Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Note<br />

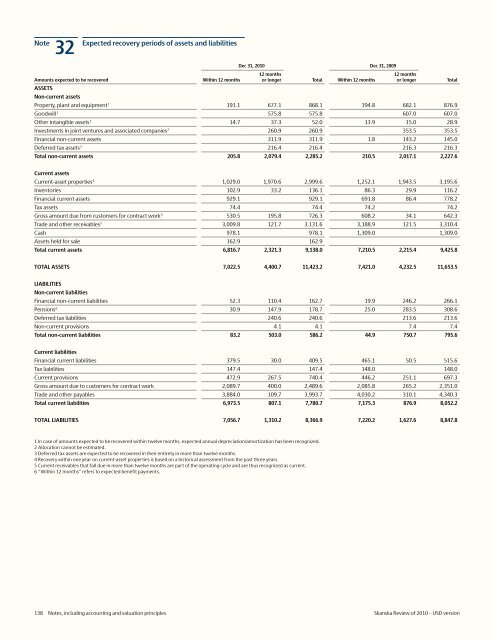

32 Expected recovery periods <strong>of</strong> assets and liabilities Dec 31, <strong>2010</strong> Dec 31, 2009<br />

Amounts expected to be recovered<br />

Within 12 months<br />

12 months<br />

or longer Total Within 12 months<br />

12 months<br />

or longer<br />

ASSETS<br />

Non-current assets<br />

Property, plant and equipment 1 191.1 677.1 868.1 194.8 682.1 876.9<br />

Goodwill 1 575.8 575.8 607.0 607.0<br />

Other intangible assets 1 14.7 37.3 52.0 13.9 15.0 28.9<br />

Investments in joint ventures and associated companies 2 260.9 260.9 353.5 353.5<br />

Financial non-current assets 311.9 311.9 1.8 143.2 145.0<br />

Deferred tax assets 3 216.4 216.4 216.3 216.3<br />

Total non-current assets 205.8 2,079.4 2,285.2 210.5 2,017.1 2,227.6<br />

Total<br />

Current assets<br />

Current-asset properties 4 1,029.0 1,970.6 2,999.6 1,252.1 1,943.5 3,195.6<br />

Inventories 102.9 33.2 136.1 86.3 29.9 116.2<br />

Financial current assets 929.1 929.1 691.8 86.4 778.2<br />

Tax assets 74.4 74.4 74.2 74.2<br />

Gross amount due from customers for contract work 5 530.5 195.8 726.3 608.2 34.1 642.3<br />

Trade and other receivables 5 3,009.8 121.7 3,131.6 3,188.9 121.5 3,310.4<br />

Cash 978.1 978.1 1,309.0 1,309.0<br />

Assets held for sale 162.9 162.9<br />

Total current assets 6,816.7 2,321.3 9,138.0 7,210.5 2,215.4 9,425.8<br />

TOTAL ASSETS 7,022.5 4,400.7 11,423.2 7,421.0 4,232.5 11,653.5<br />

LIABILITIES<br />

Non-current liabilities<br />

Financial non-current liabilities 52.3 110.4 162.7 19.9 246.2 266.1<br />

Pensions 6 30.9 147.9 178.7 25.0 283.5 308.6<br />

Deferred tax liabilities 240.6 240.6 213.6 213.6<br />

Non-current provisions 4.1 4.1 7.4 7.4<br />

Total non-current liabilities 83.2 503.0 586.2 44.9 750.7 795.6<br />

Current liabilities<br />

Financial current liabilities 379.5 30.0 409.5 465.1 50.5 515.6<br />

Tax liabilities 147.4 147.4 148.0 148.0<br />

Current provisions 472.9 267.5 740.4 446.2 251.1 697.3<br />

Gross amount due to customers for contract work 2,089.7 400.0 2,489.6 2,085.8 265.2 2,351.0<br />

Trade and other payables 3,884.0 109.7 3,993.7 4,030.2 310.1 4,340.3<br />

Total current liabilities 6,973.5 807.1 7,780.7 7,175.3 876.9 8,052.2<br />

TOTAL LIABILITIES 7,056.7 1,310.2 8,366.9 7,220.2 1,627.6 8,847.8<br />

1 In case <strong>of</strong> amounts expected to be recovered within twelve months, expected annual depreciation/amortization has been recognized.<br />

2 Allocation cannot be estimated.<br />

3 Deferred tax assets are expected to be recovered in their entirety in more than twelve months.<br />

4 Recovery within one year on current-asset properties is based on a historical assessment from the past three years.<br />

5 Current receivables that fall due in more than twelve months are part <strong>of</strong> the operating cycle and are thus recognized as current.<br />

6 “Within 12 months” refers to expected benefit payments.<br />

138 Notes, including accounting and valuation principles <strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong>