Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

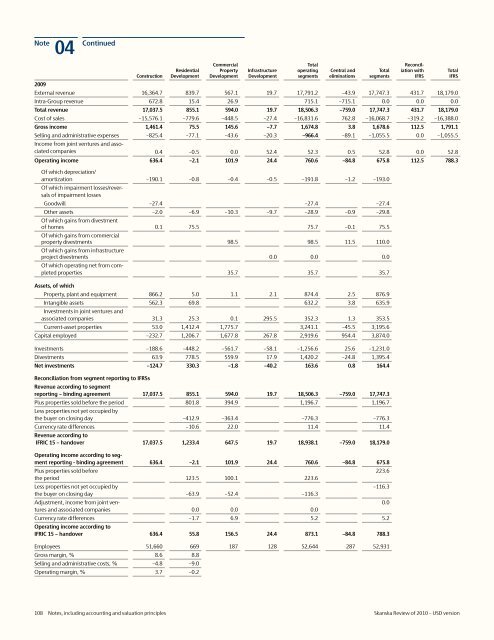

Note<br />

04 Continued Construction<br />

Residential<br />

Development<br />

Commercial<br />

Property<br />

Development<br />

Infrastructure<br />

Development<br />

Total<br />

operating<br />

segments<br />

Central and<br />

eliminations<br />

Total<br />

segments<br />

Reconciliation<br />

with<br />

IFRS<br />

2009<br />

External revenue 16,364.7 839.7 567.1 19.7 17,791.2 –43.9 17,747.3 431.7 18,179.0<br />

Intra-Group revenue 672.8 15.4 26.9 715.1 –715.1 0.0 0.0 0.0<br />

Total revenue 17,037.5 855.1 594.0 19.7 18,506.3 –759.0 17,747.3 431.7 18,179.0<br />

Cost <strong>of</strong> sales –15,576.1 –779.6 –448.5 –27.4 –16,831.6 762.8 –16,068.7 –319.2 –16,388.0<br />

Gross income 1,461.4 75.5 145.6 –7.7 1,674.8 3.8 1,678.6 112.5 1,791.1<br />

Selling and administrative expenses –825.4 –77.1 –43.6 –20.3 –966.4 –89.1 –1,055.5 0.0 –1,055.5<br />

Income from joint ventures and associated<br />

companies 0.4 –0.5 0.0 52.4 52.3 0.5 52.8 0.0 52.8<br />

Operating income 636.4 –2.1 101.9 24.4 760.6 –84.8 675.8 112.5 788.3<br />

Of which depreciation/<br />

amortization –190.1 –0.8 –0.4 –0.5 –191.8 –1.2 –193.0<br />

Of which impairment losses/reversals<br />

<strong>of</strong> impairment losses<br />

Goodwill –27.4 –27.4 –27.4<br />

Other assets –2.0 –6.9 –10.3 –9.7 –28.9 –0.9 –29.8<br />

Of which gains from divestment<br />

<strong>of</strong> homes 0.1 75.5 75.7 –0.1 75.5<br />

Of which gains from commercial<br />

property divestments 98.5 98.5 11.5 110.0<br />

Of which gains from infrastructure<br />

project divestments 0.0 0.0 0.0<br />

Of which operating net from completed<br />

properties 35.7 35.7 35.7<br />

Assets, <strong>of</strong> which<br />

Property, plant and equipment 866.2 5.0 1.1 2.1 874.4 2.5 876.9<br />

Intangible assets 562.3 69.8 632.2 3.8 635.9<br />

Investments in joint ventures and<br />

associated companies 31.3 25.3 0.1 295.5 352.3 1.3 353.5<br />

Current-asset properties 53.0 1,412.4 1,775.7 3,241.1 –45.5 3,195.6<br />

Capital employed –232.7 1,206.7 1,677.8 267.8 2,919.6 954.4 3,874.0<br />

Investments –188.6 –448.2 –561.7 –58.1 –1,256.6 25.6 –1,231.0<br />

Divestments 63.9 778.5 559.9 17.9 1,420.2 –24.8 1,395.4<br />

Net investments –124.7 330.3 –1.8 –40.2 163.6 0.8 164.4<br />

Reconciliation from segment reporting to IFRSs<br />

Revenue according to segment<br />

reporting – binding agreement 17,037.5 855.1 594.0 19.7 18,506.3 –759.0 17,747.3<br />

Plus properties sold before the period 801.8 394.9 1,196.7 1,196.7<br />

Less properties not yet occupied by<br />

the buyer on closing day –412.9 –363.4 –776.3 –776.3<br />

Currency rate differences –10.6 22.0 11.4 11.4<br />

Revenue according to<br />

IFRIC 15 – handover 17,037.5 1,233.4 647.5 19.7 18,938.1 –759.0 18,179.0<br />

Operating income according to segment<br />

reporting - binding agreement 636.4 –2.1 101.9 24.4 760.6 –84.8 675.8<br />

Plus properties sold before<br />

the period 123.5 100.1 223.6<br />

Less properties not yet occupied by<br />

the buyer on closing day –63.9 –52.4 –116.3<br />

Adjustment, income from joint ventures<br />

and associated companies 0.0 0.0 0.0<br />

Currency rate differences –1.7 6.9 5.2 5.2<br />

Operating income according to<br />

IFRIC 15 – handover 636.4 55.8 156.5 24.4 873.1 –84.8 788.3<br />

Employees 51,660 669 187 128 52,644 287 52,931<br />

Gross margin, % 8.6 8.8<br />

Selling and administrative costs, % –4.8 –9.0<br />

Operating margin, % 3.7 –0.2<br />

223.6<br />

–116.3<br />

0.0<br />

Total<br />

IFRS<br />

108 Notes, including accounting and valuation principles <strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong>