Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

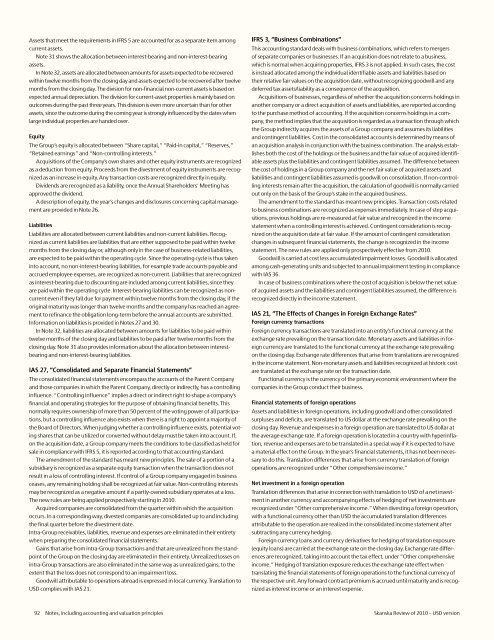

Assets that meet the requirements in IFRS 5 are accounted for as a separate item among<br />

current assets.<br />

Note 31 shows the allocation between interest-bearing and non-interest-bearing<br />

assets.<br />

In Note 32, assets are allocated between amounts for assets expected to be recovered<br />

within twelve months from the closing day and assets expected to be recovered after twelve<br />

months from the closing day. The division for non-financial non-current assets is based on<br />

expected annual depreciation. The division for current-asset properties is mainly based on<br />

outcomes during the past three years. This division is even more uncertain than for other<br />

assets, since the outcome during the coming year is strongly influenced by the dates when<br />

large individual properties are handed over.<br />

Equity<br />

The Group’s equity is allocated between “Share capital,” “Paid-in capital,” “Reserves,”<br />

“Retained earnings” and “Non-controlling interests.”<br />

Acquisitions <strong>of</strong> the Company’s own shares and other equity instruments are recognized<br />

as a deduction from equity. Proceeds from the divestment <strong>of</strong> equity instruments are recognized<br />

as an increase in equity. Any transaction costs are recognized directly in equity.<br />

Dividends are recognized as a liability, once the Annual Shareholders’ Meeting has<br />

approved the dividend.<br />

A description <strong>of</strong> equity, the year’s changes and disclosures concerning capital management<br />

are provided in Note 26.<br />

Liabilities<br />

Liabilities are allocated between current liabilities and non-current liabilities. Recognized<br />

as current liabilities are liabilities that are either supposed to be paid within twelve<br />

months from the closing day or, although only in the case <strong>of</strong> business-related liabilities,<br />

are expected to be paid within the operating cycle. Since the operating cycle is thus taken<br />

into account, no non-interest-bearing liabilities, for example trade accounts payable and<br />

accrued employee expenses, are recognized as non-current. Liabilities that are recognized<br />

as interest-bearing due to discounting are included among current liabilities, since they<br />

are paid within the operating cycle. Interest-bearing liabilities can be recognized as noncurrent<br />

even if they fall due for payment within twelve months from the closing day, if the<br />

original maturity was longer than twelve months and the company has reached an agreement<br />

to refinance the obligation long-term before the annual accounts are submitted.<br />

Information on liabilities is provided in Notes 27 and 30.<br />

In Note 32, liabilities are allocated between amounts for liabilities to be paid within<br />

twelve months <strong>of</strong> the closing day and liabilities to be paid after twelve months from the<br />

closing day. Note 31 also provides information about the allocation between interestbearing<br />

and non-interest-bearing liabilities.<br />

IAS 27, “Consolidated and Separate Financial Statements”<br />

The consolidated financial statements encompass the accounts <strong>of</strong> the Parent Company<br />

and those companies in which the Parent Company, directly or indirectly, has a controlling<br />

influence. “Controlling influence” implies a direct or indirect right to shape a company’s<br />

financial and operating strategies for the purpose <strong>of</strong> obtaining financial benefits. This<br />

normally requires ownership <strong>of</strong> more than 50 percent <strong>of</strong> the voting power <strong>of</strong> all participations,<br />

but a controlling influence also exists when there is a right to appoint a majority <strong>of</strong><br />

the Board <strong>of</strong> Directors. When judging whether a controlling influence exists, potential voting<br />

shares that can be utilized or converted without delay must be taken into account. If,<br />

on the acquisition date, a Group company meets the conditions to be classified as held for<br />

sale in compliance with IFRS 5, it is reported according to that accounting standard.<br />

The amendment <strong>of</strong> the standard has meant new principles. The sale <strong>of</strong> a portion <strong>of</strong> a<br />

subsidiary is recognized as a separate equity transaction when the transaction does not<br />

result in a loss <strong>of</strong> controlling interest. If control <strong>of</strong> a Group company engaged in business<br />

ceases, any remaining holding shall be recognized at fair value. Non-controlling interests<br />

may be recognized as a negative amount if a partly-owned subsidiary operates at a loss.<br />

The new rules are being applied prospectively starting in <strong>2010</strong>.<br />

Acquired companies are consolidated from the quarter within which the acquisition<br />

occurs. In a corresponding way, divested companies are consolidated up to and including<br />

the final quarter before the divestment date.<br />

Intra-Group receivables, liabilities, revenue and expenses are eliminated in their entirety<br />

when preparing the consolidated financial statements.<br />

Gains that arise from intra-Group transactions and that are unrealized from the standpoint<br />

<strong>of</strong> the Group on the closing day are eliminated in their entirety. Unrealized losses on<br />

intra-Group transactions are also eliminated in the same way as unrealized gains, to the<br />

extent that the loss does not correspond to an impairment loss.<br />

Goodwill attributable to operations abroad is expressed in local currency. Translation to<br />

<strong>USD</strong> complies with IAS 21.<br />

IFRS 3, “Business Combinations”<br />

This accounting standard deals with business combinations, which refers to mergers<br />

<strong>of</strong> separate companies or businesses. If an acquisition does not relate to a business,<br />

which is normal when acquiring properties, IFRS 3 is not applied. In such cases, the cost<br />

is instead allocated among the individual identifiable assets and liabilities based on<br />

their relative fair values on the acquisition date, without recognizing goodwill and any<br />

deferred tax assets/liability as a consequence <strong>of</strong> the acquisition.<br />

Acquisitions <strong>of</strong> businesses, regardless <strong>of</strong> whether the acquisition concerns holdings in<br />

another company or a direct acquisition <strong>of</strong> assets and liabilities, are reported according<br />

to the purchase method <strong>of</strong> accounting. If the acquisition concerns holdings in a company,<br />

the method implies that the acquisition is regarded as a transaction through which<br />

the Group indirectly acquires the assets <strong>of</strong> a Group company and assumes its liabilities<br />

and contingent liabilities. Cost in the consolidated accounts is determined by means <strong>of</strong><br />

an acquisition analysis in conjunction with the business combination. The analysis establishes<br />

both the cost <strong>of</strong> the holdings or the business and the fair value <strong>of</strong> acquired identifiable<br />

assets plus the liabilities and contingent liabilities assumed. The difference between<br />

the cost <strong>of</strong> holdings in a Group company and the net fair value <strong>of</strong> acquired assets and<br />

liabilities and contingent liabilities assumed is goodwill on consolidation. If non-controlling<br />

interests remain after the acquisition, the calculation <strong>of</strong> goodwill is normally carried<br />

out only on the basis <strong>of</strong> the Group’s stake in the acquired business.<br />

The amendment to the standard has meant new principles. Transaction costs related<br />

to business combinations are recognized as expenses immediately. In case <strong>of</strong> step acquisitions,<br />

previous holdings are re-measured at fair value and recognized in the income<br />

statement when a controlling interest is achieved. Contingent consideration is recognized<br />

on the acquisition date at fair value. If the amount <strong>of</strong> contingent consideration<br />

changes in subsequent financial statements, the change is recognized in the income<br />

statement. The new rules are applied only prospectively effective from <strong>2010</strong>.<br />

Goodwill is carried at cost less accumulated impairment losses. Goodwill is allocated<br />

among cash-generating units and subjected to annual impairment testing in compliance<br />

with IAS 36.<br />

In case <strong>of</strong> business combinations where the cost <strong>of</strong> acquisition is below the net value<br />

<strong>of</strong> acquired assets and the liabilities and contingent liabilities assumed, the difference is<br />

recognized directly in the income statement.<br />

IAS 21, “The Effects <strong>of</strong> Changes in Foreign Exchange Rates”<br />

Foreign currency transactions<br />

Foreign currency transactions are translated into an entity’s functional currency at the<br />

exchange rate prevailing on the transaction date. Monetary assets and liabilities in foreign<br />

currency are translated to the functional currency at the exchange rate prevailing<br />

on the closing day. Exchange rate differences that arise from translations are recognized<br />

in the income statement. Non-monetary assets and liabilities recognized at historic cost<br />

are translated at the exchange rate on the transaction date.<br />

Functional currency is the currency <strong>of</strong> the primary economic environment where the<br />

companies in the Group conduct their business.<br />

Financial statements <strong>of</strong> foreign operations<br />

Assets and liabilities in foreign operations, including goodwill and other consolidated<br />

surpluses and deficits, are translated to US dollar at the exchange rate prevailing on the<br />

closing day. Revenue and expenses in a foreign operation are translated to US dollar at<br />

the average exchange rate. If a foreign operation is located in a country with hyperinflation,<br />

revenue and expenses are to be translated in a special way if it is expected to have<br />

a material effect on the Group. In the year’s financial statements, it has not been necessary<br />

to do this. Translation differences that arise from currency translation <strong>of</strong> foreign<br />

operations are recognized under “Other comprehensive income.”<br />

Net investment in a foreign operation<br />

Translation differences that arise in connection with translation to <strong>USD</strong> <strong>of</strong> a net investment<br />

in another currency and accompanying effects <strong>of</strong> hedging <strong>of</strong> net investments are<br />

recognized under “Other comprehensive income.” When divesting a foreign operation,<br />

with a functional currency other than <strong>USD</strong> the accumulated translation differences<br />

attributable to the operation are realized in the consolidated income statement after<br />

subtracting any currency hedging.<br />

Foreign currency loans and currency derivatives for hedging <strong>of</strong> translation exposure<br />

(equity loans) are carried at the exchange rate on the closing day. Exchange rate differences<br />

are recognized, taking into account the tax effect, under “Other comprehensive<br />

income.” Hedging <strong>of</strong> translation exposure reduces the exchange rate effect when<br />

translating the financial statements <strong>of</strong> foreign operations to the functional currency <strong>of</strong><br />

the respective unit. Any forward contract premium is accrued until maturity and is recognized<br />

as interest income or an interest expense.<br />

92 Notes, including accounting and valuation principles <strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong>