Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Note<br />

18 Continued<br />

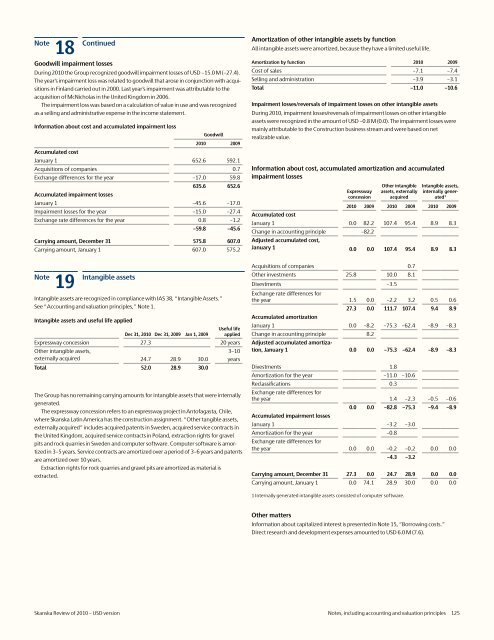

Goodwill impairment losses<br />

During <strong>2010</strong> the Group recognized goodwill impairment losses <strong>of</strong> <strong>USD</strong> –15.0 M (–27.4).<br />

The year’s impairment loss was related to goodwill that arose in conjunction with acquisitions<br />

in Finland carried out in 2000. Last year’s impairment was attributable to the<br />

acquisition <strong>of</strong> McNicholas in the United Kingdom in 2006.<br />

The impairment loss was based on a calculation <strong>of</strong> value in use and was recognized<br />

as a selling and administrative expense in the income statement.<br />

Information about cost and accumulated impairment loss<br />

Note<br />

19<br />

Intangible assets<br />

Goodwill<br />

<strong>2010</strong> 2009<br />

Accumulated cost<br />

January 1 652.6 592.1<br />

Acquisitions <strong>of</strong> companies 0.7<br />

Exchange differences for the year –17.0 59.8<br />

635.6 652.6<br />

Accumulated impairment losses<br />

January 1 –45.6 –17.0<br />

Impairment losses for the year –15.0 –27.4<br />

Exchange rate differences for the year 0.8 –1.2<br />

–59.8 –45.6<br />

Carrying amount, December 31 575.8 607.0<br />

Carrying amount, January 1 607.0 575.2<br />

Intangible assets are recognized in compliance with IAS 38, “Intangible Assets.”<br />

See “Accounting and valuation principles,” Note 1.<br />

Intangible assets and useful life applied<br />

Dec 31, <strong>2010</strong> Dec 31, 2009 Jan 1, 2009<br />

Useful life<br />

applied<br />

Expressway concession 27.3 20 years<br />

Other intangible assets,<br />

externally acquired 24.7 28.9 30.0<br />

Total 52.0 28.9 30.0<br />

3–10<br />

years<br />

The Group has no remaining carrying amounts for intangible assets that were internally<br />

generated.<br />

The expressway concession refers to an expressway project in Ant<strong>of</strong>agasta, Chile,<br />

where <strong>Skanska</strong> Latin America has the construction assignment. “Other tangible assets,<br />

externally acquired” includes acquired patents in Sweden, acquired service contracts in<br />

the United Kingdom, acquired service contracts in Poland, extraction rights for gravel<br />

pits and rock quarries in Sweden and computer s<strong>of</strong>tware. Computer s<strong>of</strong>tware is amortized<br />

in 3–5 years. Service contracts are amortized over a period <strong>of</strong> 3–6 years and patents<br />

are amortized over 10 years.<br />

Extraction rights for rock quarries and gravel pits are amortized as material is<br />

extracted.<br />

Amortization <strong>of</strong> other intangible assets by function<br />

All intangible assets were amortized, because they have a limited useful life.<br />

Amortization by function <strong>2010</strong> 2009<br />

Cost <strong>of</strong> sales –7.1 –7.4<br />

Selling and administration –3.9 –3.1<br />

Total –11.0 –10.6<br />

Impairment losses/reversals <strong>of</strong> impairment losses on other intangible assets<br />

During <strong>2010</strong>, impairment losses/reversals <strong>of</strong> impairment losses on other intangible<br />

assets were recognized in the amount <strong>of</strong> <strong>USD</strong> –0.8 M (0.0). The impairment losses were<br />

mainly attributable to the Construction business stream and were based on net<br />

realizable value.<br />

Information about cost, accumulated amortization and accumulated<br />

impairment losses<br />

Accumulated cost<br />

Expressway<br />

concession<br />

Other intangible<br />

assets, externally<br />

acquired<br />

Intangible assets,<br />

internally generated<br />

1<br />

<strong>2010</strong> 2009 <strong>2010</strong> 2009 <strong>2010</strong> 2009<br />

January 1 0.0 82.2 107.4 95.4 8.9 8.3<br />

Change in accounting principle –82.2<br />

Adjusted accumulated cost,<br />

January 1 0.0 0.0 107.4 95.4 8.9 8.3<br />

Acquisitions <strong>of</strong> companies 0.7<br />

Other investments 25.8 10.0 8.1<br />

Divestments –3.5<br />

Exchange rate differences for<br />

the year 1.5 0.0 –2.2 3.2 0.5 0.6<br />

27.3 0.0 111.7 107.4 9.4 8.9<br />

Accumulated amortization<br />

January 1 0.0 –8.2 –75.3 –62.4 –8.9 –8.3<br />

Change in accounting principle 8.2<br />

Adjusted accumulated amortization,<br />

January 1 0.0 0.0 –75.3 –62.4 –8.9 –8.3<br />

Divestments 1.8<br />

Amortization for the year –11.0 –10.6<br />

Reclassifications 0.3<br />

Exchange rate differences for<br />

the year 1.4 –2.3 –0.5 –0.6<br />

0.0 0.0 –82.8 –75.3 –9.4 –8.9<br />

Accumulated impairment losses<br />

January 1 –3.2 –3.0<br />

Amortization for the year –0.8<br />

Exchange rate differences for<br />

the year 0.0 0.0 –0.2 –0.2 0.0 0.0<br />

–4.3 –3.2<br />

Carrying amount, December 31 27.3 0.0 24.7 28.9 0.0 0.0<br />

Carrying amount, January 1 0.0 74.1 28.9 30.0 0.0 0.0<br />

1 Internally generated intangible assets consisted <strong>of</strong> computer s<strong>of</strong>tware.<br />

Other matters<br />

Information about capitalized interest is presented in Note 15, “Borrowing costs.”<br />

Direct research and development expenses amounted to <strong>USD</strong> 6.0 M (7.6).<br />

<strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong> Notes, including accounting and valuation principles 125