Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Note<br />

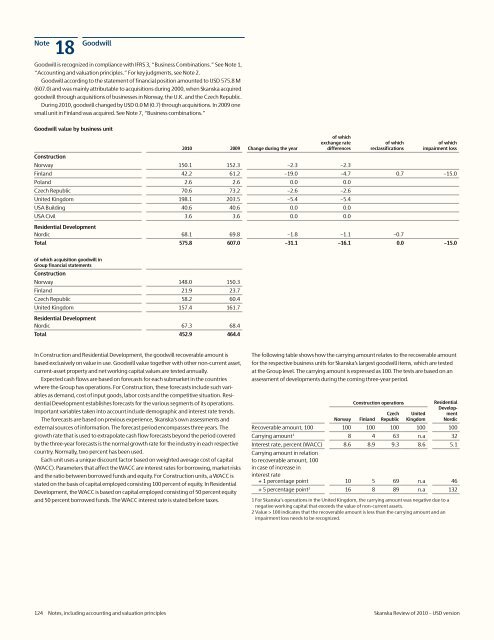

18 Goodwill<br />

Goodwill is recognized in compliance with IFRS 3, “Business Combinations.” See Note 1,<br />

“Accounting and valuation principles.” For key judgments, see Note 2.<br />

Goodwill according to the statement <strong>of</strong> financial position amounted to <strong>USD</strong> 575.8 M<br />

(607.0) and was mainly attributable to acquisitions during 2000, when <strong>Skanska</strong> acquired<br />

goodwill through acquisitions <strong>of</strong> businesses in Norway, the U.K. and the Czech Republic.<br />

During <strong>2010</strong>, goodwill changed by <strong>USD</strong> 0.0 M (0.7) through acquisitions. In 2009 one<br />

small unit in Finland was acquired. See Note 7, “Business combinations.”<br />

Goodwill value by business unit<br />

<strong>2010</strong> 2009 Change during the year<br />

<strong>of</strong> which<br />

exchange rate<br />

differences<br />

Construction<br />

Norway 150.1 152.3 –2.3 –2.3<br />

<strong>of</strong> which<br />

reclassifications<br />

<strong>of</strong> which<br />

impairment loss<br />

Finland 42.2 61.2 –19.0 –4.7 0.7 –15.0<br />

Poland 2.6 2.6 0.0 0.0<br />

Czech Republic 70.6 73.2 –2.6 –2.6<br />

United Kingdom 198.1 203.5 –5.4 –5.4<br />

USA Building 40.6 40.6 0.0 0.0<br />

USA Civil 3.6 3.6 0.0 0.0<br />

Residential Development<br />

Nordic 68.1 69.8 –1.8 –1.1 –0.7<br />

Total 575.8 607.0 –31.1 –16.1 0.0 –15.0<br />

<strong>of</strong> which acquisition goodwill in<br />

Group financial statements<br />

Construction<br />

Norway 148.0 150.3<br />

Finland 21.9 23.7<br />

Czech Republic 58.2 60.4<br />

United Kingdom 157.4 161.7<br />

Residential Development<br />

Nordic 67.3 68.4<br />

Total 452.9 464.4<br />

In Construction and Residential Development, the goodwill recoverable amount is<br />

based exclusively on value in use. Goodwill value together with other non-current asset,<br />

current-asset property and net working capital values are tested annually.<br />

Expected cash flows are based on forecasts for each submarket in the countries<br />

where the Group has operations. For Construction, these forecasts include such variables<br />

as demand, cost <strong>of</strong> input goods, labor costs and the competitive situation. Residential<br />

Development establishes forecasts for the various segments <strong>of</strong> its operations.<br />

Important variables taken into account include demographic and interest rate trends.<br />

The forecasts are based on previous experience, <strong>Skanska</strong>’s own assessments and<br />

external sources <strong>of</strong> information. The forecast period encompasses three years. The<br />

growth rate that is used to extrapolate cash flow forecasts beyond the period covered<br />

by the three-year forecasts is the normal growth rate for the industry in each respective<br />

country. Normally, two percent has been used.<br />

Each unit uses a unique discount factor based on weighted average cost <strong>of</strong> capital<br />

(WACC). Parameters that affect the WACC are interest rates for borrowing, market risks<br />

and the ratio between borrowed funds and equity. For Construction units, a WACC is<br />

stated on the basis <strong>of</strong> capital employed consisting 100 percent <strong>of</strong> equity. In Residential<br />

Development, the WACC is based on capital employed consisting <strong>of</strong> 50 percent equity<br />

and 50 percent borrowed funds. The WACC interest rate is stated before taxes.<br />

The following table shows how the carrying amount relates to the recoverable amount<br />

for the respective business units for <strong>Skanska</strong>’s largest goodwill items, which are tested<br />

at the Group level. The carrying amount is expressed as 100. The tests are based on an<br />

assessment <strong>of</strong> developments during the coming three-year period.<br />

Norway<br />

Construction operations<br />

Finland<br />

Czech<br />

Republic<br />

United<br />

Kingdom<br />

Residential<br />

Development<br />

Nordic<br />

Recoverable amount, 100 100 100 100 100 100<br />

Carrying amount 1 8 4 63 n.a 32<br />

Interest rate, percent (WACC) 8.6 8.9 9.3 8.6 5.1<br />

Carrying amount in relation<br />

to recoverable amount, 100<br />

in case <strong>of</strong> increase in<br />

interest rate<br />

+ 1 percentage point 10 5 69 n.a 46<br />

+ 5 percentage point 2 16 8 89 n.a 132<br />

1 For <strong>Skanska</strong>’s operations in the United Kingdom, the carrying amount was negative due to a<br />

negative working capital that exceeds the value <strong>of</strong> non-current assets.<br />

2 Value > 100 indicates that the recoverable amount is less than the carrying amount and an<br />

impairment loss needs to be recognized.<br />

124 Notes, including accounting and valuation principles <strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong>