Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note<br />

35 Continued<br />

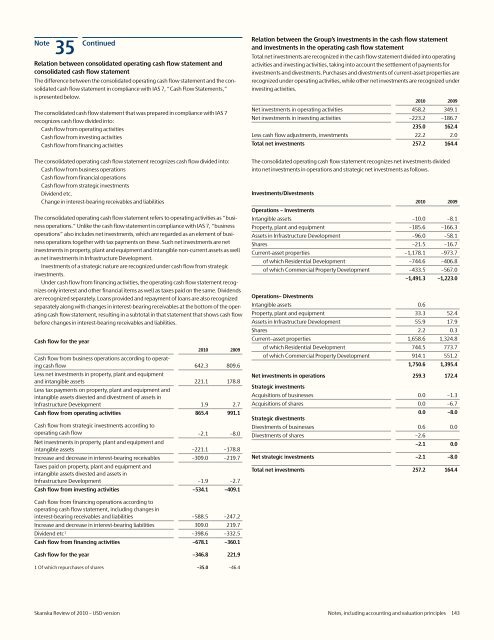

Relation between consolidated operating cash flow statement and<br />

consolidated cash flow statement<br />

The difference between the consolidated operating cash flow statement and the consolidated<br />

cash flow statement in compliance with IAS 7, “Cash Flow Statements,”<br />

is presented below.<br />

The consolidated cash flow statement that was prepared in compliance with IAS 7<br />

recognizes cash flow divided into:<br />

Cash flow from operating activities<br />

Cash flow from investing activities<br />

Cash flow from financing activities<br />

Relation between the Group’s investments in the cash flow statement<br />

and investments in the operating cash flow statement<br />

Total net investments are recognized in the cash flow statement divided into operating<br />

activities and investing activities, taking into account the settlement <strong>of</strong> payments for<br />

investments and divestments. Purchases and divestments <strong>of</strong> current-asset properties are<br />

recognized under operating activities, while other net investments are recognized under<br />

investing activities.<br />

<strong>2010</strong> 2009<br />

Net investments in operating activities 458.2 349.1<br />

Net investments in investing activities –223.2 –186.7<br />

235.0 162.4<br />

Less cash flow adjustments, investments 22.2 2.0<br />

Total net investments 257.2 164.4<br />

The consolidated operating cash flow statement recognizes cash flow divided into:<br />

Cash flow from business operations<br />

Cash flow from financial operations<br />

Cash flow from strategic investments<br />

Dividend etc.<br />

Change in interest-bearing receivables and liabilities<br />

The consolidated operating cash flow statement refers to operating activities as “business<br />

operations.” Unlike the cash flow statement in compliance with IAS 7, “business<br />

operations” also includes net investments, which are regarded as an element <strong>of</strong> business<br />

operations together with tax payments on these. Such net investments are net<br />

investments in property, plant and equipment and intangible non-current assets as well<br />

as net investments in Infrastructure Development.<br />

Investments <strong>of</strong> a strategic nature are recognized under cash flow from strategic<br />

investments.<br />

Under cash flow from financing activities, the operating cash flow statement recognizes<br />

only interest and other financial items as well as taxes paid on the same. Dividends<br />

are recognized separately. Loans provided and repayment <strong>of</strong> loans are also recognized<br />

separately along with changes in interest-bearing receivables at the bottom <strong>of</strong> the operating<br />

cash flow statement, resulting in a subtotal in that statement that shows cash flow<br />

before changes in interest-bearing receivables and liabilities.<br />

Cash flow for the year<br />

<strong>2010</strong> 2009<br />

Cash flow from business operations according to operating<br />

cash flow 642.3 809.6<br />

Less net investments in property, plant and equipment<br />

and intangible assets 221.1 178.8<br />

Less tax payments on property, plant and equipment and<br />

intangible assets divested and divestment <strong>of</strong> assets in<br />

Infrastructure Development 1.9 2.7<br />

Cash flow from operating activities 865.4 991.1<br />

Cash flow from strategic investments according to<br />

operating cash flow –2.1 –8.0<br />

Net investments in property, plant and equipment and<br />

intangible assets –221.1 –178.8<br />

Increase and decrease in interest-bearing receivables –309.0 –219.7<br />

Taxes paid on property, plant and equipment and<br />

intangible assets divested and assets in<br />

Infrastructure Development –1.9 –2.7<br />

Cash flow from investing activities –534.1 –409.1<br />

The consolidated operating cash flow statement recognizes net investments divided<br />

into net investments in operations and strategic net investments as follows.<br />

Investments/Divestments<br />

<strong>2010</strong> 2009<br />

Operations – Investments<br />

Intangible assets –10.0 –8.1<br />

Property, plant and equipment –185.6 –166.3<br />

Assets in Infrastructure Development –96.0 –58.1<br />

Shares –21.5 –16.7<br />

Current-asset properties –1,178.1 –973.7<br />

<strong>of</strong> which Residential Development –744.6 –406.8<br />

<strong>of</strong> which Commercial Property Development –433.5 –567.0<br />

Operations– Divestments<br />

Intangible assets 0.6<br />

–1,491.3 –1,223.0<br />

Property, plant and equipment 33.3 52.4<br />

Assets in Infrastructure Development 55.9 17.9<br />

Shares 2.2 0.3<br />

Current–asset properties 1,658.6 1,324.8<br />

<strong>of</strong> which Residential Development 744.5 773.7<br />

<strong>of</strong> which Commercial Property Development 914.1 551.2<br />

1,750.6 1,395.4<br />

Net investments in operations 259.3 172.4<br />

Strategic investments<br />

Acquisitions <strong>of</strong> businesses 0.0 –1.3<br />

Acquisitions <strong>of</strong> shares 0.0 –6.7<br />

0.0 –8.0<br />

Strategic divestments<br />

Divestments <strong>of</strong> businesses 0.6 0.0<br />

Divestments <strong>of</strong> shares –2.6<br />

–2.1 0.0<br />

Net strategic investments –2.1 –8.0<br />

Total net investments 257.2 164.4<br />

Cash flow from financing operations according to<br />

operating cash flow statement, including changes in<br />

interest-bearing receivables and liabilities –588.5 –247.2<br />

Increase and decrease in interest-bearing liabilities 309.0 219.7<br />

Dividend etc 1 –398.6 –332.5<br />

Cash flow from financing activities –678.1 –360.1<br />

Cash flow for the year –346.8 221.9<br />

1 Of which repurchases <strong>of</strong> shares –35.0 –46.4<br />

<strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong> Notes, including accounting and valuation principles 143