Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note<br />

06 Continued<br />

Information on the changes recognized in the consolidated income statement and<br />

in “Other comprehensive income” during the period can be found in the table “Impact<br />

<strong>of</strong> financial instruments on the consolidated income statement, other comprehensive<br />

income and equity” below.<br />

Translation exposure<br />

Net investments in Commercial Property and Infrastructure Development operations<br />

are currency-hedged, because the intention is to sell these assets over time.<br />

To a certain extent, <strong>Skanska</strong> also currency hedges equity in those markets/currencies<br />

where a relatively large share <strong>of</strong> the Group’s equity is invested. Decisions on currency<br />

hedging in these cases are made by <strong>Skanska</strong>’s Board <strong>of</strong> Directors from time to time. At the<br />

end <strong>of</strong> <strong>2010</strong>, about 28 percent <strong>of</strong> equity in North American, Norwegian, Polish and Czech<br />

companies in the <strong>Skanska</strong> Group was currency hedged.<br />

These hedges consist <strong>of</strong> forward currency contracts and foreign currency loans. The<br />

positive fair value <strong>of</strong> the forward currency contracts amounts to <strong>USD</strong> 14.1 M (18.4) and<br />

their negative fair value amounts to <strong>USD</strong> 12.8 M (22.3) . The fair value <strong>of</strong> foreign currency<br />

loans amounts to <strong>USD</strong> 92.2 M (96.5).<br />

An exchange rate shift where the <strong>USD</strong> falls/rises by 10 percent against other currencies<br />

would have an effect <strong>of</strong> <strong>USD</strong> 0.24 billion on “Other comprehensive income” after taking<br />

hedges into account.<br />

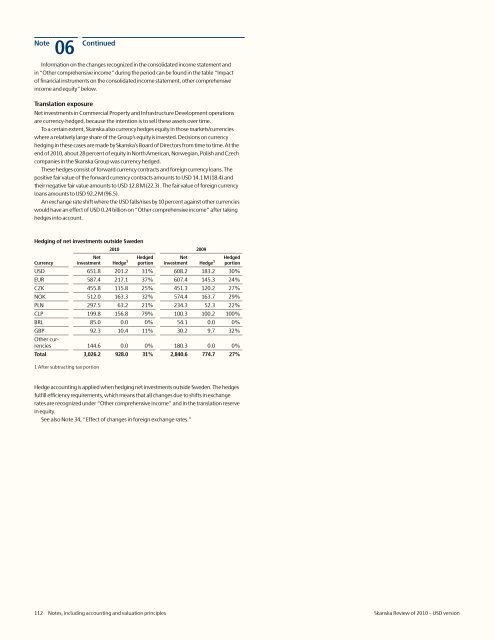

Hedging <strong>of</strong> net investments outside Sweden<br />

Currency<br />

<strong>2010</strong> 2009<br />

Net<br />

Hedged<br />

investment Hedge 1 portion<br />

Net<br />

Hedged<br />

investment Hedge 1 portion<br />

<strong>USD</strong> 651.8 201.2 31% 608.2 183.2 30%<br />

EUR 587.4 217.1 37% 607.4 145.3 24%<br />

CZK 455.8 115.8 25% 451.3 120.2 27%<br />

NOK 512.0 163.3 32% 574.4 163.7 29%<br />

PLN 297.5 63.2 21% 234.3 52.3 22%<br />

CLP 199.8 156.8 79% 100.3 100.2 100%<br />

BRL 85.0 0.0 0% 54.1 0.0 0%<br />

GBP 92.3 10.4 11% 30.2 9.7 32%<br />

Other currencies<br />

144.6 0.0 0% 180.3 0.0 0%<br />

Total 3,026.2 928.0 31% 2,840.6 774.7 27%<br />

1 After subtracting tax portion<br />

Hedge accounting is applied when hedging net investments outside Sweden. The hedges<br />

fulfill efficiency requirements, which means that all changes due to shifts in exchange<br />

rates are recognized under “Other comprehensive income” and in the translation reserve<br />

in equity.<br />

See also Note 34, “Effect <strong>of</strong> changes in foreign exchange rates.”<br />

112 Notes, including accounting and valuation principles <strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong>