Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note<br />

26<br />

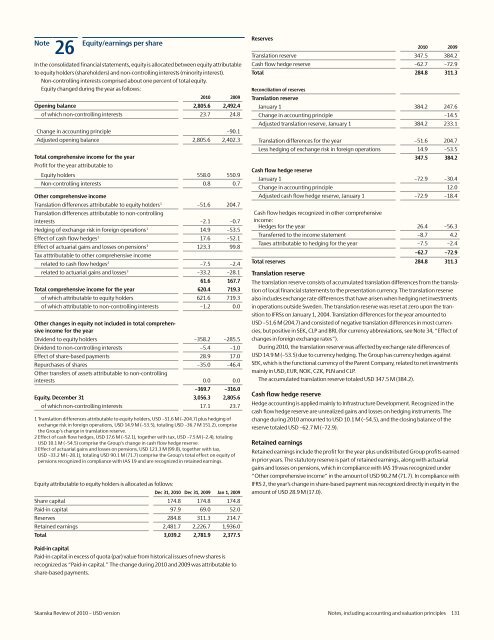

Equity/earnings per share<br />

In the consolidated financial statements, equity is allocated between equity attributable<br />

to equity holders (shareholders) and non-controlling interests (minority interest).<br />

Non-controlling interests comprised about one percent <strong>of</strong> total equity.<br />

Equity changed during the year as follows:<br />

<strong>2010</strong> 2009<br />

Opening balance 2,805.6 2,492.4<br />

<strong>of</strong> which non-controlling interests 23.7 24.8<br />

Change in accounting principle –90.1<br />

Adjusted opening balance 2,805.6 2,402.3<br />

Total comprehensive income for the year<br />

Pr<strong>of</strong>it for the year attributable to<br />

Equity holders 558.0 550.9<br />

Non-controlling interests 0.8 0.7<br />

Other comprehensive income<br />

Translation differences attributable to equity holders 1 –51.6 204.7<br />

Translation differences attributable to non-controlling<br />

interests –2.1 –0.7<br />

Hedging <strong>of</strong> exchange risk in foreign operations 1 14.9 –53.5<br />

Effect <strong>of</strong> cash flow hedges 2 17.6 –52.1<br />

Effect <strong>of</strong> actuarial gains and losses on pensions 3 123.3 99.8<br />

Tax atttributable to other comprehensive income<br />

related to cash flow hedges 2 –7.5 –2.4<br />

related to actuarial gains and losses 3 –33.2 –28.1<br />

61.6 167.7<br />

Total comprehensive income for the year 620.4 719.3<br />

<strong>of</strong> which attributable to equity holders 621.6 719.3<br />

<strong>of</strong> which attributable to non-controlling interests –1.2 0.0<br />

Other changes in equity not included in total comprehensive<br />

income for the year<br />

Dividend to equity holders –358.2 –285.5<br />

Dividend to non-controlling interests –5.4 –1.0<br />

Effect <strong>of</strong> share-based payments 28.9 17.0<br />

Repurchases <strong>of</strong> shares –35.0 –46.4<br />

Other transfers <strong>of</strong> assets attributable to non-controlling<br />

interests 0.0 0.0<br />

–369.7 –316.0<br />

Equity, December 31 3,056.3 2,805.6<br />

<strong>of</strong> which non-controlling interests 17.1 23.7<br />

1 Translation differences attributable to equity holders, <strong>USD</strong> –51.6 M (–204.7) plus hedging <strong>of</strong><br />

exchange risk in foreign operations, <strong>USD</strong> 14.9 M (–53.5), totaling <strong>USD</strong> –36.7 M 151.2), comprise<br />

the Group’s change in translation reserve.<br />

2 Effect <strong>of</strong> cash flow hedges, <strong>USD</strong> 17.6 M (–52.1), together with tax, <strong>USD</strong> –7.5 M (–2.4), totaling<br />

<strong>USD</strong> 10.1 M (–54.5) comprise the Group’s change in cash flow hedge reserve.<br />

3 Effect <strong>of</strong> actuarial gains and losses on pensions, <strong>USD</strong> 123.3 M (99.8), together with tax,<br />

<strong>USD</strong> –33.2 M (–28.1), totaling <strong>USD</strong> 90.1 M (71.7) comprise the Group’s total effect on equity <strong>of</strong><br />

pensions recognized in compliance with IAS 19 and are recognized in retained earnings.<br />

Equity attributable to equity holders is allocated as follows:<br />

Dec 31, <strong>2010</strong> Dec 31, 2009 Jan 1, 2009<br />

Share capital 174.8 174.8 174.8<br />

Paid-in capital 97.9 69.0 52.0<br />

Reserves 284.8 311.3 214.7<br />

Retained earnings 2,481.7 2,226.7 1,936.0<br />

Total 3,039.2 2,781.9 2,377.5<br />

Reserves<br />

<strong>2010</strong> 2009<br />

Translation reserve 347.5 384.2<br />

Cash flow hedge reserve –62.7 –72.9<br />

Total 284.8 311.3<br />

Reconciliation <strong>of</strong> reserves<br />

Translation reserve<br />

January 1 384.2 247.6<br />

Change in accounting principle –14.5<br />

Adjusted translation reserve, January 1 384.2 233.1<br />

Translation differences for the year –51.6 204.7<br />

Less hedging <strong>of</strong> exchange risk in foreign operations 14.9 –53.5<br />

Cash flow hedge reserve<br />

347.5 384.2<br />

January 1 –72.9 –30.4<br />

Change in accounting principle 12.0<br />

Adjusted cash flow hedge reserve, January 1 –72.9 –18.4<br />

Cash flow hedges recognized in other comprehensive<br />

income:<br />

Hedges for the year 26.4 –56.3<br />

Transferred to the income statement –8.7 4.2<br />

Taxes attributable to hedging for the year –7.5 –2.4<br />

–62.7 –72.9<br />

Total reserves 284.8 311.3<br />

Translation reserve<br />

The translation reserve consists <strong>of</strong> accumulated translation differences from the translation<br />

<strong>of</strong> local financial statements to the presentation currency. The translation reserve<br />

also includes exchange rate differences that have arisen when hedging net investments<br />

in operations outside Sweden. The translation reserve was reset at zero upon the transition<br />

to IFRSs on January 1, 2004. Translation differences for the year amounted to<br />

<strong>USD</strong> –51.6 M (204.7) and consisted <strong>of</strong> negative translation differences in most currencies,<br />

but positive in SEK, CLP and BRL (for currency abbreviations, see Note 34, “Effect <strong>of</strong><br />

changes in foreign exchange rates”).<br />

During <strong>2010</strong>, the translation reserve was affected by exchange rate differences <strong>of</strong><br />

<strong>USD</strong> 14.9 M (–53.5) due to currency hedging. The Group has currency hedges against<br />

SEK, which is the functional currency <strong>of</strong> the Parent Company, related to net investments<br />

mainly in <strong>USD</strong>, EUR, NOK, CZK, PLN and CLP.<br />

The accumulated translation reserve totaled <strong>USD</strong> 347.5 M (384.2).<br />

Cash flow hedge reserve<br />

Hedge accounting is applied mainly to Infrastructure Development. Recognized in the<br />

cash flow hedge reserve are unrealized gains and losses on hedging instruments. The<br />

change during <strong>2010</strong> amounted to <strong>USD</strong> 10.1 M (–54.5), and the closing balance <strong>of</strong> the<br />

reserve totaled <strong>USD</strong> –62.7 M (–72.9).<br />

Retained earnings<br />

Retained earnings include the pr<strong>of</strong>it for the year plus undistributed Group pr<strong>of</strong>its earned<br />

in prior years. The statutory reserve is part <strong>of</strong> retained earnings, along with actuarial<br />

gains and losses on pensions, which in compliance with IAS 19 was recognized under<br />

“Other comprehensive income” in the amount <strong>of</strong> <strong>USD</strong> 90.2 M (71.7). In compliance with<br />

IFRS 2, the year’s change in share-based payment was recognized directly in equity in the<br />

amount <strong>of</strong> <strong>USD</strong> 28.9 M (17.0).<br />

Paid-in capital<br />

Paid-in capital in excess <strong>of</strong> quota (par) value from historical issues <strong>of</strong> new shares is<br />

recognized as “Paid-in capital.” The change during <strong>2010</strong> and 2009 was attributable to<br />

share-based payments.<br />

<strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong> Notes, including accounting and valuation principles 131