Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note<br />

27<br />

Financial liabilities<br />

Financial liabilities are allocated between non-current and current liabilities. Normally, a<br />

maturity date within one year is required if a liability is to be treated as current. This does<br />

not apply to discounted operating liabilities, which are part <strong>of</strong> <strong>Skanska</strong>’s operating cycle<br />

and are consequently recognized as current liabilities regardless <strong>of</strong> their maturity date.<br />

Concerning financial risks and financial policies, see Note 6, “Financial instruments<br />

and financial risk management.”<br />

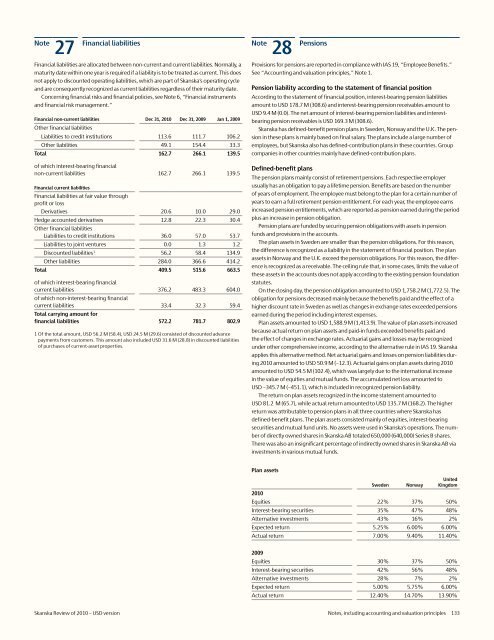

Financial non-current liabilities Dec 31, <strong>2010</strong> Dec 31, 2009 Jan 1, 2009<br />

Other financial liabilities<br />

Liabilities to credit institutions 113.6 111.7 106.2<br />

Other liabilities 49.1 154.4 33.3<br />

Total 162.7 266.1 139.5<br />

<strong>of</strong> which interest-bearing financial<br />

non-current liabilities 162.7 266.1 139.5<br />

Financial current liabilities<br />

Financial liabilities at fair value through<br />

pr<strong>of</strong>it or loss<br />

Derivatives 20.6 10.0 29.0<br />

Hedge accounted derivatives 12.8 22.3 30.4<br />

Other financial liabilities<br />

Liabilities to credit institutions 36.0 57.0 53.7<br />

Liabilities to joint ventures 0.0 1.3 1.2<br />

Discounted liabilities 1 56.2 58.4 134.9<br />

Other liabilities 284.0 366.6 414.2<br />

Total 409.5 515.6 663.5<br />

<strong>of</strong> which interest-bearing financial<br />

current liabilities 376.2 483.3 604.0<br />

<strong>of</strong> which non-interest-bearing financial<br />

current liabilities 33.4 32.3 59.4<br />

Total carrying amount for<br />

financial liabilities 572.2 781.7 802.9<br />

1 Of the total amount, <strong>USD</strong> 56.2 M (58.4), <strong>USD</strong> 24.5 M (29.6) consisted <strong>of</strong> discounted advance<br />

payments from customers. This amount also included <strong>USD</strong> 31.6 M (28.8) in discounted liabilities<br />

<strong>of</strong> purchases <strong>of</strong> current-asset properties.<br />

Note<br />

28 Pensions<br />

Provisions for pensions are reported in compliance with IAS 19, “Employee Benefits.”<br />

See “Accounting and valuation principles,” Note 1.<br />

Pension liability according to the statement <strong>of</strong> financial position<br />

According to the statement <strong>of</strong> financial position, interest-bearing pension liabilities<br />

amount to <strong>USD</strong> 178.7 M (308.6) and interest-bearing pension receivables amount to<br />

<strong>USD</strong> 9.4 M (0.0). The net amount <strong>of</strong> interest-bearing pension liabilities and interestbearing<br />

pension receivables is <strong>USD</strong> 169.3 M (308.6).<br />

<strong>Skanska</strong> has defined-benefit pension plans in Sweden, Norway and the U.K. The pension<br />

in these plans is mainly based on final salary. The plans include a large number <strong>of</strong><br />

employees, but <strong>Skanska</strong> also has defined-contribution plans in these countries. Group<br />

companies in other countries mainly have defined-contribution plans.<br />

Defined-benefit plans<br />

The pension plans mainly consist <strong>of</strong> retirement pensions. Each respective employer<br />

usually has an obligation to pay a lifetime pension. Benefits are based on the number<br />

<strong>of</strong> years <strong>of</strong> employment. The employee must belong to the plan for a certain number <strong>of</strong><br />

years to earn a full retirement pension entitlement. For each year, the employee earns<br />

increased pension entitlements, which are reported as pension earned during the period<br />

plus an increase in pension obligation.<br />

Pension plans are funded by securing pension obligations with assets in pension<br />

funds and provisions in the accounts.<br />

The plan assets in Sweden are smaller than the pension obligations. For this reason,<br />

the difference is recognized as a liability in the statement <strong>of</strong> financial position. The plan<br />

assets in Norway and the U.K. exceed the pension obligations. For this reason, the difference<br />

is recognized as a receivable. The ceiling rule that, in some cases, limits the value <strong>of</strong><br />

these assets in the accounts does not apply according to the existing pension foundation<br />

statutes.<br />

On the closing day, the pension obligation amounted to <strong>USD</strong> 1,758.2 M (1,772.5). The<br />

obligation for pensions decreased mainly because the benefits paid and the effect <strong>of</strong> a<br />

higher discount rate in Sweden as well as changes in exchange rates exceeded pensions<br />

earned during the period including interest expenses.<br />

Plan assets amounted to <strong>USD</strong> 1,588.9 M (1,413.9). The value <strong>of</strong> plan assets increased<br />

because actual return on plan assets and paid-in funds exceeded benefits paid and<br />

the effect <strong>of</strong> changes in exchange rates. Actuarial gains and losses may be recognized<br />

under other comprehensive income, according to the alternative rule in IAS 19. <strong>Skanska</strong><br />

applies this alternative method. Net actuarial gains and losses on pension liabilities during<br />

<strong>2010</strong> amounted to <strong>USD</strong> 50.9 M (–12.3). Actuarial gains on plan assets during <strong>2010</strong><br />

amounted to <strong>USD</strong> 54.5 M (102.4), which was largely due to the international increase<br />

in the value <strong>of</strong> equities and mutual funds. The accumulated net loss amounted to<br />

<strong>USD</strong> –345.7 M (–451.1), which is included in recognized pension liability.<br />

The return on plan assets recognized in the income statement amounted to<br />

<strong>USD</strong> 81.2 M (65.7), while actual return amounted to <strong>USD</strong> 135.7 M (168.2). The higher<br />

return was attributable to pension plans in all three countries where <strong>Skanska</strong> has<br />

defined-benefit plans. The plan assets consisted mainly <strong>of</strong> equities, interest-bearing<br />

securities and mutual fund units. No assets were used in <strong>Skanska</strong>’s operations. The number<br />

<strong>of</strong> directly owned shares in <strong>Skanska</strong> AB totaled 650,000 (640,000) Series B shares.<br />

There was also an insignificant percentage <strong>of</strong> indirectly owned shares in <strong>Skanska</strong> AB via<br />

investments in various mutual funds.<br />

Plan assets<br />

Sweden<br />

Norway<br />

United<br />

Kingdom<br />

<strong>2010</strong><br />

Equities 22% 37% 50%<br />

Interest-bearing securities 35% 47% 48%<br />

Alternative investments 43% 16% 2%<br />

Expected return 5.25% 6.00% 6.00%<br />

Actual return 7.00% 9.40% 11.40%<br />

2009<br />

Equities 30% 37% 50%<br />

Interest-bearing securities 42% 56% 48%<br />

Alternative investments 28% 7% 2%<br />

Expected return 5.00% 5.75% 6.00%<br />

Actual return 12.40% 14.70% 13.90%<br />

<strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong> Notes, including accounting and valuation principles 133