Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The City Green Court <strong>of</strong>fice<br />

building in Prague,<br />

Kapitalexponering i pågående<br />

Czech<br />

projekt<br />

Republic, is being<br />

developed with an eye to the<br />

Mkr<br />

environment.<br />

4 000<br />

City Green Court, which will<br />

have 3 50016,000 sq. m (172,200 sq. ft.)<br />

<strong>of</strong> 3 000 leasable space, is expected<br />

to be completed during the first<br />

2 500<br />

quarter <strong>of</strong> 2012. The property is<br />

located 2 000 in the Pankrác central<br />

business 1 500 district.<br />

Like other <strong>of</strong>fice projects<br />

1 000<br />

developed by <strong>Skanska</strong>, City<br />

Green 500 Court is designed to meet<br />

3. Uthyrning<br />

2. Design och projektering<br />

1. Planläggning och bygglov<br />

2000 2002 2004 2006<br />

18–36<br />

2008<br />

månader<br />

<strong>2010</strong><br />

Tid<br />

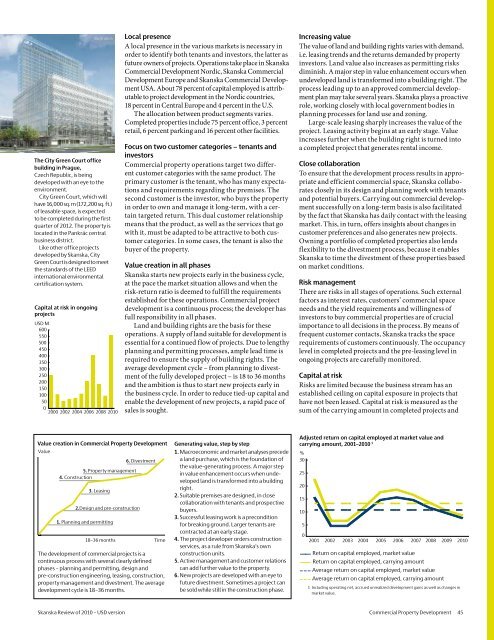

Value creation in Commercial Property Development<br />

Value<br />

Illustration<br />

5. Property management<br />

4. Construction<br />

3. Leasing<br />

2.Design and pre-construction<br />

1. Planning and permitting<br />

6. Divestment<br />

18–36 months Time<br />

The development <strong>of</strong> commercial projects is a<br />

continuous process with several clearly defined<br />

phases – planning and permitting, design and<br />

pre-construction engineering, leasing, construction,<br />

property management and divestment. The average<br />

development cycle is 18–36 months.<br />

Local presence<br />

A local presence in the various markets is necessary in<br />

order to identify both tenants and investors, the latter as<br />

future owners <strong>of</strong> projects. Operations take place in <strong>Skanska</strong><br />

Commercial Development Nordic, <strong>Skanska</strong> Commercial<br />

Development Europe and <strong>Skanska</strong> Commercial Development<br />

USA. About 78 percent <strong>of</strong> capital employed is attributable<br />

to project development in the Nordic countries,<br />

18 percent in Central Europe and 4 percent in the U.S.<br />

The allocation between product segments varies.<br />

Completed properties include 75 percent <strong>of</strong>fice, 3 percent<br />

retail, 6 percent parking and 16 percent other facilities.<br />

Focus on two customer categories − tenants and<br />

investors<br />

Commercial property operations target two different<br />

customer categories with the same product. The<br />

primary customer is the tenant, who has many expectations<br />

and requirements regarding the premises. The<br />

second customer is the investor, who buys the property<br />

in order to own and manage it long-term, with a certain<br />

targeted return. This dual customer relationship<br />

means that the product, as well as the services that go<br />

with it, must be adapted to be attractive to both customer<br />

categories. In some cases, the tenant is also the<br />

buyer <strong>of</strong> the property.<br />

Value creation in all phases<br />

the 0standards <strong>of</strong> the LEED<br />

international 2000 2002environmental<br />

2004 2006 2008 <strong>2010</strong> <strong>Skanska</strong> starts new projects early in the business cycle,<br />

certification system.<br />

at the pace the market situation allows and when the<br />

risk-return ratio is deemed to fulfill the requirements<br />

established for these operations. Commercial project<br />

Capital at risk in ongoing development is a continuous process; the developer has<br />

projects<br />

Värdeskapande i Kommersiell fastighetsutveckling<br />

full responsibility in all phases.<br />

<strong>USD</strong><br />

Värde<br />

M<br />

Land and building rights are the basis for these<br />

600<br />

operations. 6. Försäljning A supply <strong>of</strong> land suitable for development is<br />

essential for a continued flow <strong>of</strong> projects. Due to lengthy<br />

5. Förvaltning<br />

4. Byggande<br />

550<br />

500<br />

450<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

planning and permitting processes, ample lead time is<br />

required to ensure the supply <strong>of</strong> building rights. The<br />

average development cycle – from planning to divestment<br />

<strong>of</strong> the fully developed project – is 18 to 36 months<br />

and the ambition is thus to start new projects early in<br />

the business cycle. In order to reduce tied-up capital and<br />

enable the development <strong>of</strong> new projects, a rapid pace <strong>of</strong><br />

sales is sought.<br />

Generating value, step by step<br />

1. Macroeconomic and market analyses precede<br />

a land purchase, which is the foundation <strong>of</strong><br />

the value-generating process. A major step<br />

in value enhancement occurs when undeveloped<br />

land is transformed into a building<br />

right.<br />

2. Suitable premises are designed, in close<br />

collaboration with tenants and prospective<br />

buyers.<br />

3. Successful leasing work is a precondition<br />

for breaking ground. Larger tenants are<br />

contracted at an early stage.<br />

4. The project developer orders construction<br />

services, as a rule from <strong>Skanska</strong>’s own<br />

construction units.<br />

5. Active management and customer relations<br />

can add further value to the property.<br />

6. New projects are developed with an eye to<br />

future divestment. Sometimes a project can<br />

be sold while still in the construction phase.<br />

Increasing value<br />

The value <strong>of</strong> land and building rights varies with demand,<br />

i.e. leasing trends and the returns demanded by property<br />

investors. Land value also increases as permitting risks<br />

diminish. A major step in value enhancement occurs when<br />

undeveloped land is transformed into a building right. The<br />

process leading up to an approved commercial development<br />

plan may take several years. <strong>Skanska</strong> plays a pro active<br />

role, working closely with local government bodies in<br />

planning processes for land use and zoning.<br />

Large-scale leasing sharply increases the value <strong>of</strong> the<br />

project. Leasing activity begins at an early stage. Value<br />

increases further when the building right is turned into<br />

a completed project that generates rental income.<br />

Close collaboration<br />

To ensure that the development process results in appropriate<br />

and efficient commercial space, <strong>Skanska</strong> collaborates<br />

closely in its design and planning work with tenants<br />

and potential buyers. Carrying out commercial development<br />

successfully on a long-term basis is also facilitated<br />

by the fact that <strong>Skanska</strong> has daily contact with the leasing<br />

market. This, in turn, <strong>of</strong>fers insights about changes in<br />

customer preferences and also generates new projects.<br />

Owning a portfolio <strong>of</strong> completed properties also lends<br />

flexibility Justerad avkastning to the divestment på sysselsatt process, kapital because it enables Voly<br />

till marknadsvärde och redovisat värde 2001−<strong>2010</strong> <strong>Skanska</strong> to time the divestment <strong>of</strong> these properties 1)<br />

av k<br />

based<br />

%<br />

Mdr k<br />

on market conditions.<br />

30<br />

10<br />

Risk 25 management<br />

8<br />

There are risks in all stages <strong>of</strong> operations. Such external<br />

20<br />

factors as interest rates, customers’ commercial space<br />

6<br />

needs 15 and the yield requirements and willingness <strong>of</strong><br />

investors to buy commercial properties are <strong>of</strong> crucial<br />

4<br />

10<br />

importance to all decisions in the process. By means <strong>of</strong><br />

frequent customer contacts, <strong>Skanska</strong> tracks the space<br />

2<br />

5<br />

requirements <strong>of</strong> customers continuously. The occupancy<br />

0<br />

0<br />

level 2001 in completed 2002 2003 projects 2004 2005 and the 2006 pre-leasing 2007 2008 level 2009 in <strong>2010</strong><br />

2<br />

ongoing projects are carefully monitored.<br />

−− Avkastning på sysselsatt kapital, marknadsvärde<br />

−− Capital Avkastning at riskpå sysselsatt kapital, redovisat värde<br />

--- Genomsnitt Avkastning på sysselsatt kapital, marknadsvärde<br />

Risks are limited because the business stream has an<br />

•<br />

--- established Genomsnitt ceiling Avkastning on capital på sysselsatt exposure kapital, in projects redovisat that<br />

värde 1) A<br />

1) Inklusive driftnetto, upparbetade orealiserade utvecklingsvinster och förändringar<br />

have not been leased. Capital at risk is measured as the<br />

i marknadsvärde.<br />

f<br />

sum <strong>of</strong> the carrying amount in completed projects and<br />

Adjusted return on capital employed at market value and<br />

Volu<br />

carrying amount, 2001–<strong>2010</strong> 1<br />

Deve<br />

%<br />

SEK b<br />

30<br />

10<br />

25<br />

8<br />

20<br />

6<br />

15<br />

4<br />

10<br />

2<br />

5<br />

0<br />

0<br />

2001 2002 2003 2004 2005 2006 2007 2008 2009 <strong>2010</strong><br />

2<br />

−− Return on capital employed, market value<br />

−− Return on capital employed, carrying amount<br />

--- Average return on capital employed, market value •<br />

--- Average return on capital employed, carrying amount 1 R<br />

1 Including operating net, accrued unrealized development gains as well as changes in<br />

p<br />

market value.<br />

o<br />

c<br />

<strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong> Commercial Property Development 45