Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

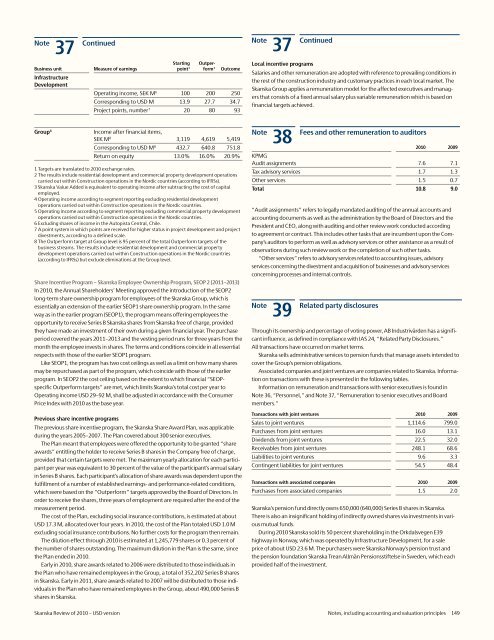

Note<br />

Business unit<br />

Infrastructure<br />

Development<br />

Group 6<br />

37 Continued<br />

Measure <strong>of</strong> earnings<br />

Starting<br />

point 1<br />

Outperform<br />

1<br />

Outcome<br />

Operating income, SEK M 6 100 200 250<br />

Corresponding to <strong>USD</strong> M 13.9 27.7 34.7<br />

Project points, number 7 20 80 93<br />

Income after financial items,<br />

SEK M 8 3,119 4,619 5,419<br />

Corresponding to <strong>USD</strong> M 8 432.7 640.8 751.8<br />

Return on equity 13.0% 16.0% 20.9%<br />

1 Targets are translated to <strong>2010</strong> exchange rates.<br />

2 The results include residential development and commercial property development operations<br />

carried out within Construction operations in the Nordic countries (according to IFRSs).<br />

3 <strong>Skanska</strong> Value Added is equivalent to operating income after subtracting the cost <strong>of</strong> capital<br />

employed.<br />

4 Operating income according to segment reporting excluding residential development<br />

operations carried out within Construction operations in the Nordic countries.<br />

5 Operating income according to segment reporting excluding commercial property development<br />

operations carried out within Construction operations in the Nordic countries.<br />

6 Excluding shares <strong>of</strong> income in the Autopista Central, Chile.<br />

7 A point system in which points are received for higher status in project development and project<br />

divestments, according to a defined scale.<br />

8 The Outperform target at Group level is 95 percent <strong>of</strong> the total Outperform targets <strong>of</strong> the<br />

business streams. The results include residential development and commercial property<br />

development operations carried out within Construction operations in the Nordic countries<br />

(according to IFRSs) but exclude eliminations at the Group level.<br />

Share Incentive Program – <strong>Skanska</strong> Employee Ownership Program, SEOP 2 (2011–2013)<br />

In <strong>2010</strong>, the Annual Shareholders’ Meeting approved the introduction <strong>of</strong> the SEOP2<br />

long-term share ownership program for employees <strong>of</strong> the <strong>Skanska</strong> Group, which is<br />

essentially an extension <strong>of</strong> the earlier SEOP1 share ownership program. In the same<br />

way as in the earlier program (SEOP1), the program means <strong>of</strong>fering employees the<br />

opportunity to receive Series B <strong>Skanska</strong> shares from <strong>Skanska</strong> free <strong>of</strong> charge, provided<br />

they have made an investment <strong>of</strong> their own during a given financial year. The purchase<br />

period covered the years 2011–2013 and the vesting period runs for three years from the<br />

month the employee invests in shares. The terms and conditions coincide in all essential<br />

respects with those <strong>of</strong> the earlier SEOP1 program.<br />

Like SEOP1, the program has two cost ceilings as well as a limit on how many shares<br />

may be repurchased as part <strong>of</strong> the program, which coincide with those <strong>of</strong> the earlier<br />

program. In SEOP2 the cost ceiling based on the extent to which financial “SEOPspecific<br />

Outperform targets” are met, which limits <strong>Skanska</strong>’s total cost per year to<br />

Operating income <strong>USD</strong> 29–92 M, shall be adjusted in accordance with the Consumer<br />

Price Index with <strong>2010</strong> as the base year.<br />

Previous share incentive programs<br />

The previous share incentive program, the <strong>Skanska</strong> Share Award Plan, was applicable<br />

during the years 2005–2007. The Plan covered about 300 senior executives.<br />

The Plan meant that employees were <strong>of</strong>fered the opportunity to be granted “share<br />

awards” entitling the holder to receive Series B shares in the Company free <strong>of</strong> charge,<br />

provided that certain targets were met. The maximum yearly allocation for each participant<br />

per year was equivalent to 30 percent <strong>of</strong> the value <strong>of</strong> the participant’s annual salary<br />

in Series B shares. Each participant’s allocation <strong>of</strong> share awards was dependent upon the<br />

fulfillment <strong>of</strong> a number <strong>of</strong> established earnings- and performance-related conditions,<br />

which were based on the “Outperform” targets approved by the Board <strong>of</strong> Directors. In<br />

order to receive the shares, three years <strong>of</strong> employment are required after the end <strong>of</strong> the<br />

measurement period.<br />

The cost <strong>of</strong> the Plan, excluding social insurance contributions, is estimated at about<br />

<strong>USD</strong> 17.3 M, allocated over four years. In <strong>2010</strong>, the cost <strong>of</strong> the Plan totaled <strong>USD</strong> 1.0 M<br />

excluding social insurance contributions. No further costs for the program then remain.<br />

The dilution effect through <strong>2010</strong> is estimated at 1,245,779 shares or 0.3 percent <strong>of</strong><br />

the number <strong>of</strong> shares outstanding. The maximum dilution in the Plan is the same, since<br />

the Plan ended in <strong>2010</strong>.<br />

Early in <strong>2010</strong>, share awards related to 2006 were distributed to those individuals in<br />

the Plan who have remained employees in the Group, a total <strong>of</strong> 352,202 Series B shares<br />

in <strong>Skanska</strong>. Early in 2011, share awards related to 2007 will be distributed to those individuals<br />

in the Plan who have remained employees in the Group, about 490,000 Series B<br />

shares in <strong>Skanska</strong>.<br />

Note<br />

Note<br />

Note<br />

37 Continued<br />

Local incentive programs<br />

Salaries and other remuneration are adopted with reference to prevailing conditions in<br />

the rest <strong>of</strong> the construction industry and customary practices in each local market. The<br />

<strong>Skanska</strong> Group applies a remuneration model for the affected executives and managers<br />

that consists <strong>of</strong> a fixed annual salary plus variable remuneration which is based on<br />

financial targets achieved.<br />

38<br />

Fees and other remuneration to auditors<br />

KPMG<br />

Audit assignments 7.6 7.1<br />

Tax advisory services 1.7 1.3<br />

Other services 1.5 0.7<br />

Total 10.8 9.0<br />

“Audit assignments” refers to legally mandated auditing <strong>of</strong> the annual accounts and<br />

accounting documents as well as the administration by the Board <strong>of</strong> Directors and the<br />

President and CEO, along with auditing and other review work conducted according<br />

to agreement or contract. This includes other tasks that are incumbent upon the Company’s<br />

auditors to perform as well as advisory services or other assistance as a result <strong>of</strong><br />

observations during such review work or the completion <strong>of</strong> such other tasks.<br />

“Other services” refers to advisory services related to accounting issues, advisory<br />

services concerning the divestment and acquisition <strong>of</strong> businesses and advisory services<br />

concerning processes and internal controls.<br />

39 Related party disclosures <strong>2010</strong> 2009<br />

Through its ownership and percentage <strong>of</strong> voting power, AB Industrivärden has a significant<br />

influence, as defined in compliance with IAS 24, “Related Party Disclosures.”<br />

All transactions have occurred on market terms.<br />

<strong>Skanska</strong> sells administrative services to pension funds that manage assets intended to<br />

cover the Group’s pension obligations.<br />

Associated companies and joint ventures are companies related to <strong>Skanska</strong>. Information<br />

on transactions with these is presented in the following tables.<br />

Information on remuneration and transactions with senior executives is found in<br />

Note 36, “Personnel,” and Note 37, “Remuneration to senior executives and Board<br />

members.”<br />

Transactions with joint ventures <strong>2010</strong> 2009<br />

Sales to joint ventures 1,114.6 799.0<br />

Purchases from joint ventures 16.0 13.1<br />

Dividends from joint ventures 22.5 32.0<br />

Receivables from joint ventures 248.1 68.6<br />

Liabilities to joint ventures 9.6 3.3<br />

Contingent liabilities for joint ventures 54.5 48.4<br />

Transactions with associated companies <strong>2010</strong> 2009<br />

Purchases from associated companies 1.5 2.0<br />

<strong>Skanska</strong>’s pension fund directly owns 650,000 (640,000) Series B shares in <strong>Skanska</strong>.<br />

There is also an insignificant holding <strong>of</strong> indirectly owned shares via investments in various<br />

mutual funds.<br />

During <strong>2010</strong> <strong>Skanska</strong> sold its 50 percent shareholding in the Orkdalsvegen E39<br />

highway in Norway, which was operated by Infrastructure Development, for a sale<br />

price <strong>of</strong> about <strong>USD</strong> 23.6 M. The purchasers were <strong>Skanska</strong> Norway’s pension trust and<br />

the pension foundation <strong>Skanska</strong> Trean Allmän Pensionsstiftelse in Sweden, which each<br />

provided half <strong>of</strong> the investment.<br />

<strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong> Notes, including accounting and valuation principles 149