Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note<br />

20 Continued Note 21<br />

Financial assets<br />

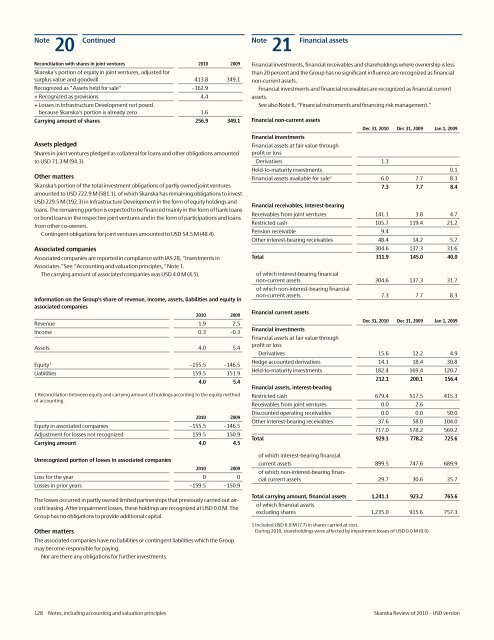

Reconciliation with shares in joint ventures <strong>2010</strong> 2009<br />

<strong>Skanska</strong>'s portion <strong>of</strong> equity in joint ventures, adjusted for<br />

surplus value and goodwill 413.8 349.1<br />

Recognized as "Assets held for sale" –162.9<br />

+ Recognized as provisions 4.4<br />

+ Losses in Infrastructure Development not posed<br />

because <strong>Skanska</strong>'s portion is already zero 1.6<br />

Carrying amount <strong>of</strong> shares 256.9 349.1<br />

Assets pledged<br />

Shares in joint ventures pledged as collateral for loans and other obligations amounted<br />

to <strong>USD</strong> 71.3 M (94.3).<br />

Other matters<br />

<strong>Skanska</strong>’s portion <strong>of</strong> the total investment obligations <strong>of</strong> partly owned joint ventures<br />

amounted to <strong>USD</strong> 722.9 M (581.1), <strong>of</strong> which <strong>Skanska</strong> has remaining obligations to invest<br />

<strong>USD</strong> 229.5 M (192.3) in Infrastructure Development in the form <strong>of</strong> equity holdings and<br />

loans. The remaining portion is expected to be financed mainly in the form <strong>of</strong> bank loans<br />

or bond loans in the respective joint ventures and in the form <strong>of</strong> participations and loans<br />

from other co-owners.<br />

Contingent obligations for joint ventures amounted to <strong>USD</strong> 54.5 M (48.4).<br />

Associated companies<br />

Associated companies are reported in compliance with IAS 28, “Investments in<br />

Associates.”See “Accounting and valuation principles,” Note 1.<br />

The carrying amount <strong>of</strong> associated companies was <strong>USD</strong> 4.0 M (4.5).<br />

Information on the Group's share <strong>of</strong> revenue, income, assets, liabilities and equity in<br />

associated companies<br />

<strong>2010</strong> 2009<br />

Revenue 1.9 2.5<br />

Income 0.3 –0.3<br />

Assets 4.0 5.4<br />

Equity 1 –155.5 –146.5<br />

Liabilities 159.5 151.9<br />

4.0 5.4<br />

1 Reconciliation between equity and carrying amount <strong>of</strong> holdings according to the equity method<br />

<strong>of</strong> accounting.<br />

<strong>2010</strong> 2009<br />

Equity in associated companies –155.5 –146.5<br />

Adjustment for losses not recognized 159.5 150.9<br />

Carrying amount 4.0 4.5<br />

Unrecognized portion <strong>of</strong> losses in associated companies<br />

<strong>2010</strong> 2009<br />

Loss for the year 0 0<br />

Losses in prior years –159.5 –150.9<br />

The losses occurred in partly owned limited partnerships that previously carried out aircraft<br />

leasing. After impairment losses, these holdings are recognized at <strong>USD</strong> 0.0 M. The<br />

Group has no obligations to provide additional capital.<br />

Other matters<br />

The associated companies have no liabilities or contingent liabilities which the Group<br />

may become responsible for paying.<br />

Nor are there any obligations for further investments.<br />

Financial investments, financial receivables and shareholdings where ownership is less<br />

than 20 percent and the Group has no significant influence are recognized as financial<br />

non-current assets.<br />

Financial investments and financial receivables are recognized as financial current<br />

assets.<br />

See also Note 6, “Financial instruments and financing risk management.”<br />

Financial non-current assets<br />

Financial investments<br />

Financial assets at fair value through<br />

pr<strong>of</strong>it or loss<br />

Derivatives 1.3<br />

Dec 31, <strong>2010</strong> Dec 31, 2009 Jan 1, 2009<br />

Held-to-maturity investments 0.1<br />

Financial assets available for sale 1 6.0 7.7 8.3<br />

7.3 7.7 8.4<br />

Financial receivables, interest-bearing<br />

Receivables from joint ventures 141.1 3.8 4.7<br />

Restricted cash 105.7 119.4 21.2<br />

Pension receivable 9.4<br />

Other interest-bearing receivables 48.4 14.2 5.7<br />

304.6 137.3 31.6<br />

Total 311.9 145.0 40.0<br />

<strong>of</strong> which interest-bearing financial<br />

non-current assets 304.6 137.3 31.7<br />

<strong>of</strong> which non-interest-bearing financial<br />

non-current assets 7.3 7.7 8.3<br />

Financial current assets<br />

Dec 31, <strong>2010</strong> Dec 31, 2009 Jan 1, 2009<br />

Financial investments<br />

Financial assets at fair value through<br />

pr<strong>of</strong>it or loss<br />

Derivatives 15.6 12.2 4.9<br />

Hedge accounted derivatives 14.1 18.4 30.8<br />

Held-to-maturity investments 182.4 169.4 120.7<br />

212.1 200.1 156.4<br />

Financial assets, interest-bearing<br />

Restricted cash 679.4 517.5 415.3<br />

Receivables from joint ventures 0.0 2.6<br />

Discounted operating receivables 0.0 0.0 50.0<br />

Other interest-bearing receivables 37.6 58.0 104.0<br />

717.0 578.2 569.2<br />

Total 929.1 778.2 725.6<br />

<strong>of</strong> which interest-bearing financial<br />

current assets 899.5 747.6 689.9<br />

<strong>of</strong> which non-interest-bearing financial<br />

current assets 29.7 30.6 35.7<br />

Total carrying amount, financial assets 1,241.1 923.2 765.6<br />

<strong>of</strong> which financial assets<br />

excluding shares 1,235.0 915.6 757.3<br />

1 Included <strong>USD</strong> 6.0 M (7.7) in shares carried at cost.<br />

During <strong>2010</strong>, shareholdings were affected by impairment losses <strong>of</strong> <strong>USD</strong> 0.0 M (0.0).<br />

128 Notes, including accounting and valuation principles <strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong>