Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

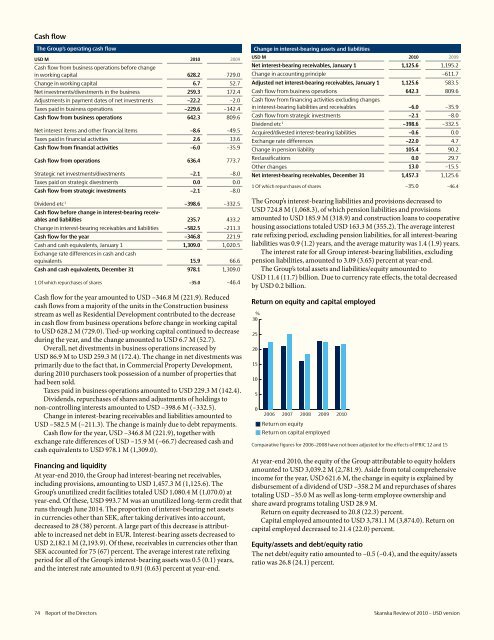

Cash flow<br />

The Group’s operating cash flow<br />

<strong>USD</strong> M <strong>2010</strong> 2009<br />

Cash flow from business operations before change<br />

in working capital 628.2 729.0<br />

Change in working capital 6.7 52.7<br />

Net investments/divestments in the business 259.3 172.4<br />

Adjustments in payment dates <strong>of</strong> net investments –22.2 –2.0<br />

Taxes paid in business operations –229.6 –142.4<br />

Cash flow from business operations 642.3 809.6<br />

Net interest items and other financial items –8.6 –49.5<br />

Taxes paid in financial activities 2.6 13.6<br />

Cash flow from financial activities –6.0 –35.9<br />

Cash flow from operations 636.4 773.7<br />

Strategic net investments/divestments –2.1 –8.0<br />

Taxes paid on strategic divestments 0.0 0.0<br />

Cash flow from strategic investments –2.1 –8.0<br />

Dividend etc 1 –398.6 –332.5<br />

Cash flow before change in interest-bearing receivables<br />

and liabilities 235.7 433.2<br />

Change in interest-bearing receivables and liabilities –582.5 –211.3<br />

Cash flow for the year –346.8 221.9<br />

Cash and cash equivalents, January 1 1,309.0 1,020.5<br />

Exchange rate differences in cash and cash<br />

equivalents 15.9 66.6<br />

Cash and cash equivalents, December 31 978.1 1,309.0<br />

1 Of which repurchases <strong>of</strong> shares –35.0 –46.4<br />

Cash flow for the year amounted to <strong>USD</strong> –346.8 M (221.9). Reduced<br />

cash flows from a majority <strong>of</strong> the units in the Construction business<br />

stream as well as Residential Development contributed to the decrease<br />

in cash flow from business operations before change in working capital<br />

to <strong>USD</strong> 628.2 M (729.0). Tied-up working capital continued to decrease<br />

during the year, and the change amounted to <strong>USD</strong> 6.7 M (52.7).<br />

Overall, net divestments in business operations increased by<br />

<strong>USD</strong> 86.9 M to <strong>USD</strong> 259.3 M (172.4). The change in net divestments was<br />

primarily due to the fact that, in Commercial Property Development,<br />

during <strong>2010</strong> purchasers took possession <strong>of</strong> a number <strong>of</strong> properties that<br />

had been sold.<br />

Taxes paid in business operations amounted to <strong>USD</strong> 229.3 M (142.4).<br />

Dividends, repurchases <strong>of</strong> shares and adjustments <strong>of</strong> holdings to<br />

non-controlling interests amounted to <strong>USD</strong> –398.6 M (–332.5).<br />

Change in interest-bearing receivables and liabilities amounted to<br />

<strong>USD</strong> –582.5 M (–211.3). The change is mainly due to debt repayments.<br />

Cash flow for the year, <strong>USD</strong> –346.8 M (221.9), together with<br />

exchange rate differences <strong>of</strong> <strong>USD</strong> –15.9 M (–66.7) decreased cash and<br />

cash equivalents to <strong>USD</strong> 978.1 M (1,309.0).<br />

Financing and liquidity<br />

At year-end <strong>2010</strong>, the Group had interest-bearing net receivables,<br />

including provisions, amounting to <strong>USD</strong> 1,457.3 M (1,125.6). The<br />

Group’s unutilized credit facilities totaled <strong>USD</strong> 1,080.4 M (1,070.0) at<br />

year-end. Of these, <strong>USD</strong> 993.7 M was an unutilized long-term credit that<br />

runs through June 2014. The proportion <strong>of</strong> interest-bearing net assets<br />

in currencies other than SEK, after taking derivatives into account,<br />

decreased to 28 (38) percent. A large part <strong>of</strong> this decrease is attributable<br />

to increased net debt in EUR. Interest-bearing assets decreased to<br />

<strong>USD</strong> 2,182.1 M (2,193.9). Of these, receivables in currencies other than<br />

SEK accounted for 75 (67) percent. The average interest rate refixing<br />

period for all <strong>of</strong> the Group’s interest-bearing assets was 0.5 (0.1) years,<br />

and the interest rate amounted to 0.91 (0.63) percent at year-end.<br />

Change in interest-bearing assets and liabilities<br />

<strong>USD</strong> M <strong>2010</strong> 2009<br />

Net interest-bearing receivables, January 1 1,125.6 1,195.2<br />

Change in accounting principle –611.7<br />

Adjusted net interest-bearing receivables, January 1 1,125.6 583.5<br />

Cash flow from business operations 642.3 809.6<br />

Cash flow from financing activities excluding changes<br />

in interest-bearing liabilities and receivables –6.0 –35.9<br />

Cash Avkastning flow from på eget strategic och investments –2.1 –8.0<br />

sysselsatt kapital<br />

Dividend etc 1 –398.6 –332.5<br />

%<br />

Acquired/divested 30<br />

interest-bearing liabilities –0.6 0.0<br />

Exchange rate differences –22.0 4.7<br />

Change 25 in pension liability 105.4 90.2<br />

Reclassifications 0.0 29.7<br />

20<br />

Other changes 13.0 –15.5<br />

Net interest-bearing receivables, December 31 15<br />

1,457.3 1,125.6<br />

1 Of which repurchases <strong>of</strong> shares –35.0 –46.4<br />

10<br />

The Group’s interest-bearing liabilities and provisions decreased to<br />

<strong>USD</strong> 5 724.8 M (1,068.3), <strong>of</strong> which pension liabilities and provisions<br />

amounted to <strong>USD</strong> 185.9 M (318.9) and construction loans to cooperative<br />

0<br />

housing associations totaled <strong>USD</strong> 163.3 M (355.2). The average interest<br />

2006 2007 2008 2009 <strong>2010</strong><br />

rate refixing period, excluding pension liabilities, for all interest-bearing<br />

liabilities Avkastning på eget kapital<br />

was 0.9 (1.2) years, and the average maturity was 1.4 (1.9) years.<br />

• Avkastning på sysselsatt kapital<br />

The interest rate for all Group interest-bearing liabilities, excluding<br />

pension liabilities, amounted to 3.09 (3.65) percent at year-end.<br />

The Group’s total assets and liabilities/equity amounted to<br />

<strong>USD</strong> 11.4 (11.7) billion. Due to currency rate effects, the total decreased<br />

by <strong>USD</strong> 0.2 billion.<br />

Return on equity and capital employed<br />

%<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

2006 2007 2008 2009 <strong>2010</strong><br />

Return on equity<br />

• Return on capital employed<br />

Comparative figures for 2006–2008 have not been adjusted for the effects <strong>of</strong> IFRIC 12 and 15<br />

At year-end <strong>2010</strong>, the equity <strong>of</strong> the Group attributable to equity holders<br />

amounted to <strong>USD</strong> 3,039.2 M (2,781.9). Aside from total comprehensive<br />

income for the year, <strong>USD</strong> 621.6 M, the change in equity is explained by<br />

disbursement <strong>of</strong> a dividend <strong>of</strong> <strong>USD</strong> –358.2 M and repurchases <strong>of</strong> shares<br />

totaling <strong>USD</strong> –35.0 M as well as long-term employee ownership and<br />

share award programs totaling <strong>USD</strong> 28.9 M.<br />

Return on equity decreased to 20.8 (22.3) percent.<br />

Capital employed amounted to <strong>USD</strong> 3,781.1 M (3,874.0). Return on<br />

capital employed decreased to 21.4 (22.0) percent.<br />

Equity/assets and debt/equity ratio<br />

The net debt/equity ratio amounted to –0.5 (–0.4), and the equity/assets<br />

ratio was 26.8 (24.1) percent.<br />

74 Report <strong>of</strong> the Directors <strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong>