Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note<br />

06 Continued earnings and cash flow. Interest rate risk is defined as the possible negative impact on<br />

net financial items in case <strong>of</strong> a one percentage point increase in interest rates across<br />

all maturities. The change in fair value related to interest-bearing assets and liabilities<br />

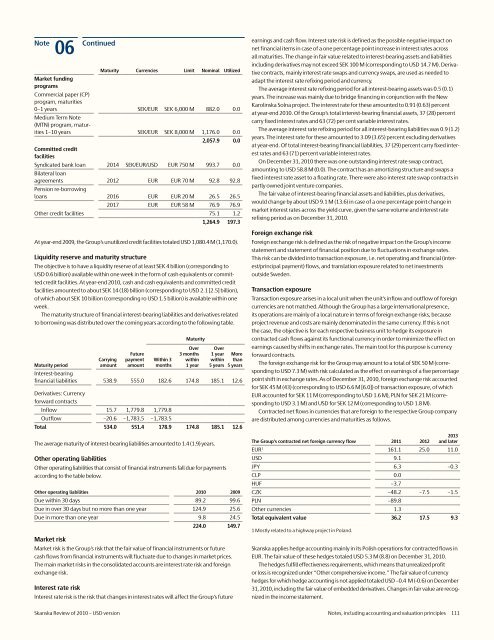

Maturity Currencies Limit Nominal Utilized<br />

Market funding<br />

programs<br />

Commercial paper (CP)<br />

program, maturities<br />

0–1 years SEK/EUR SEK 6,000 M 882.0 0.0<br />

Medium Term Note<br />

(MTN) program, maturities<br />

1–10 years SEK/EUR SEK 8,000 M 1,176.0 0.0<br />

2,057.9 0.0<br />

Committed credit<br />

facilities<br />

Syndicated bank loan 2014 SEK/EUR/<strong>USD</strong> EUR 750 M 993.7 0.0<br />

Bilateral loan<br />

agreements 2012 EUR EUR 70 M 92.8 92.8<br />

Pension re-borrowing<br />

loans 2016 EUR EUR 20 M 26.5 26.5<br />

2017 EUR EUR 58 M 76.9 76.9<br />

Other credit facilities 75.1 1.2<br />

1,264.9 197.3<br />

including derivatives may not exceed SEK 100 M (corresponding to <strong>USD</strong> 14.7 M). Derivative<br />

contracts, mainly interest rate swaps and currency swaps, are used as needed to<br />

adapt the interest rate refixing period and currency.<br />

The average interest rate refixing period for all interest-bearing assets was 0.5 (0.1)<br />

years. The increase was mainly due to bridge financing in conjunction with the New<br />

Karolinska Solna project. The interest rate for these amounted to 0.91 (0.63) percent<br />

at year-end <strong>2010</strong>. Of the Group’s total interest-bearing financial assets, 37 (28) percent<br />

carry fixed interest rates and 63 (72) per cent variable interest rates.<br />

The average interest rate refixing period for all interest-bearing liabilities was 0.9 (1.2)<br />

years. The interest rate for these amounted to 3.09 (3.65) percent excluding derivatives<br />

at year-end. Of total interest-bearing financial liabilities, 37 (29) percent carry fixed interest<br />

rates and 63 (71) percent variable interest rates.<br />

On December 31, <strong>2010</strong> there was one outstanding interest rate swap contract,<br />

amounting to <strong>USD</strong> 58.8 M (0.0). The contract has an amortizing structure and swaps a<br />

fixed interest rate asset to a floating rate. There were also interest rate swap contracts in<br />

partly owned joint venture companies.<br />

The fair value <strong>of</strong> interest-bearing financial assets and liabilities, plus derivatives,<br />

would change by about <strong>USD</strong> 9.1 M (13.6) in case <strong>of</strong> a one percentage point change in<br />

market interest rates across the yield curve, given the same volume and interest rate<br />

refixing period as on December 31, <strong>2010</strong>.<br />

At year-end 2009, the Group’s unutilized credit facilities totaled <strong>USD</strong> 1,080.4 M (1,170.0).<br />

Liquidity reserve and maturity structure<br />

The objective is to have a liquidity reserve <strong>of</strong> at least SEK 4 billion (corresponding to<br />

<strong>USD</strong> 0.6 billion) available within one week in the form <strong>of</strong> cash equivalents or committed<br />

credit facilities. At year-end <strong>2010</strong>, cash and cash equivalents and committed credit<br />

facilities amounted to about SEK 14 (18) billion (corresponding to <strong>USD</strong> 2.1 [2.5] billion),<br />

<strong>of</strong> which about SEK 10 billion (corresponding ro <strong>USD</strong> 1.5 billion) is available within one<br />

week.<br />

The maturity structure <strong>of</strong> financial interest-bearing liabilities and derivatives related<br />

to borrowing was distributed over the coming years according to the following table.<br />

Maturity period<br />

Carrying<br />

amount<br />

Future<br />

payment<br />

amount<br />

Within 3<br />

months<br />

Maturity<br />

Over<br />

3 months<br />

within<br />

1 year<br />

Over<br />

1 year<br />

within<br />

5 years<br />

More<br />

than<br />

5 years<br />

Interest-bearing<br />

financial liabilities 538.9 555.0 182.6 174.8 185.1 12.6<br />

Derivatives: Currency<br />

forward contracts<br />

Inflow 15.7 1,779.8 1,779.8<br />

Outflow –20.6 –1,783.5 –1,783.5<br />

Total 534.0 551.4 178.9 174.8 185.1 12.6<br />

The average maturity <strong>of</strong> interest-bearing liabilities amounted to 1.4 (1.9) years.<br />

Other operating liabilities<br />

Other operating liabilities that consist <strong>of</strong> financial instruments fall due for payments<br />

according to the table below.<br />

Other operating liabilities <strong>2010</strong> 2009<br />

Due within 30 days 89.2 99.6<br />

Due in over 30 days but no more than one year 124.9 25.6<br />

Due in more than one year 9.8 24.5<br />

Market risk<br />

224.0 149.7<br />

Market risk is the Group’s risk that the fair value <strong>of</strong> financial instruments or future<br />

cash flows from financial instruments will fluctuate due to changes in market prices.<br />

The main market risks in the consolidated accounts are interest rate risk and foreign<br />

exchange risk.<br />

Interest rate risk<br />

Interest rate risk is the risk that changes in interest rates will affect the Group’s future<br />

Foreign exchange risk<br />

Foreign exchange risk is defined as the risk <strong>of</strong> negative impact on the Group’s income<br />

statement and statement <strong>of</strong> financial position due to fluctuations in exchange rates.<br />

This risk can be divided into transaction exposure, i.e. net operating and financial (interest/principal<br />

payment) flows, and translation exposure related to net investments<br />

outside Sweden.<br />

Transaction exposure<br />

Transaction exposure arises in a local unit when the unit’s inflow and outflow <strong>of</strong> foreign<br />

currencies are not matched. Although the Group has a large international presence,<br />

its operations are mainly <strong>of</strong> a local nature in terms <strong>of</strong> foreign exchange risks, because<br />

project revenue and costs are mainly denominated in the same currency. If this is not<br />

the case, the objective is for each respective business unit to hedge its exposure in<br />

contracted cash flows against its functional currency in order to minimize the effect on<br />

earnings caused by shifts in exchange rates. The main tool for this purpose is currency<br />

forward contracts.<br />

The foreign exchange risk for the Group may amount to a total <strong>of</strong> SEK 50 M (corresponding<br />

to <strong>USD</strong> 7.3 M) with risk calculated as the effect on earnings <strong>of</strong> a five percentage<br />

point shift in exchange rates. As <strong>of</strong> December 31, <strong>2010</strong>, foreign exchange risk accounted<br />

for SEK 45 M (43) (corresponding to <strong>USD</strong> 6.6 M [6.0]) <strong>of</strong> transaction exposure, <strong>of</strong> which<br />

EUR accounted for SEK 11 M (corresponding to <strong>USD</strong> 1.6 M), PLN for SEK 21 M (corresponding<br />

to <strong>USD</strong> 3.1 M) and <strong>USD</strong> for SEK 12 M (corresponding to <strong>USD</strong> 1.8 M).<br />

Contracted net flows in currencies that are foreign to the respective Group company<br />

are distributed among currencies and maturities as follows.<br />

The Group's contracted net foreign currency flow 2011 2012<br />

2013<br />

and later<br />

EUR 1 161.1 25.0 11.0<br />

<strong>USD</strong> 9.1<br />

JPY 6.3 –0.3<br />

CLP 0.0<br />

HUF –3.7<br />

CZK –48.2 –7.5 –1.5<br />

PLN –89.8<br />

Other currencies 1.3<br />

Total equivalent value 36.2 17.5 9.3<br />

1 Mostly related to a highway project in Poland.<br />

<strong>Skanska</strong> applies hedge accounting mainly in its Polish operations for contracted flows in<br />

EUR. The fair value <strong>of</strong> these hedges totaled <strong>USD</strong> 5.3 M (8.8) on December 31, <strong>2010</strong>.<br />

The hedges fulfill effectiveness requirements, which means that unrealized pr<strong>of</strong>it<br />

or loss is recognized under “Other comprehensive income.” The fair value <strong>of</strong> currency<br />

hedges for which hedge accounting is not applied totaled <strong>USD</strong> –0.4 M (-0.6) on December<br />

31, <strong>2010</strong>, including the fair value <strong>of</strong> embedded derivatives. Changes in fair value are recognized<br />

in the income statement.<br />

<strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong> Notes, including accounting and valuation principles 111