Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Note<br />

03 Continued<br />

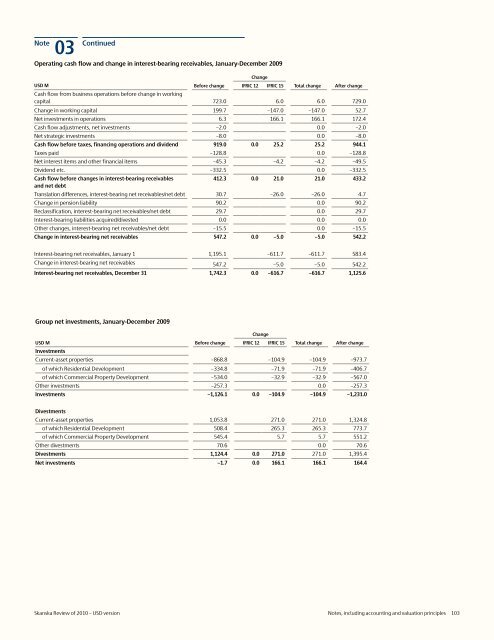

Operating cash flow and change in interest-bearing receivables, January-December 2009<br />

<strong>USD</strong> M Before change IFRIC 12 IFRIC 15 Total change After change<br />

Cash flow from business operations before change in working<br />

capital 723.0 6.0 6.0 729.0<br />

Change in working capital 199.7 –147.0 –147.0 52.7<br />

Net investments in operations 6.3 166.1 166.1 172.4<br />

Cash flow adjustments, net investments –2.0 0.0 –2.0<br />

Net strategic investments –8.0 0.0 –8.0<br />

Cash flow before taxes, financing operations and dividend 919.0 0.0 25.2 25.2 944.1<br />

Taxes paid –128.8 0.0 –128.8<br />

Net interest items and other financial items –45.3 –4.2 –4.2 –49.5<br />

Dividend etc. –332.5 0.0 –332.5<br />

Cash flow before changes in interest-bearing receivables<br />

412.3 0.0 21.0 21.0 433.2<br />

and net debt<br />

Translation differences, interest-bearing net receivables/net debt 30.7 –26.0 –26.0 4.7<br />

Change in pension liability 90.2 0.0 90.2<br />

Reclassification, interest-bearing net receivables/net debt 29.7 0.0 29.7<br />

Interest-bearing liabilities acquired/divested 0.0 0.0 0.0<br />

Other changes, interest-bearing net receivables/net debt –15.5 0.0 –15.5<br />

Change in interest-bearing net receivables 547.2 0.0 –5.0 –5.0 542.2<br />

Change<br />

Interest-bearing net receivables, January 1 1,195.1 –611.7 –611.7 583.4<br />

Change in interest-bearing net receivables 547.2 –5.0 –5.0 542.2<br />

Interest-bearing net receivables, December 31 1,742.3 0.0 –616.7 –616.7 1,125.6<br />

Group net investments, January-December 2009<br />

Change<br />

<strong>USD</strong> M Before change IFRIC 12 IFRIC 15 Total change After change<br />

Investments<br />

Current-asset properties –868.8 –104.9 –104.9 –973.7<br />

<strong>of</strong> which Residential Development –334.8 –71.9 –71.9 –406.7<br />

<strong>of</strong> which Commercial Property Development –534.0 –32.9 –32.9 –567.0<br />

Other investments –257.3 0.0 –257.3<br />

Investments –1,126.1 0.0 –104.9 –104.9 –1,231.0<br />

Divestments<br />

Current-asset properties 1,053.8 271.0 271.0 1,324.8<br />

<strong>of</strong> which Residential Development 508.4 265.3 265.3 773.7<br />

<strong>of</strong> which Commercial Property Development 545.4 5.7 5.7 551.2<br />

Other divestments 70.6 0.0 70.6<br />

Divestments 1,124.4 0.0 271.0 271.0 1,395.4<br />

Net investments –1.7 0.0 166.1 166.1 164.4<br />

<strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong> Notes, including accounting and valuation principles 103