Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note<br />

37 Continued<br />

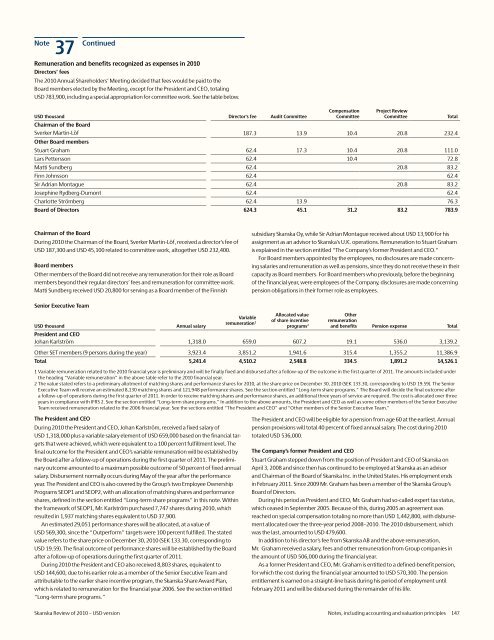

Remuneration and benefits recognized as expenses in <strong>2010</strong><br />

Directors’ fees<br />

The <strong>2010</strong> Annual Shareholders’ Meeting decided that fees would be paid to the<br />

Board members elected by the Meeting, except for the President and CEO, totaling<br />

<strong>USD</strong> 783,900, including a special appropriation for committee work. See the table below.<br />

<strong>USD</strong> thousand Director's fee Audit Committee<br />

Compensation<br />

Committee<br />

Project <strong>Review</strong><br />

Committee<br />

Chairman <strong>of</strong> the Board<br />

Sverker Martin-Löf 187.3 13.9 10.4 20.8 232.4<br />

Other Board members<br />

Stuart Graham 62.4 17.3 10.4 20.8 111.0<br />

Lars Pettersson 62.4 10.4 72.8<br />

Matti Sundberg 62.4 20.8 83.2<br />

Finn Johnsson 62.4 62.4<br />

Sir Adrian Montague 62.4 20.8 83.2<br />

Josephine Rydberg-Dumont 62.4 62.4<br />

Charlotte Strömberg 62.4 13.9 76.3<br />

Board <strong>of</strong> Directors 624.3 45.1 31.2 83.2 783.9<br />

Total<br />

Chairman <strong>of</strong> the Board<br />

During <strong>2010</strong> the Chairman <strong>of</strong> the Board, Sverker Martin-Löf, received a director’s fee <strong>of</strong><br />

<strong>USD</strong> 187,300 and <strong>USD</strong> 45,100 related to committee work, altogether <strong>USD</strong> 232,400.<br />

Board members<br />

Other members <strong>of</strong> the Board did not receive any remuneration for their role as Board<br />

members beyond their regular directors’ fees and remuneration for committee work.<br />

Matti Sundberg received <strong>USD</strong> 20,800 for serving as a Board member <strong>of</strong> the Finnish<br />

subsidiary <strong>Skanska</strong> Oy, while Sir Adrian Montague received about <strong>USD</strong> 13,900 for his<br />

assignment as an advisor to <strong>Skanska</strong>’s U.K. operations. Remuneration to Stuart Graham<br />

is explained in the section entitled “The Company’s former President and CEO.”<br />

For Board members appointed by the employees, no disclosures are made concerning<br />

salaries and remuneration as well as pensions, since they do not receive these in their<br />

capacity as Board members. For Board members who previously, before the beginning<br />

<strong>of</strong> the financial year, were employees <strong>of</strong> the Company, disclosures are made concerning<br />

pension obligations in their former role as employees.<br />

Senior Executive Team<br />

<strong>USD</strong> thousand<br />

Annual salary<br />

Variable<br />

remuneration 1<br />

Allocated value<br />

<strong>of</strong> share incentive<br />

programs 2<br />

Other<br />

remuneration<br />

and benefits Pension expense Total<br />

President and CEO<br />

Johan Karlström 1,318.0 659.0 607.2 19.1 536.0 3,139.2<br />

Other SET members (9 persons during the year) 3,923.4 3,851.2 1,941.6 315.4 1,355.2 11,386.9<br />

Total 5,241.4 4,510.2 2,548.8 334.5 1,891.2 14,526.1<br />

1 Variable remuneration related to the <strong>2010</strong> financial year is preliminary and will be finally fixed and disbursed after a follow-up <strong>of</strong> the outcome in the first quarter <strong>of</strong> 2011. The amounts included under<br />

the heading “Variable remuneration” in the above table refer to the <strong>2010</strong> financial year.<br />

2 The value stated refers to a preliminary allotment <strong>of</strong> matching shares and performance shares for <strong>2010</strong>, at the share price on December 30, <strong>2010</strong> (SEK 133.30, corresponding to <strong>USD</strong> 19.59). The Senior<br />

Executive Team will receive an estimated 8,130 matching shares and 121,948 performance shares. See the section entitled “Long-term share programs.” The Board will decide the final outcome after<br />

a follow-up <strong>of</strong> operations during the first quarter <strong>of</strong> 2011. In order to receive matching shares and performance shares, an additional three years <strong>of</strong> service are required. The cost is allocated over three<br />

years in compliance with IFRS 2. See the section entitled “Long-term share programs.” In addition to the above amounts, the President and CEO as well as some other members <strong>of</strong> the Senior Executive<br />

Team received remuneration related to the 2006 financial year. See the sections entitled “The President and CEO” and “Other members <strong>of</strong> the Senior Executive Team.”<br />

The President and CEO<br />

During <strong>2010</strong> the President and CEO, Johan Karlström, received a fixed salary <strong>of</strong><br />

<strong>USD</strong> 1,318,000 plus a variable salary element <strong>of</strong> <strong>USD</strong> 659,000 based on the financial targets<br />

that were achieved, which were equivalent to a 100 percent fulfillment level. The<br />

final outcome for the President and CEO’s variable remuneration will be established by<br />

the Board after a follow-up <strong>of</strong> operations during the first quarter <strong>of</strong> 2011. The preliminary<br />

outcome amounted to a maximum possible outcome <strong>of</strong> 50 percent <strong>of</strong> fixed annual<br />

salary. Disbursement normally occurs during May <strong>of</strong> the year after the performance<br />

year. The President and CEO is also covered by the Group’s two Employee Ownership<br />

Programs SEOP1 and SEOP2, with an allocation <strong>of</strong> matching shares and performance<br />

shares, defined in the section entitled “Long-term share programs” in this note. Within<br />

the framework <strong>of</strong> SEOP1, Mr. Karlström purchased 7,747 shares during <strong>2010</strong>, which<br />

resulted in 1,937 matching shares equivalent to <strong>USD</strong> 37,900.<br />

An estimated 29,051 performance shares will be allocated, at a value <strong>of</strong><br />

<strong>USD</strong> 569,300, since the “Outperform” targets were 100 percent fulfilled. The stated<br />

value refers to the share price on December 30, <strong>2010</strong> (SEK 133.30, corresponding to<br />

<strong>USD</strong> 19.59). The final outcome <strong>of</strong> performance shares will be established by the Board<br />

after a follow-up <strong>of</strong> operations during the first quarter <strong>of</strong> 2011.<br />

During <strong>2010</strong> the President and CEO also received 8,803 shares, equivalent to<br />

<strong>USD</strong> 144,600, due to his earlier role as a member <strong>of</strong> the Senior Executive Team and<br />

attributable to the earlier share incentive program, the <strong>Skanska</strong> Share Award Plan,<br />

which is related to remuneration for the financial year 2006. See the section entitled<br />

“Long-term share programs.”<br />

The President and CEO will be eligible for a pension from age 60 at the earliest. Annual<br />

pension provisions will total 40 percent <strong>of</strong> fixed annual salary. The cost during <strong>2010</strong><br />

totaled <strong>USD</strong> 536,000.<br />

The Company’s former President and CEO<br />

Stuart Graham stepped down from the position <strong>of</strong> President and CEO <strong>of</strong> <strong>Skanska</strong> on<br />

April 3, 2008 and since then has continued to be employed at <strong>Skanska</strong> as an advisor<br />

and Chairman <strong>of</strong> the Board <strong>of</strong> <strong>Skanska</strong> Inc. in the United States. His employment ends<br />

in February 2011. Since 2009 Mr. Graham has been a member <strong>of</strong> the <strong>Skanska</strong> Group’s<br />

Board <strong>of</strong> Directors.<br />

During his period as President and CEO, Mr. Graham had so-called expert tax status,<br />

which ceased in September 2005. Because <strong>of</strong> this, during 2005 an agreement was<br />

reached on special compensation totaling no more than <strong>USD</strong> 1,442,800, with disbursement<br />

allocated over the three-year period 2008–<strong>2010</strong>. The <strong>2010</strong> disbursement, which<br />

was the last, amounted to <strong>USD</strong> 479,600.<br />

In addition to his director’s fee from <strong>Skanska</strong> AB and the above remuneration,<br />

Mr. Graham received a salary, fees and other remuneration from Group companies in<br />

the amount <strong>of</strong> <strong>USD</strong> 506,000 during the financial year.<br />

As a former President and CEO, Mr. Graham is entitled to a defined-benefit pension,<br />

for which the cost during the financial year amounted to <strong>USD</strong> 570,300. The pension<br />

entitlement is earned on a straight-line basis during his period <strong>of</strong> employment until<br />

February 2011 and will be disbursed during the remainder <strong>of</strong> his life.<br />

<strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong> Notes, including accounting and valuation principles 147