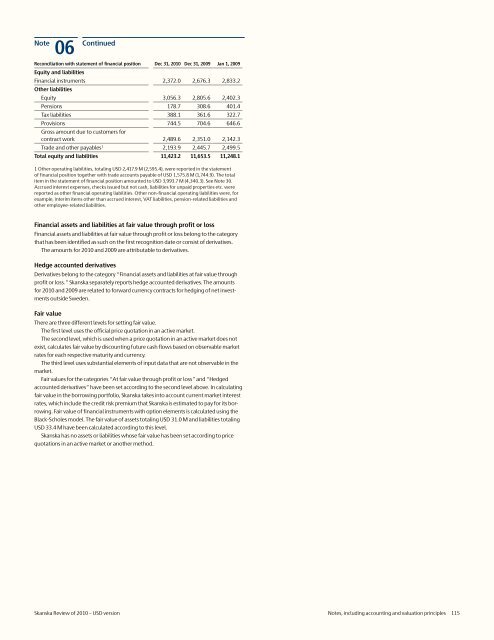

Reconciliation with statement <strong>of</strong> financial position Dec 31, <strong>2010</strong> Dec 31, 2009 Jan 1, 2009<br />

Equity and liabilities<br />

Financial instruments 2,372.0 2,676.3 2,833.2<br />

Other liabilities<br />

Equity 3,056.3 2,805.6 2,402.3<br />

Pensions 178.7 308.6 401.4<br />

Tax liabilities 388.1 361.6 322.7<br />

Provisions 744.5 704.6 646.6<br />

Gross amount due to customers for<br />

contract work 2,489.6 2,351.0 2,142.3<br />

Trade and other payables 1 2,193.9 2,445.7 2,499.5<br />

Total equity and liabilities 11,423.2 11,653.5 11,248.1<br />

1 Other operating liabilities, totaling <strong>USD</strong> 2,417.9 M (2,595.4), were reported in the statement<br />

<strong>of</strong> financial position together with trade accounts payable <strong>of</strong> <strong>USD</strong> 1,575.8 M (1,744.9). The total<br />

item in the statement <strong>of</strong> financial position amounted to <strong>USD</strong> 3,993.7 M (4,340.3). See Note 30.<br />

Accrued interest expenses, checks issued but not cash, liabilities for unpaid properties etc. were<br />

reported as other financial operating liabilities. Other non-financial operating liabilities were, for<br />

example, interim items other than accrued interest, VAT liabilities, pension-related liabilities and<br />

other employee-related liabilities.<br />

Financial assets and liabilities at fair value through pr<strong>of</strong>it or loss<br />

Financial assets and liabilities at fair value through pr<strong>of</strong>it or loss belong to the category<br />

that has been identified as such on the first recognition date or consist <strong>of</strong> derivatives.<br />

The amounts for <strong>2010</strong> and 2009 are attributable to derivatives.<br />

Hedge accounted derivatives<br />

Derivatives belong to the category “Financial assets and liabilities at fair value through<br />

pr<strong>of</strong>it or loss.” <strong>Skanska</strong> separately reports hedge accounted derivatives. The amounts<br />

for <strong>2010</strong> and 2009 are related to forward currency contracts for hedging <strong>of</strong> net investments<br />

outside Sweden.<br />

Fair value<br />

There are three different levels for setting fair value.<br />

The first level uses the <strong>of</strong>ficial price quotation in an active market.<br />

The second level, which is used when a price quotation in an active market does not<br />

exist, calculates fair value by discounting future cash flows based on observable market<br />

rates for each respective maturity and currency.<br />

The third level uses substantial elements <strong>of</strong> input data that are not observable in the<br />

market.<br />

Fair values for the categories “At fair value through pr<strong>of</strong>it or loss” and “Hedged<br />

accounted derivatives” have been set according to the second level above. In calculating<br />

fair value in the borrowing portfolio, <strong>Skanska</strong> takes into account current market interest<br />

rates, which include the credit risk premium that <strong>Skanska</strong> is estimated to pay for its borrowing.<br />

Fair value <strong>of</strong> financial instruments with option elements is calculated using the<br />

Black-Scholes model. The fair value <strong>of</strong> assets totaling <strong>USD</strong> 31.0 M and liabilities totaling<br />

<strong>USD</strong> 33.4 M have been calculated according to this level.<br />

<strong>Skanska</strong> has no assets or liabilities whose fair value has been set according to price<br />

quotations in an active market or another method.<br />

<strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong> Notes, including accounting and valuation principles 115