Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

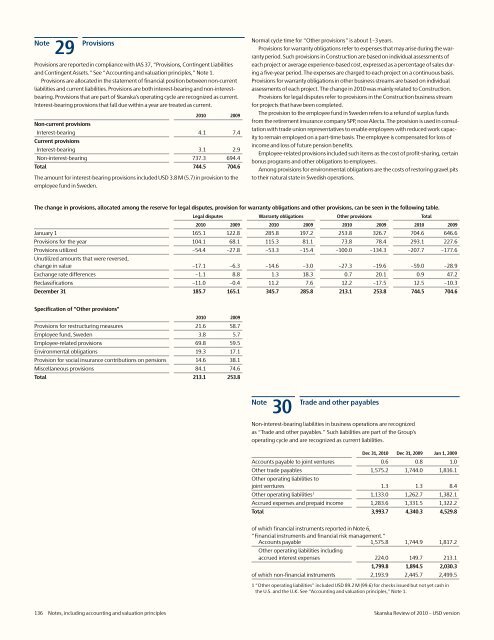

29 Provisions Note<br />

Note<br />

Provisions are reported in compliance with IAS 37, “Provisions, Contingent Liabilities<br />

and Contingent Assets.” See “Accounting and valuation principles,” Note 1.<br />

Provisions are allocated in the statement <strong>of</strong> financial position between non-current<br />

liabilities and current liabilities. Provisions are both interest-bearing and non-interestbearing.<br />

Provisions that are part <strong>of</strong> <strong>Skanska</strong>’s operating cycle are recognized as current.<br />

Interest-bearing provisions that fall due within a year are treated as current.<br />

<strong>2010</strong> 2009<br />

Non-current provisions<br />

Interest-bearing 4.1 7.4<br />

Current provisions<br />

Interest-bearing 3.1 2.9<br />

Non-interest-bearing 737.3 694.4<br />

Total 744.5 704.6<br />

The amount for interest-bearing provisions included <strong>USD</strong> 3.8 M (5.7) in provision to the<br />

employee fund in Sweden.<br />

Normal cycle time for “Other provisions” is about 1–3 years.<br />

Provisions for warranty obligations refer to expenses that may arise during the warranty<br />

period. Such provisions in Construction are based on individual assessments <strong>of</strong><br />

each project or average experience-based cost, expressed as a percentage <strong>of</strong> sales during<br />

a five-year period. The expenses are charged to each project on a continuous basis.<br />

Provisions for warranty obligations in other business streams are based on individual<br />

assessments <strong>of</strong> each project. The change in <strong>2010</strong> was mainly related to Construction.<br />

Provisions for legal disputes refer to provisions in the Construction business stream<br />

for projects that have been completed.<br />

The provision to the employee fund in Sweden refers to a refund <strong>of</strong> surplus funds<br />

from the retirement insurance company SPP, now Alecta. The provision is used in consultation<br />

with trade union representatives to enable employees with reduced work capacity<br />

to remain employed on a part-time basis. The employee is compensated for loss <strong>of</strong><br />

income and loss <strong>of</strong> future pension benefits.<br />

Employee-related provisions included such items as the cost <strong>of</strong> pr<strong>of</strong>it-sharing, certain<br />

bonus programs and other obligations to employees.<br />

Among provisions for environmental obligations are the costs <strong>of</strong> restoring gravel pits<br />

to their natural state in Swedish operations.<br />

The change in provisions, allocated among the reserve for legal disputes, provision for warranty obligations and other provisions, can be seen in the following table.<br />

Legal disputes Warranty obligations Other provisions Total<br />

<strong>2010</strong> 2009 <strong>2010</strong> 2009 <strong>2010</strong> 2009 <strong>2010</strong> 2009<br />

January 1 165.1 122.8 285.8 197.2 253.8 326.7 704.6 646.6<br />

Provisions for the year 104.1 68.1 115.3 81.1 73.8 78.4 293.1 227.6<br />

Provisions utilized –54.4 –27.8 –53.3 –15.4 –100.0 –134.3 –207.7 –177.6<br />

Unutilized amounts that were reversed,<br />

change in value –17.1 –6.3 –14.6 –3.0 –27.3 –19.6 –59.0 –28.9<br />

Exchange rate differences –1.1 8.8 1.3 18.3 0.7 20.1 0.9 47.2<br />

Reclassifications –11.0 –0.4 11.2 7.6 12.2 –17.5 12.5 –10.3<br />

December 31 185.7 165.1 345.7 285.8 213.1 253.8 744.5 704.6<br />

Specification <strong>of</strong> "Other provisions"<br />

<strong>2010</strong> 2009<br />

Provisions for restructuring measures 21.6 58.7<br />

Employee fund, Sweden 3.8 5.7<br />

Employee-related provisions 69.8 59.5<br />

Environmental obligations 19.3 17.1<br />

Provision for social insurance contributions on pensions 14.6 38.1<br />

Miscellaneous provisions 84.1 74.6<br />

Total 213.1 253.8<br />

30<br />

Trade and other payables<br />

Non-interest-bearing liabilities in business operations are recognized<br />

as “Trade and other payables.” Such liabilities are part <strong>of</strong> the Group’s<br />

operating cycle and are recognized as current liabilities.<br />

Dec 31, <strong>2010</strong> Dec 31, 2009 Jan 1, 2009<br />

Accounts payable to joint ventures 0.6 0.8 1.0<br />

Other trade payables 1,575.2 1,744.0 1,816.1<br />

Other operating liabilities to<br />

joint ventures 1.3 1.3 8.4<br />

Other operating liabilities 1 1,133.0 1,262.7 1,382.1<br />

Accrued expenses and prepaid income 1,283.6 1,331.5 1,322.2<br />

Total 3,993.7 4,340.3 4,529.8<br />

<strong>of</strong> which financial instruments reported in Note 6,<br />

"Financial instruments and financial risk management."<br />

Accounts payable 1,575.8 1,744.9 1,817.2<br />

Other operating liabilities including<br />

accrued interest expenses 224.0 149.7 213.1<br />

1,799.8 1,894.5 2,030.3<br />

<strong>of</strong> which non-financial instruments 2,193.9 2,445.7 2,499.5<br />

1 “Other operating liabilities” included <strong>USD</strong> 89.2 M (99.6) for checks issued but not yet cash in<br />

the U.S. and the U.K. See “Accounting and valuation principles,” Note 1.<br />

136 Notes, including accounting and valuation principles <strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong>