Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Note<br />

40 Leases<br />

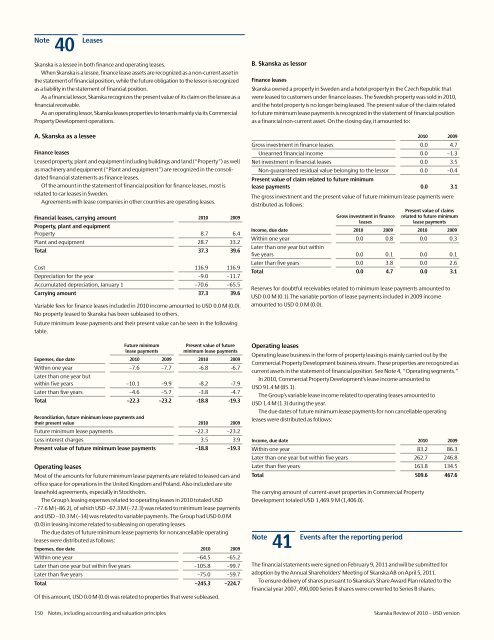

<strong>Skanska</strong> is a lessee in both finance and operating leases.<br />

When <strong>Skanska</strong> is a lessee, finance lease assets are recognized as a non-current asset in<br />

the statement <strong>of</strong> financial position, while the future obligation to the lessor is recognized<br />

as a liability in the statement <strong>of</strong> financial position.<br />

As a financial lessor, <strong>Skanska</strong> recognizes the present value <strong>of</strong> its claim on the lessee as a<br />

financial receivable.<br />

As an operating lessor, <strong>Skanska</strong> leases properties to tenants mainly via its Commercial<br />

Property Development operations.<br />

A. <strong>Skanska</strong> as a lessee<br />

Finance leases<br />

Leased property, plant and equipment including buildings and land (“Property”) as well<br />

as machinery and equipment (“Plant and equipment”) are recognized in the consolidated<br />

financial statements as finance leases.<br />

Of the amount in the statement <strong>of</strong> financial position for finance leases, most is<br />

related to car leases in Sweden.<br />

Agreements with lease companies in other countries are operating leases.<br />

Financial leases, carrying amount <strong>2010</strong> 2009<br />

Property, plant and equipment<br />

Property 8.7 6.4<br />

Plant and equipment 28.7 33.2<br />

Total 37.3 39.6<br />

Cost 116.9 116.9<br />

Depreciation for the year –9.0 –11.7<br />

Accumulated depreciation, January 1 –70.6 –65.5<br />

Carrying amount 37.3 39.6<br />

Variable fees for finance leases included in <strong>2010</strong> income amounted to <strong>USD</strong> 0.0 M (0.0).<br />

No property leased to <strong>Skanska</strong> has been subleased to others.<br />

Future minimum lease payments and their present value can be seen in the following<br />

table.<br />

Future minimum<br />

lease payments<br />

Present value <strong>of</strong> future<br />

minimum lease payments<br />

Expenses, due date <strong>2010</strong> 2009 <strong>2010</strong> 2009<br />

Within one year –7.6 –7.7 -6.8 -6.7<br />

Later than one year but<br />

within five years –10.1 –9.9 -8.2 -7.9<br />

Later than five years –4.6 –5.7 -3.8 -4.7<br />

Total –22.3 –23.2 -18.8 -19.3<br />

Reconciliation, future minimum lease payments and<br />

their present value <strong>2010</strong> 2009<br />

Future minimum lease payments –22.3 –23.2<br />

Less interest charges 3.5 3.9<br />

Present value <strong>of</strong> future minimum lease payments –18.8 –19.3<br />

Operating leases<br />

Most <strong>of</strong> the amounts for future minimum lease payments are related to leased cars and<br />

<strong>of</strong>fice space for operations in the United Kingdom and Poland. Also included are site<br />

leasehold agreements, especially in Stockholm.<br />

The Group’s leasing expenses related to operating leases in <strong>2010</strong> totaled <strong>USD</strong><br />

–77.6 M (–86.2), <strong>of</strong> which <strong>USD</strong> –67.3 M (–72.3) was related to minimum lease payments<br />

and <strong>USD</strong> –10.3 M (–14) was related to variable payments. The Group had <strong>USD</strong> 0.0 M<br />

(0.0) in leasing income related to subleasing on operating leases.<br />

The due dates <strong>of</strong> future minimum lease payments for noncancellable operating<br />

leases were distributed as follows:<br />

Expenses, due date <strong>2010</strong> 2009<br />

Within one year –64.5 –65.2<br />

Later than one year but within five years –105.8 –99.7<br />

Later than five years –75.0 –59.7<br />

Total –245.3 –224.7<br />

Of this amount, <strong>USD</strong> 0.0 M (0.0) was related to properties that were subleased.<br />

B. <strong>Skanska</strong> as lessor<br />

Finance leases<br />

<strong>Skanska</strong> owned a property in Sweden and a hotel property in the Czech Republic that<br />

were leased to customers under finance leases. The Swedish property was sold in <strong>2010</strong>,<br />

and the hotel property is no longer being leased. The present value <strong>of</strong> the claim related<br />

to future minimum lease payments is recognized in the statement <strong>of</strong> financial position<br />

as a financial non-current asset. On the closing day, it amounted to:<br />

41 Events after the reporting period Note<br />

<strong>2010</strong> 2009<br />

Gross investment in finance leases 0.0 4.7<br />

Unearned financial income 0.0 –1.3<br />

Net investment in financial leases 0.0 3.5<br />

Non-guaranteed residual value belonging to the lessor 0.0 –0.4<br />

Present value <strong>of</strong> claim related to future minimum<br />

lease payments 0.0 3.1<br />

The gross investment and the present value <strong>of</strong> future minimum lease payments were<br />

distributed as follows:<br />

Present value <strong>of</strong> claims<br />

Gross investment in finance related to future minimum<br />

leases<br />

lease payments<br />

Income, due date <strong>2010</strong> 2009 <strong>2010</strong> 2009<br />

Within one year 0.0 0.8 0.0 0.3<br />

Later than one year but within<br />

five years 0.0 0.1 0.0 0.1<br />

Later than five years 0.0 3.8 0.0 2.6<br />

Total 0.0 4.7 0.0 3.1<br />

Reserves for doubtful receivables related to minimum lease payments amounted to<br />

<strong>USD</strong> 0.0 M (0.1).The variable portion <strong>of</strong> lease payments included in 2009 income<br />

amounted to <strong>USD</strong> 0.0 M (0.0).<br />

Operating leases<br />

Operating lease business in the form <strong>of</strong> property leasing is mainly carried out by the<br />

Commercial Property Development business stream. These properties are recognized as<br />

current assets in the statement <strong>of</strong> financial position. See Note 4, “Operating segments.”<br />

In <strong>2010</strong>, Commercial Property Development’s lease income amounted to<br />

<strong>USD</strong> 91.4 M (85.1).<br />

The Group’s variable lease income related to operating leases amounted to<br />

<strong>USD</strong> 1.4 M (1.3) during the year.<br />

The due dates <strong>of</strong> future minimum lease payments for non cancellable operating<br />

leases were distributed as follows:<br />

Income, due date <strong>2010</strong> 2009<br />

Within one year 83.2 86.3<br />

Later than one year but within five years 262.7 246.8<br />

Later than five years 163.8 134.5<br />

Total 509.6 467.6<br />

The carrying amount <strong>of</strong> current-asset properties in Commercial Property<br />

Development totaled <strong>USD</strong> 1,469.9 M (1,406.0).<br />

The financial statements were signed on February 9, 2011 and will be submitted for<br />

adoption by the Annual Shareholders’ Meeting <strong>of</strong> <strong>Skanska</strong> AB on April 5, 2011.<br />

To ensure delivery <strong>of</strong> shares pursuant to <strong>Skanska</strong>’s Share Award Plan related to the<br />

financial year 2007, 490,000 Series B shares were converted to Series B shares.<br />

150 Notes, including accounting and valuation principles <strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong>