Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Note<br />

04 Continued<br />

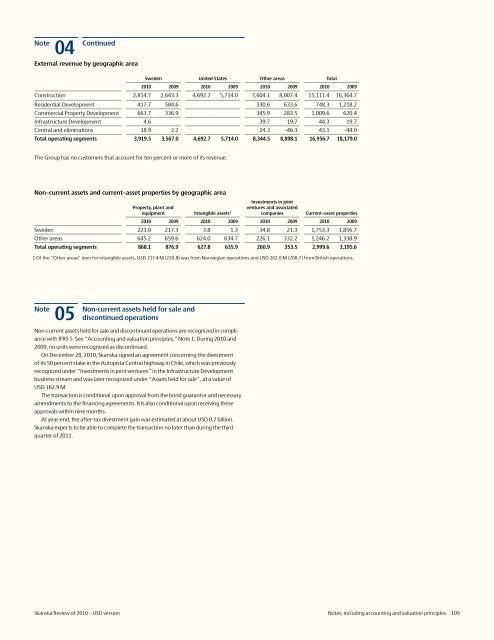

External revenue by geographic area<br />

Sweden United States Other areas Total<br />

<strong>2010</strong> 2009 <strong>2010</strong> 2009 <strong>2010</strong> 2009 <strong>2010</strong> 2009<br />

Construction 2,814.7 2,643.3 4,692.7 5,714.0 7,604.1 8,007.4 15,111.4 16,364.7<br />

Residential Development 417.7 584.6 330.6 633.6 748.3 1,218.2<br />

Commercial Property Development 663.7 336.9 345.9 283.5 1,009.6 620.4<br />

Infrastructure Development 4.6 39.7 19.7 44.3 19.7<br />

Central and eliminations 18.9 2.2 24.3 –46.3 43.1 –44.0<br />

Total operating segments 3,919.5 3,567.0 4,692.7 5,714.0 8,344.5 8,898.1 16,956.7 18,179.0<br />

The Group has no customers that account for ten percent or more <strong>of</strong> its revenue.<br />

Non–current assets and current–asset properties by geographic area<br />

equipment Intangible assets 1 companies<br />

Investments in joint<br />

Property, plant and<br />

ventures and associated<br />

Current–asset properties<br />

<strong>2010</strong> 2009 <strong>2010</strong> 2009 <strong>2010</strong> 2009 <strong>2010</strong> 2009<br />

Sweden 223.0 217.3 3.8 1.3 34.8 21.3 1,753.3 1,856.7<br />

Other areas 645.2 659.6 624.0 634.7 226.1 332.2 1,246.2 1,338.9<br />

Total operating segments 868.1 876.9 627.8 635.9 260.9 353.5 2,999.6 3,195.6<br />

1 Of the "Other areas" item for intangible assets, <strong>USD</strong> 217.4 M (220.8) was from Norwegian operations and <strong>USD</strong> 202.0 M (208.7) from British operations.<br />

<br />

Note<br />

05<br />

Non-current assets held for sale and<br />

discontinued operations<br />

Non-current assets held for sale and discontinued operations are recognized in compliance<br />

with IFRS 5. See “Accounting and valuation principles,” Note 1. During <strong>2010</strong> and<br />

2009, no units were recognized as discontinued.<br />

On December 28, <strong>2010</strong>, <strong>Skanska</strong> signed an agreement concerning the divestment<br />

<strong>of</strong> its 50 percent stake in the Autopista Central highway in Chile, which was previously<br />

recognized under “Investments in joint ventures” in the Infrastructure Development<br />

business stream and was later recognized under “Assets held for sale”, at a value <strong>of</strong><br />

<strong>USD</strong> 162.9 M.<br />

The transaction is conditional upon approval from the bond guarantor and necessary<br />

amendments to the financing agreements. It is also conditional upon receiving these<br />

approvals within nine months.<br />

At year-end, the after-tax divestment gain was estimated at about <strong>USD</strong> 0.7 billion.<br />

<strong>Skanska</strong> expects to be able to complete the transaction no later than during the third<br />

quarter <strong>of</strong> 2011.<br />

<strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong> Notes, including accounting and valuation principles 109