Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Note<br />

43 Continued<br />

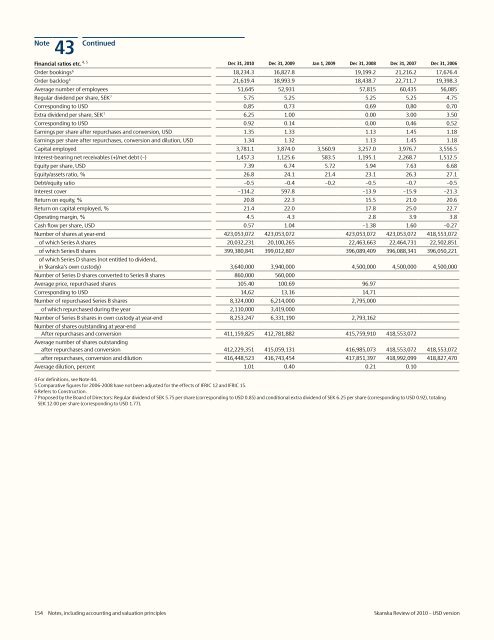

Financial ratios etc. 4, 5 Dec 31, <strong>2010</strong> Dec 31, 2009 Jan 1, 2009 Dec 31, 2008 Dec 31, 2007 Dec 31, 2006<br />

Order bookings 6 18,234.3 16,827.8 19,199.2 21,216.2 17,676.4<br />

Order backlog 6 21,619.4 18,993.9 18,438.7 22,711.7 19,398.3<br />

Average number <strong>of</strong> employees 51,645 52,931 57,815 60,435 56,085<br />

Regular dividend per share, SEK 7 5.75 5.25 5.25 5.25 4.75<br />

Corresponding to <strong>USD</strong> 0,85 0,73 0,69 0,80 0,70<br />

Extra dividend per share, SEK 7 6.25 1.00 0.00 3.00 3.50<br />

Corresponding to <strong>USD</strong> 0.92 0.14 0,00 0,46 0,52<br />

Earnings per share after repurchases and con<strong>version</strong>, <strong>USD</strong> 1.35 1.33 1.13 1.45 1.18<br />

Earnings per share after repurchases, con<strong>version</strong> and dilution, <strong>USD</strong> 1.34 1.32 1.13 1.45 1.18<br />

Capital employed 3,781.1 3,874.0 3,560.9 3,257.0 3,976.7 3,556.5<br />

Interest-bearing net receivables (+)/net debt (–) 1,457.3 1,125.6 583.5 1,195.1 2,268.7 1,512.5<br />

Equity per share, <strong>USD</strong> 7.39 6.74 5.72 5.94 7.63 6.68<br />

Equity/assets ratio, % 26.8 24.1 21.4 23.1 26.3 27.1<br />

Debt/equity ratio –0.5 –0.4 –0.2 –0.5 –0.7 –0.5<br />

Interest cover –114.2 597.8 –13.9 –15.9 –21.3<br />

Return on equity, % 20.8 22.3 15.5 21.0 20.6<br />

Return on capital employed, % 21.4 22.0 17.8 25.0 22.7<br />

Operating margin, % 4.5 4.3 2.8 3.9 3.8<br />

Cash flow per share, <strong>USD</strong> 0.57 1.04 –1.38 1.60 –0.27<br />

Number <strong>of</strong> shares at year-end 423,053,072 423,053,072 423,053,072 423,053,072 418,553,072<br />

<strong>of</strong> which Series A shares 20,032,231 20,100,265 22,463,663 22,464,731 22,502,851<br />

<strong>of</strong> which Series B shares 399,380,841 399,012,807 396,089,409 396,088,341 396,050,221<br />

<strong>of</strong> which Series D shares (not entitled to dividend,<br />

in <strong>Skanska</strong>'s own custody) 3,640,000 3,940,000 4,500,000 4,500,000 4,500,000<br />

Number <strong>of</strong> Series D shares converted to Series B shares 860,000 560,000<br />

Average price, repurchased shares 105.40 100.69 96.97<br />

Corresponding to <strong>USD</strong> 14,62 13,16 14,71<br />

Number <strong>of</strong> repurchased Series B shares 8,324,000 6,214,000 2,795,000<br />

<strong>of</strong> which repurchased during the year 2,110,000 3,419,000<br />

Number <strong>of</strong> Series B shares in own custody at year-end 8,253,247 6,331,190 2,793,162<br />

Number <strong>of</strong> shares outstanding at year-end<br />

After repurchases and con<strong>version</strong> 411,159,825 412,781,882 415,759,910 418,553,072<br />

Average number <strong>of</strong> shares outstanding<br />

after repurchases and con<strong>version</strong> 412,229,351 415,059,131 416,985,073 418,553,072 418,553,072<br />

after repurchases, con<strong>version</strong> and dilution 416,448,523 416,743,454 417,851,397 418,992,099 418,827,470<br />

Average dilution, percent 1.01 0.40 0.21 0.10<br />

4 For definitions, see Note 44.<br />

5 Comparative figures for 2006-2008 have not been adjusted for the effects <strong>of</strong> IFRIC 12 and IFRIC 15.<br />

6 Refers to Construction.<br />

7 Proposed by the Board <strong>of</strong> Directors: Regular dividend <strong>of</strong> SEK 5.75 per share (corresponding to <strong>USD</strong> 0.85) and conditional extra dividend <strong>of</strong> SEK 6.25 per share (corresponding to <strong>USD</strong> 0.92), totaling<br />

SEK 12.00 per share (corresponding to <strong>USD</strong> 1.77).<br />

154 Notes, including accounting and valuation principles <strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong>