Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

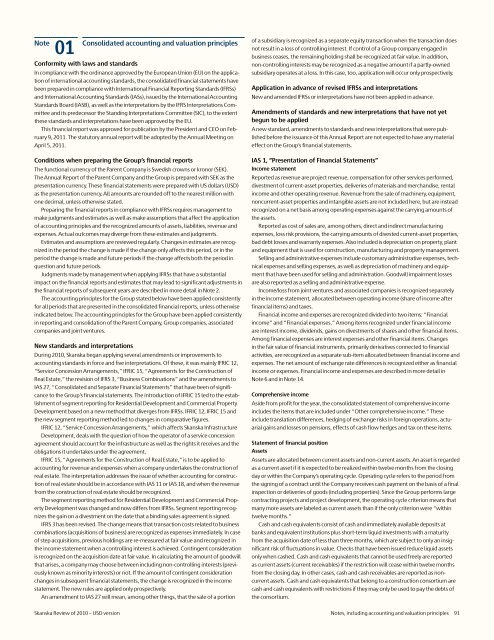

Note<br />

01<br />

Consolidated accounting and valuation principles<br />

Conformity with laws and standards<br />

In compliance with the ordinance approved by the European Union (EU) on the application<br />

<strong>of</strong> international accounting standards, the consolidated financial statements have<br />

been prepared in compliance with International Financial Reporting Standards (IFRSs)<br />

and International Accounting Standards (IASs), issued by the International Accounting<br />

Standards Board (IASB), as well as the interpretations by the IFRS Interpretations Committee<br />

and its predecessor the Standing Interpretations Committee (SIC), to the extent<br />

these standards and interpretations have been approved by the EU.<br />

This financial report was approved for publication by the President and CEO on February<br />

9, 2011. The statutory annual report will be adopted by the Annual Meeting on<br />

April 5, 2011.<br />

Conditions when preparing the Group’s financial reports<br />

The functional currency <strong>of</strong> the Parent Company is Swedish crowns or kronor (SEK).<br />

The Annual Report <strong>of</strong> the Parent Company and the Group is prepared with SEK as the<br />

presentation currency. These financial statements were prepared with US dollars (<strong>USD</strong>)<br />

as the presentation currency. All amounts are rounded <strong>of</strong>f to the nearest million with<br />

one decimal, unless otherwise stated.<br />

Preparing the financial reports in compliance with IFRSs requires management to<br />

make judgments and estimates as well as make assumptions that affect the application<br />

<strong>of</strong> accounting principles and the recognized amounts <strong>of</strong> assets, liabilities, revenue and<br />

expenses. Actual outcomes may diverge from these estimates and judgments.<br />

Estimates and assumptions are reviewed regularly. Changes in estimates are recognized<br />

in the period the change is made if the change only affects this period, or in the<br />

period the change is made and future periods if the change affects both the period in<br />

question and future periods.<br />

Judgments made by management when applying IFRSs that have a substantial<br />

impact on the financial reports and estimates that may lead to significant adjustments in<br />

the financial reports <strong>of</strong> subsequent years are described in more detail in Note 2.<br />

The accounting principles for the Group stated below have been applied consistently<br />

for all periods that are presented in the consolidated financial reports, unless otherwise<br />

indicated below. The accounting principles for the Group have been applied consistently<br />

in reporting and consolidation <strong>of</strong> the Parent Company, Group companies, associated<br />

companies and joint ventures.<br />

New standards and interpretations<br />

During <strong>2010</strong>, <strong>Skanska</strong> began applying several amendments or improvements to<br />

accounting standards in force and five interpretations. Of these, it was mainly IFRIC 12,<br />

“Service Concession Arrangements,” IFRIC 15, “Agreements for the Construction <strong>of</strong><br />

Real Estate,” the revision <strong>of</strong> IFRS 3, “Business Combinations” and the amendments to<br />

IAS 27, “Consolidated and Separate Financial Statements” that have been <strong>of</strong> significance<br />

to the Group’s financial statements. The introduction <strong>of</strong> IFRIC 15 led to the establishment<br />

<strong>of</strong> segment reporting for Residential Development and Commercial Property<br />

Development based on a new method that diverges from IFRSs. IFRIC 12, IFRIC 15 and<br />

the new segment reporting method led to changes in comparative figures.<br />

IFRIC 12, “Service Concession Arrangements,” which affects <strong>Skanska</strong> Infrastructure<br />

Development, deals with the question <strong>of</strong> how the operator <strong>of</strong> a service concession<br />

agreement should account for the infrastructure as well as the rights it receives and the<br />

obligations it undertakes under the agreement.<br />

IFRIC 15, “Agreements for the Construction <strong>of</strong> Real Estate,” is to be applied to<br />

accounting for revenue and expenses when a company undertakes the construction <strong>of</strong><br />

real estate. The interpretation addresses the issue <strong>of</strong> whether accounting for construction<br />

<strong>of</strong> real estate should be in accordance with IAS 11 or IAS 18, and when the revenue<br />

from the construction <strong>of</strong> real estate should be recognized.<br />

The segment reporting method for Residential Development and Commercial Property<br />

Development was changed and now differs from IFRSs. Segment reporting recognizes<br />

the gain on a divestment on the date that a binding sales agreement is signed.<br />

IFRS 3 has been revised. The change means that transaction costs related to business<br />

combinations (acquisitions <strong>of</strong> business) are recognized as expenses immediately. In case<br />

<strong>of</strong> step acquisitions, previous holdings are re-measured at fair value and recognized in<br />

the income statement when a controlling interest is achieved. Contingent consideration<br />

is recognized on the acquisition date at fair value. In calculating the amount <strong>of</strong> goodwill<br />

that arises, a company may choose between including non-controlling interests (previously<br />

known as minority interests) or not. If the amount <strong>of</strong> contingent consideration<br />

changes in subsequent financial statements, the change is recognized in the income<br />

statement. The new rules are applied only prospectively.<br />

An amendment to IAS 27 will mean, among other things, that the sale <strong>of</strong> a portion<br />

<strong>of</strong> a subsidiary is recognized as a separate equity transaction when the transaction does<br />

not result in a loss <strong>of</strong> controlling interest. If control <strong>of</strong> a Group company engaged in<br />

business ceases, the remaining holding shall be recognized at fair value. In addition,<br />

non-controlling interests may be recognized as a negative amount if a partly-owned<br />

subsidiary operates at a loss. In this case, too, application will occur only prospectively.<br />

Application in advance <strong>of</strong> revised IFRSs and interpretations<br />

New and amended IFRSs or interpretations have not been applied in advance.<br />

Amendments <strong>of</strong> standards and new interpretations that have not yet<br />

begun to be applied<br />

A new standard, amendments to standards and new interpretations that were published<br />

before the issuance <strong>of</strong> this Annual Report are not expected to have any material<br />

effect on the Group’s financial statements.<br />

IAS 1, “Presentation <strong>of</strong> Financial Statements”<br />

Income statement<br />

Reported as revenue are project revenue, compensation for other services performed,<br />

divestment <strong>of</strong> current-asset properties, deliveries <strong>of</strong> materials and merchandise, rental<br />

income and other operating revenue. Revenue from the sale <strong>of</strong> machinery, equipment,<br />

noncurrent-asset properties and intangible assets are not included here, but are instead<br />

recognized on a net basis among operating expenses against the carrying amounts <strong>of</strong><br />

the assets.<br />

Reported as cost <strong>of</strong> sales are, among others, direct and indirect manufacturing<br />

expenses, loss risk provisions, the carrying amounts <strong>of</strong> divested current-asset properties,<br />

bad debt losses and warranty expenses. Also included is depreciation on property, plant<br />

and equipment that is used for construction, manufacturing and property management.<br />

Selling and administrative expenses include customary administrative expenses, technical<br />

expenses and selling expenses, as well as depreciation <strong>of</strong> machinery and equipment<br />

that have been used for selling and administration. Goodwill impairment losses<br />

are also reported as a selling and administrative expense.<br />

Income/loss from joint ventures and associated companies is recognized separately<br />

in the income statement, allocated between operating income (share <strong>of</strong> income after<br />

financial items) and taxes.<br />

Financial income and expenses are recognized divided into two items: “Financial<br />

income” and “Financial expenses.” Among items recognized under financial income<br />

are interest income, dividends, gains on divestments <strong>of</strong> shares and other financial items.<br />

Among financial expenses are interest expenses and other financial items. Changes<br />

in the fair value <strong>of</strong> financial instruments, primarily derivatives connected to financial<br />

activities, are recognized as a separate sub-item allocated between financial income and<br />

expenses. The net amount <strong>of</strong> exchange rate differences is recognized either as financial<br />

income or expenses. Financial income and expenses are described in more detail in<br />

Note 6 and in Note 14.<br />

Comprehensive income<br />

Aside from pr<strong>of</strong>it for the year, the consolidated statement <strong>of</strong> comprehensive income<br />

includes the items that are included under “Other comprehensive income.” These<br />

include translation differences, hedging <strong>of</strong> exchange risks in foreign operations, actuarial<br />

gains and losses on pensions, effects <strong>of</strong> cash flow hedges and tax on these items.<br />

Statement <strong>of</strong> financial position<br />

Assets<br />

Assets are allocated between current assets and non-current assets. An asset is regarded<br />

as a current asset if it is expected to be realized within twelve months from the closing<br />

day or within the Company’s operating cycle. Operating cycle refers to the period from<br />

the signing <strong>of</strong> a contract until the Company receives cash payment on the basis <strong>of</strong> a final<br />

inspection or deliveries <strong>of</strong> goods (including properties). Since the Group performs large<br />

contracting projects and project development, the operating cycle criterion means that<br />

many more assets are labeled as current assets than if the only criterion were “within<br />

twelve months.”<br />

Cash and cash equivalents consist <strong>of</strong> cash and immediately available deposits at<br />

banks and equivalent institutions plus short-term liquid investments with a maturity<br />

from the acquisition date <strong>of</strong> less than three months, which are subject to only an insignificant<br />

risk <strong>of</strong> fluctuations in value. Checks that have been issued reduce liquid assets<br />

only when cashed. Cash and cash equivalents that cannot be used freely are reported<br />

as current assets (current receivables) if the restriction will cease within twelve months<br />

from the closing day. In other cases, cash and cash receivables are reported as noncurrent<br />

assets. Cash and cash equivalents that belong to a construction consortium are<br />

cash and cash equivalents with restrictions if they may only be used to pay the debts <strong>of</strong><br />

the consortium.<br />

<strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong> Notes, including accounting and valuation principles 91