Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note<br />

06 Continued<br />

Collateral<br />

The Group has provided collateral (assets pledged) in the form <strong>of</strong> financial receivables<br />

amounting to <strong>USD</strong> 147.0M (153.5). See also Note 33, “Assets pledged, contingent<br />

liabilities and contingent assets.” These assets may be utilized by a customer if <strong>Skanska</strong><br />

does not fulfill its obligations according to the respective construction contract.<br />

To a varying extent, the Group has obtained collateral for trade accounts payable in<br />

the form <strong>of</strong> guarantees issued by banks and insurance companies and, in some cases, in<br />

the form <strong>of</strong> guarantees from the parent companies <strong>of</strong> customers.<br />

The Group obtained a commercial property in the Czech Republic, Vysocanska brana,<br />

at a carrying amount <strong>of</strong> <strong>USD</strong> 26.5 M, which served as collateral for a receivable.<br />

Note<br />

07<br />

Business combinations<br />

Business combinations (acquisitions <strong>of</strong> businesses) are reported in compliance with<br />

IFRS 3, “Business Combinations.” See “Accounting and valuation principles,” Note 1.<br />

Acquisitions <strong>of</strong> Group companies/businesses<br />

During the year, <strong>Skanska</strong> made no acquisitions. In 2009 <strong>Skanska</strong> made some minor<br />

acquisitions in Poland and Finland, totaling <strong>USD</strong> –1.3 M. At the time <strong>of</strong> these purchases,<br />

<strong>USD</strong> 0.7 M was allocated to intangible assets in the form <strong>of</strong> customer contracts in<br />

Poland and <strong>USD</strong> 0.7 M to goodwill in Finland. The acquisitions are part <strong>of</strong> the Construction<br />

business stream.<br />

Note<br />

08 Revenue<br />

Projects in <strong>Skanska</strong>’s contracting operations are reported in compliance with<br />

IAS 11, “Construction Contracts.” See Note 9. Revenue other than project revenue<br />

is recognized in compliance with IAS 18, “Revenue.” See “Accounting and valuation<br />

principles,” Note 1.<br />

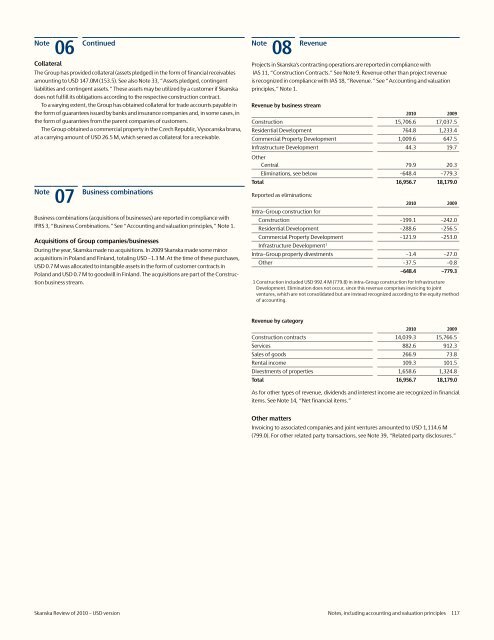

Revenue by business stream<br />

<strong>2010</strong> 2009<br />

Construction 15,706.6 17,037.5<br />

Residential Development 764.8 1,233.4<br />

Commercial Property Development 1,009.6 647.5<br />

Infrastructure Development 44.3 19.7<br />

Other<br />

Central 79.9 20.3<br />

Eliminations, see below –648.4 –779.3<br />

Total 16,956.7 18,179.0<br />

Reported as eliminations:<br />

Intra–Group construction for<br />

<strong>2010</strong> 2009<br />

Construction –199.1 –242.0<br />

Residential Development –288.6 –256.5<br />

Commercial Property Development –121.9 –253.0<br />

Infrastructure Development 1<br />

Intra–Group property divestments –1.4 –27.0<br />

Other –37.5 –0.8<br />

–648.4 –779.3<br />

1 Construction included <strong>USD</strong> 992.4 M (779.8) in intra-Group construction for Infrastructure<br />

Development. Elimination does not occur, since this revenue comprises invoicing to joint<br />

ventures, which are not consolidated but are instead recognized according to the equity method<br />

<strong>of</strong> accounting.<br />

Revenue by category<br />

<strong>2010</strong> 2009<br />

Construction contracts 14,039.3 15,766.5<br />

Services 882.6 912.3<br />

Sales <strong>of</strong> goods 266.9 73.8<br />

Rental income 109.3 101.5<br />

Divestments <strong>of</strong> properties 1,658.6 1,324.8<br />

Total 16,956.7 18,179.0<br />

As for other types <strong>of</strong> revenue, dividends and interest income are recognized in financial<br />

items. See Note 14, “Net financial items.”<br />

Other matters<br />

Invoicing to associated companies and joint ventures amounted to <strong>USD</strong> 1,114.6 M<br />

(799.0). For other related party transactions, see Note 39, “Related party disclosures.”<br />

<strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong> Notes, including accounting and valuation principles 117