Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

To win<br />

the New<br />

Karolinska Solna<br />

project, <strong>Skanska</strong><br />

brought together its<br />

hospital construction<br />

and PPP expertise<br />

from Sweden, the<br />

U.K. and the U.S.<br />

and payment risks are higher, while it also has major<br />

potential for increasing the return on its investment by<br />

means <strong>of</strong> more efficient operation and higher utilization.<br />

In the market risk model, <strong>Skanska</strong>’s investment consists<br />

largely <strong>of</strong> share capital. Payment streams thus consist<br />

mainly <strong>of</strong> dividends, which are determined by the pr<strong>of</strong>itability<br />

<strong>of</strong> the facility. The market risk model is more<br />

common in the U.S. and Latin America.<br />

Financing <strong>of</strong> projects<br />

The financing <strong>of</strong> a project or project company is allocated<br />

between <strong>Skanska</strong> and its partner(s), which invest<br />

in the project company in the form <strong>of</strong> equity and subordinated<br />

shareholder loans. The rest <strong>of</strong> the financing −<br />

which in availability model projects may total more than<br />

90 percent and in market risk model projects 60–80 percent<br />

<strong>of</strong> project cost − consists <strong>of</strong> bank or bond loans.<br />

Cash flows from the project company to <strong>Skanska</strong><br />

consist <strong>of</strong> interest and principal repayments on subordinated<br />

loans issued by <strong>Skanska</strong>, dividends from<br />

project company pr<strong>of</strong>its and, finally, repayment <strong>of</strong> share<br />

capital. In the current project portfolio, <strong>Skanska</strong>’s ownership<br />

stake in project companies normally does not<br />

exceed 50 percent, and <strong>Skanska</strong> thus does not exercise<br />

any controlling ownership role.<br />

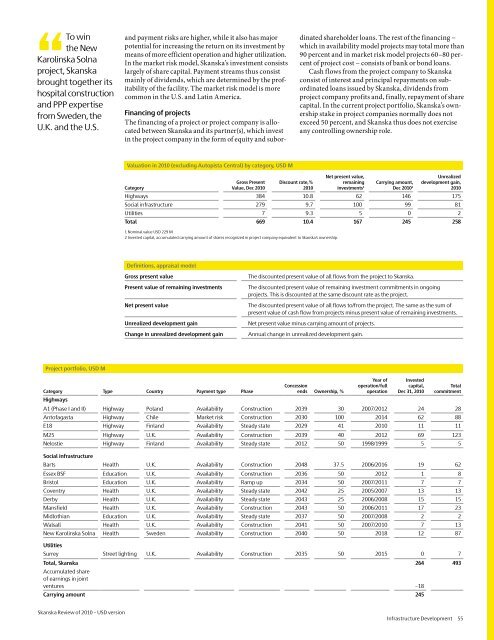

Valuation in <strong>2010</strong> (excluding Autopista Central) by category, <strong>USD</strong> M<br />

Category<br />

Gross Present<br />

Value, Dec <strong>2010</strong><br />

Discount rate,%<br />

<strong>2010</strong><br />

Net present value,<br />

remaining<br />

investments 1<br />

Carrying amount,<br />

Dec <strong>2010</strong> 2<br />

Unrealized<br />

development gain,<br />

<strong>2010</strong><br />

Highways 384 10.8 62 146 175<br />

Social infrastructure 279 9.7 100 99 81<br />

Utilities 7 9.3 5 0 2<br />

Total 669 10.4 167 245 258<br />

1 Nominal value <strong>USD</strong> 229 M<br />

2 Invested capital, accumulated carrying amount <strong>of</strong> shares recognized in project company equivalent to <strong>Skanska</strong>’s ownership.<br />

Definitions, appraisal model<br />

Gross present value<br />

Present value <strong>of</strong> remaining investments<br />

Net present value<br />

Unrealized development gain<br />

Change in unrealized development gain<br />

The discounted present value <strong>of</strong> all flows from the project to <strong>Skanska</strong>.<br />

The discounted present value <strong>of</strong> remaining investment commitments in ongoing<br />

projects. This is discounted at the same discount rate as the project.<br />

The discounted present value <strong>of</strong> all flows to/from the project. The same as the sum <strong>of</strong><br />

present value <strong>of</strong> cash flow from projects minus present value <strong>of</strong> remaining investments.<br />

Net present value minus carrying amount <strong>of</strong> projects.<br />

Annual change in unrealized development gain.<br />

Project portfolio, <strong>USD</strong> M<br />

Category Type Country Payment type Phase<br />

Highways<br />

Concession<br />

ends Ownership, %<br />

Year <strong>of</strong><br />

operation/full<br />

operation<br />

Invested<br />

capital,<br />

Dec 31, <strong>2010</strong><br />

Total<br />

commitment<br />

A1 (Phase I and II) Highway Poland Availability Construction 2039 30 2007/2012 24 28<br />

Ant<strong>of</strong>agasta Highway Chile Market risk Construction 2030 100 2014 62 88<br />

E18 Highway Finland Availability Steady state 2029 41 <strong>2010</strong> 11 11<br />

M25 Highway U.K. Availability Construction 2039 40 2012 69 123<br />

Nelostie Highway Finland Availability Steady state 2012 50 1998/1999 5 5<br />

Social infrastructure<br />

Barts Health U.K. Availability Construction 2048 37.5 2006/2016 19 62<br />

Essex BSF Education U.K. Availability Construction 2036 50 2012 1 8<br />

Bristol Education U.K. Availability Ramp up 2034 50 2007/2011 7 7<br />

Coventry Health U.K. Availability Steady state 2042 25 2005/2007 13 13<br />

Derby Health U.K. Availability Steady state 2043 25 2006/2008 15 15<br />

Mansfield Health U.K. Availability Construction 2043 50 2006/2011 17 23<br />

Midlothian Education U.K. Availability Steady state 2037 50 2007/2008 2 2<br />

Walsall Health U.K. Availability Construction 2041 50 2007/<strong>2010</strong> 7 13<br />

New Karolinska Solna Health Sweden Availability Construction 2040 50 2018 12 87<br />

Utilities<br />

Surrey Street lighting U.K. Availability Construction 2035 50 2015 0 7<br />

Total, <strong>Skanska</strong> 264 493<br />

Accumulated share<br />

<strong>of</strong> earnings in joint<br />

ventures –18<br />

Carrying amount 245<br />

<strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong><br />

Infrastructure Development 55