Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note<br />

28 Continued<br />

The ITP 1 occupational pension plan in Sweden is a defined-contribution plan. <strong>Skanska</strong><br />

pays premiums for employees covered by ITP 1, and each employee selects a manager.<br />

The Company <strong>of</strong>fers employees the opportunity to select <strong>Skanska</strong> as the manager. For<br />

employees who have selected <strong>Skanska</strong> as their manager, there is a guaranteed minimum<br />

amount that the employee will receive upon retirement. This guarantee means that the<br />

portion <strong>of</strong> the ITP plan for which <strong>Skanska</strong> is the manager is recognized as a defined-benefit<br />

plan. The net amount <strong>of</strong> obligations and plan assets for ITP 1 managed by <strong>Skanska</strong> is<br />

recognized in the Company’s statement <strong>of</strong> financial position.<br />

The ITP 2 occupational pension plan in Sweden is a defined-benefit plan. A small<br />

portion is secured by insurance from the retirement insurance company Alecta. This is<br />

a multi-employer insurance plan, and there is insufficient information to report these<br />

obligations as a defined-benefit plan. Pensions secured by insurance from Alecta are<br />

therefore reported as a defined-contribution plan. Since the same conditions apply to<br />

the new AFP plan in Norway, it is also reported as a defined-contribution plan.<br />

Defined-contribution plans<br />

These plans mainly cover retirement pension, disability pension and family pension. The<br />

premiums are paid regularly during the year by the respective Group company to separate<br />

legal entities, for example insurance companies. The size <strong>of</strong> the premium is based<br />

on salary. The pension expense for the period is included in the income statement.<br />

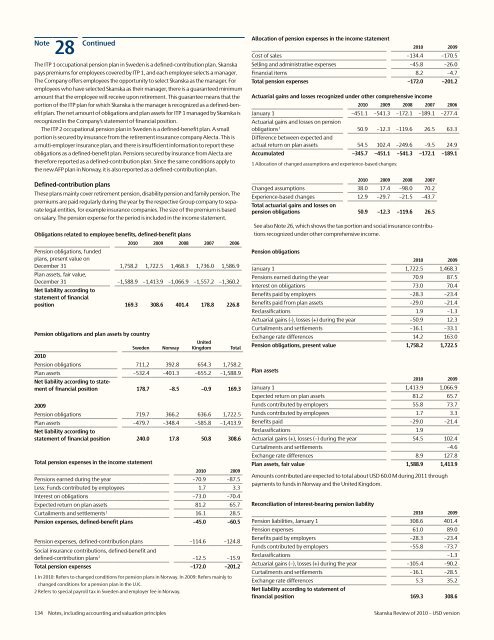

Obligations related to employee benefits, defined-benefit plans<br />

Pension obligations and plan assets by country<br />

Sweden<br />

Norway<br />

United<br />

Kingdom<br />

<strong>2010</strong><br />

Pension obligations 711.2 392.8 654.3 1,758.2<br />

Total<br />

Plan assets –532.4 –401.3 –655.2 –1,588.9<br />

Net liability according to statement<br />

<strong>of</strong> financial position 178.7 –8.5 –0.9 169.3<br />

2009<br />

Pension obligations 719.7 366.2 636.6 1,722.5<br />

Plan assets –479.7 –348.4 –585.8 –1,413.9<br />

Net liability according to<br />

statement <strong>of</strong> financial position 240.0 17.8 50.8 308.6<br />

Total pension expenses in the income statement<br />

<strong>2010</strong> 2009 2008 2007 2006<br />

Pension obligations, funded<br />

plans, present value on<br />

December 31 1,758.2 1,722.5 1,468.3 1,736.0 1,586.9<br />

Plan assets, fair value,<br />

December 31 –1,588.9 –1,413.9 –1,066.9 –1,557.2 –1,360.2<br />

Net liability according to<br />

statement <strong>of</strong> financial<br />

position 169.3 308.6 401.4 178.8 226.8<br />

<strong>2010</strong> 2009<br />

Pensions earned during the year –70.9 –87.5<br />

Less: Funds contributed by employees 1.7 3.3<br />

Interest on obligations –73.0 –70.4<br />

Expected return on plan assets 81.2 65.7<br />

Curtailments and settlements 1 16.1 28.5<br />

Pension expenses, defined-benefit plans –45.0 –60.5<br />

Pension expenses, defined-contribution plans –114.6 –124.8<br />

Social insurance contributions, defined-benefit and<br />

defined-contribution plans 2 –12.5 –15.9<br />

Total pension expenses –172.0 –201.2<br />

1 In <strong>2010</strong>: Refers to changed conditions for pension plans in Norway. In 2009: Refers mainly to<br />

changed conditions for a pension plan in the U.K.<br />

2 Refers to special payroll tax in Sweden and employer fee in Norway.<br />

Allocation <strong>of</strong> pension expenses in the income statement<br />

Actuarial gains and losses recognized under other comprehensive income<br />

Pension obligations<br />

<strong>2010</strong> 2009<br />

January 1 1,722.5 1,468.3<br />

Pensions earned during the year 70.9 87.5<br />

Interest on obligations 73.0 70.4<br />

Benefits paid by employers –28.3 –23.4<br />

Benefits paid from plan assets –29.0 –21.4<br />

Reclassifications 1.9 –1.3<br />

Actuarial gains (-), losses (+) during the year –50.9 12.3<br />

Curtailments and settlements –16.1 –33.1<br />

Exchange rate differences 14.2 163.0<br />

Pension obligations, present value 1,758.2 1,722.5<br />

Plan assets<br />

<strong>2010</strong> 2009<br />

January 1 1,413.9 1,066.9<br />

Expected return on plan assets 81.2 65.7<br />

Funds contributed by employers 55.8 73.7<br />

Funds contributed by employees 1.7 3.3<br />

Benefits paid –29.0 –21.4<br />

Reclassifications 1.9<br />

Actuarial gains (+), losses (–) during the year 54.5 102.4<br />

Curtailments and settlements –4.6<br />

Exchange rate differences 8.9 127.8<br />

Plan assets, fair value 1,588.9 1,413.9<br />

Amounts contributed are expected to total about <strong>USD</strong> 60.0 M during 2011 through<br />

payments to funds in Norway and the United Kingdom.<br />

Reconciliation <strong>of</strong> interest-bearing pension liability<br />

<strong>2010</strong> 2009 2008 2007 2006<br />

January 1 –451.1 –541.3 –172.1 –189.1 –277.4<br />

Actuarial gains and losses on pension<br />

obligations 1 50.9 –12.3 –119.6 26.5 63.3<br />

Difference between expected and<br />

actual return on plan assets 54.5 102.4 –249.6 –9.5 24.9<br />

Accumulated –345.7 –451.1 –541.3 –172.1 –189.1<br />

1 Allocation <strong>of</strong> changed assumptions and experience-based changes:<br />

<strong>2010</strong> 2009<br />

Cost <strong>of</strong> sales –134.4 –170.5<br />

Selling and administrative expenses –45.8 –26.0<br />

Financial items 8.2 –4.7<br />

Total pension expenses –172.0 –201.2<br />

<strong>2010</strong> 2009 2008 2007<br />

Changed assumptions 38.0 17.4 –98.0 70.2<br />

Experience-based changes 12.9 –29.7 –21.5 –43.7<br />

Total actuarial gains and losses on<br />

pension obligations 50.9 –12.3 –119.6 26.5<br />

See also Note 26, which shows the tax portion and social insurance contributions<br />

recognized under other comprehensive income.<br />

<strong>2010</strong> 2009<br />

Pension liabilities, January 1 308.6 401.4<br />

Pension expenses 61.0 89.0<br />

Benefits paid by employers –28.3 –23.4<br />

Funds contributed by employers –55.8 –73.7<br />

Reclassifications –1.3<br />

Actuarial gains (–), losses (+) during the year –105.4 –90.2<br />

Curtailments and settlements –16.1 –28.5<br />

Exchange rate differences 5.3 35.2<br />

Net liability according to statement <strong>of</strong><br />

financial position 169.3 308.6<br />

134 Notes, including accounting and valuation principles <strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong>