Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

At the end <strong>of</strong> <strong>2010</strong>, <strong>Skanska</strong> signed an agreement to sell<br />

its 50 percent stake in the Autopista Central in Chile.<br />

The divestment, which will be completed during 2011, is<br />

expected to result in an after-tax gain <strong>of</strong> approximately<br />

<strong>USD</strong> 0.73 billion. The urban highway in Santiago has<br />

been in operation since 2004.<br />

During the year, <strong>Skanska</strong> also sold its stakes in the<br />

E39 highway south <strong>of</strong> Trondheim, Norway and the<br />

Bexley Schools project in southeastern London, U.K.<br />

In the U.K., work began on modernizing the street<br />

lighting network in Surrey, southeast <strong>of</strong> London. This<br />

represents a new product segment in public-private<br />

partnerships. <strong>Skanska</strong> is also working on the possibility<br />

<strong>of</strong> constructing and operating thermoelectric power<br />

plants in the U.K. for generating energy through waste<br />

combustion. This segment will grow, due to new<br />

European Union directives that will not allow continued<br />

use <strong>of</strong> waste landfills.<br />

Construction is continuing on a number <strong>of</strong> other projects.<br />

These include school projects in Bristol and Essex as<br />

part <strong>of</strong> the large-scale British school modernization program,<br />

Building Schools for the Future, and four hospitals:<br />

Barts, the Royal London, Mansfield and Walsall.<br />

In the U.K., <strong>Skanska</strong> is also continuing its expansion<br />

<strong>of</strong> the M25 orbital road around London.<br />

In Poland, <strong>Skanska</strong> is currently building the second,<br />

62 km (39 mi.) phase <strong>of</strong> the A1 expressway project. The<br />

first 90 km (56 mi.) phase <strong>of</strong> the expressway was completed<br />

in the autumn <strong>of</strong><br />

Marknadsriskprojekt, exempel<br />

2008.<br />

<strong>Skanska</strong> Infrastructure Bedömt Development bruttonuvärde, is also active in<br />

the U.S. market. A highway exklusive tunnel Autopista in Central, Virginia is one<br />

fördelat per:<br />

<strong>of</strong> several potential projects it is working on in the PPP<br />

market. In the U.S., <strong>Skanska</strong> is studying a number <strong>of</strong><br />

potential infrastructure Kategori projects such as highways and<br />

tunnels. <strong>Skanska</strong> is currently conducting feasibility<br />

studies that will provide documentation for decisions by<br />

public agencies on possibly choosing a PPP solution in<br />

order to implement and operate these projects. <strong>Skanska</strong><br />

is being compensated for some parts <strong>of</strong> these studies.<br />

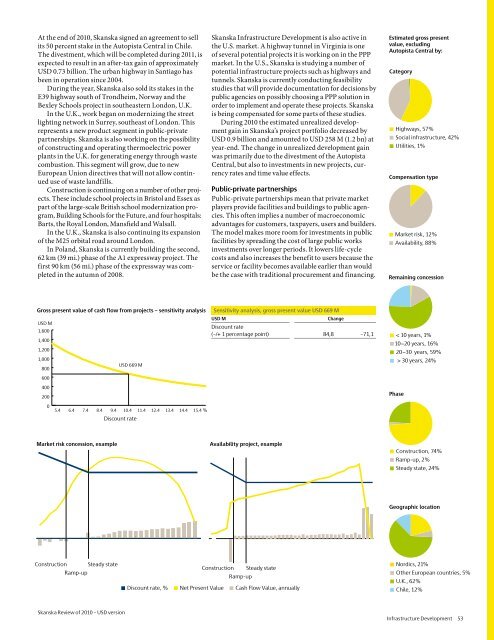

During <strong>2010</strong> the estimated unrealized development<br />

gain in <strong>Skanska</strong>’s Väg, project 57% portfolio decreased by<br />

<strong>USD</strong> 0.9 billion and amounted Social infrastruktur, to <strong>USD</strong> 42% 258 M (1.2 bn) at<br />

year-end. The change • Anläggning, unrealized 1% development gain<br />

was primarily due to the divestment <strong>of</strong> the Autopista<br />

Central, but also to investments in new projects, currency<br />

rates and time value effects.<br />

Ersättningsmodell<br />

Public-private partnerships<br />

Public-private partnerships mean that private market<br />

players provide facilities and buildings to public agencies.<br />

This <strong>of</strong>ten implies a number <strong>of</strong> macroeconomic<br />

advantages for customers, taxpayers, users and builders.<br />

The model makes more room for investments in public<br />

facilities by spreading Marknadsrisk, the cost <strong>of</strong> large 12% public works<br />

investments over longer • Tillgänglighet, periods. It 88% lowers life-cycle<br />

costs and also increases the benefit to users because the<br />

service or facility becomes available earlier than would<br />

Tillgänglighetsprojekt, exempel<br />

be the case with traditional procurement and financing.<br />

Återstående<br />

koncessionslöptid<br />

Estimated gross present<br />

value, excluding<br />

Autopista Central by:<br />

Highways, 57%<br />

Social infrastructure, 42%<br />

• Utilities, 1%<br />

Compensation type<br />

Market risk, 12%<br />

• Availability, 88%<br />

Remaining concession<br />

Gross present value <strong>of</strong> cash flow from projects – sensitivity analysis<br />

<strong>USD</strong> M<br />

1,600<br />

1,400<br />

1,200<br />

1,000<br />

800<br />

600<br />

400<br />

<strong>USD</strong> 669 M<br />

200 Byggfas Långsiktig driftfas<br />

Byggfas Långsiktig driftfas<br />

Uppstartsfas<br />

Uppstartsfas Fas<br />

0<br />

5.4 6.4 7.4 8.4 9.4 10.4 11.4 12.4 13.4 14.4 15.4 %<br />

Discount rate • Diskonteringsränta, %<br />

Sensitivity analysis, gross present value <strong>USD</strong> 669 M<br />

<strong>USD</strong> M Change<br />

Discount rate<br />

(–/+ 1 percentage point) 84,8 –71,1<br />

< 10 år, 1%<br />

10−20 år, 16%<br />

20−30 år, 59%<br />

• > 30 år, 24%<br />

• Nettonuvärde • Årligt kassaflöde<br />

< 10 years, 1%<br />

10−20 years, 16%<br />

20−30 years, 59%<br />

• > 30 years, 24%<br />

Phase<br />

Market risk concession, example<br />

Availability project, example<br />

Category<br />

Bygg, 74%<br />

Uppstart, 2%<br />

• Drift, 24%<br />

Construction, 74%<br />

Ramp-up, 2%<br />

• Steady state, 24%<br />

Geografi<br />

Geographic location<br />

Construction Steady state<br />

Ramp-up<br />

• Discount rate, % • Net Present Value •<br />

Construction Steady state<br />

Norden, 21%<br />

Ramp-up<br />

Övriga Europa, 5%<br />

Storbritannien, 62%<br />

Cash Flow Value, annually<br />

• Chile, 12%<br />

Nordics, 21%<br />

Other European countries, 5%<br />

U.K., 62%<br />

• Chile, 12%<br />

<strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong><br />

Infrastructure Development 53