- Page 1:

Business Case for the Sunshine Coas

- Page 4 and 5:

Business Case for the Sunshine Coas

- Page 6 and 7:

Business Case for the Sunshine Coas

- Page 8 and 9:

Business Case for the Sunshine Coas

- Page 10 and 11:

Business Case for the Sunshine Coas

- Page 12 and 13:

Business Case for the Sunshine Coas

- Page 14 and 15:

Business Case for the Sunshine Coas

- Page 16 and 17:

Business Case for the Sunshine Coas

- Page 18 and 19:

Business Case for the Sunshine Coas

- Page 20 and 21:

Business Case for the Sunshine Coas

- Page 22 and 23:

0 60 120 240 360 480 600 Meters Whi

- Page 24 and 25:

Business Case for the Sunshine Coas

- Page 26 and 27:

Business Case for the Sunshine Coas

- Page 28 and 29:

Business Case for the Sunshine Coas

- Page 30 and 31:

Business Case for the Sunshine Coas

- Page 32 and 33:

Business Case for the Sunshine Coas

- Page 34 and 35:

Business Case for the Sunshine Coas

- Page 36 and 37:

Business Case for the Sunshine Coas

- Page 38 and 39:

Business Case for the Sunshine Coas

- Page 40 and 41:

Business Case for the Sunshine Coas

- Page 42 and 43:

Business Case for the Sunshine Coas

- Page 44 and 45:

Business Case for the Sunshine Coas

- Page 46 and 47:

Sunshine Coast Airport Master Plan

- Page 48 and 49:

Acknowledgement This Master Plan ha

- Page 50 and 51:

1 Executive Summary 1.1 Introductio

- Page 52 and 53:

1.6 Peak Stand Demand FIGURE 1-3 BU

- Page 54 and 55:

TABLE 1-2 PARKING DEMAND FORECAST Y

- Page 56 and 57:

1.12 2020 Master Plan A layout show

- Page 58 and 59:

1 Introduction 1.1 Sunshine Coast A

- Page 60 and 61:

723 submissions were received from

- Page 62 and 63:

2 Aviation Demand Forecast 2.1 Hist

- Page 64 and 65:

FIGURE 2-3 HISTORIC AND FORECAST AN

- Page 66 and 67:

FIGURE 2-6 HISTORIC AND FORECAST AN

- Page 68 and 69:

2.5 Peak Stand Demand Peak stand de

- Page 70 and 71:

FIGURE 3-1 RPT APRON LAYOUT 3.3.2 G

- Page 72 and 73:

4 Passenger Terminal 4.1 Terminal T

- Page 74 and 75:

FIGURE 4-1 2020 TERMINAL LAYOUT CON

- Page 76 and 77:

access road is constructed the airp

- Page 78 and 79:

6 Runways 6.1 Existing Facilities S

- Page 80 and 81:

The public consultation which accom

- Page 82 and 83:

7 Taxiways 7.1 Runway 18/36 Taxiway

- Page 84 and 85:

Sunshine Coast Airport has recently

- Page 86 and 87:

FIGURE 8-1 AVIATION SUPPORT FACILIT

- Page 88 and 89:

9 Master Plan 9.1 2020 Master Plan

- Page 90 and 91:

10 Environmental Impacts 10.1 Aircr

- Page 92 and 93:

Arrivals, departures and training c

- Page 94 and 95:

♦ Figure 10-2 : 2025 New Runway 1

- Page 96 and 97:

10.1.8 Flight Path Movement Chart I

- Page 98 and 99:

Boronia rosmarinifolia Eucalyptus c

- Page 100 and 101:

FIGURE 10-8 OBSTACLE LIMITATION SUR

- Page 102 and 103:

Development Commence detailed studi

- Page 104 and 105:

Appendices Appendix A - Schedule of

- Page 106 and 107:

Date Organisation Position 28-04-05

- Page 108 and 109:

Appendix B - SCA Public Participati

- Page 110 and 111:

A media relations campaign was also

- Page 112 and 113:

appendix b Project Implementation S

- Page 114 and 115:

New Runway Project Strategy Documen

- Page 116 and 117:

New Runway Project Strategy Glossar

- Page 118 and 119:

New Runway Project Strategy Table o

- Page 120 and 121:

New Runway Project Strategy Executi

- Page 122 and 123:

New Runway Project Strategy Milesto

- Page 124 and 125:

New Runway Project Strategy Feasibi

- Page 126 and 127:

New Runway Project Strategy Project

- Page 128 and 129:

New Runway Project Strategy 1. Intr

- Page 130 and 131:

New Runway Project Strategy 2.4.2.

- Page 132 and 133:

New Runway Project Strategy obligat

- Page 134 and 135:

New Runway Project Strategy 2.10. F

- Page 136 and 137:

New Runway Project Strategy 3. New

- Page 138 and 139:

New Runway Project Strategy 3.6. As

- Page 140 and 141:

New Runway Project Strategy 3.9.1.

- Page 142 and 143:

New Runway Project Strategy 4. Stak

- Page 144 and 145:

New Runway Project Strategy 5. Feas

- Page 146 and 147:

New Runway Project Strategy 6. Work

- Page 148 and 149:

New Runway Project Strategy 7. Proj

- Page 150 and 151:

New Runway Project Strategy 8. Proj

- Page 152 and 153:

New Runway Project Strategy Council

- Page 154 and 155:

New Runway Project Strategy o New b

- Page 156 and 157:

New Runway Project Strategy 9.4. Fo

- Page 158 and 159:

New Runway Project Strategy 10.7. R

- Page 160 and 161:

New Runway Project Strategy Vol X.0

- Page 162 and 163:

New Runway Project Strategy 12. Pro

- Page 164 and 165:

New Runway Project Strategy 13.5. R

- Page 166 and 167:

New Runway Project Strategy preferr

- Page 168 and 169:

Appendix 1 to Sunshine Coast Airpor

- Page 170 and 171:

Appendix 2 to Sunshine Coast Airpor

- Page 172 and 173:

Appendix 3 to Sunshine Coast Airpor

- Page 174 and 175:

Appendix 5 to Sunshine Coast Airpor

- Page 176 and 177:

Appendix 7 to Sunshine Coast Airpor

- Page 178 and 179:

Sunshine Coast Airport Traffic Fore

- Page 180 and 181:

10. Glossary.......................

- Page 182 and 183:

2 2. Sunshine Coast Airport Traffic

- Page 184 and 185:

4 Table 2.1: Sunshine Coast Airport

- Page 186 and 187:

6 2.3 Current Airline Services As a

- Page 188 and 189:

8 3. Forecast Approach & Review of

- Page 190 and 191:

Australian aviation has not felt th

- Page 192 and 193:

In its review of possible strongly

- Page 194 and 195:

14 • Qantas Group firm orders red

- Page 196 and 197:

16 • Melbourne-Shanghai services

- Page 198 and 199:

In the IVS and NVS the ‘Sunshine

- Page 200 and 201: 20 • The Sunshine Coast’s labou

- Page 202 and 203: 22 5. Forecast Scenarios and Outcom

- Page 204 and 205: 24 o New Asian route(s) added leadi

- Page 206 and 207: Figure 5.1 presents the passenger m

- Page 208 and 209: 28 6. Busy Hour Analysis 6.1 Review

- Page 210 and 211: 30 Seats/Aircraft: Table 6.3: Busy

- Page 212 and 213: 32 Table 7.2: Sunshine Coast Gross

- Page 214 and 215: 34 8.2 Current Airline Routes and F

- Page 216 and 217: 36 9. Attachment 3: Potential Impac

- Page 218 and 219: 38 10. Glossary Data Sourced from t

- Page 220 and 221: 40 DISCLAIMER The Forecasts describ

- Page 222: Sunshine Coast Airport Airport Mast

- Page 227 and 228: 1 Executive Summary

- Page 229 and 230: Executive Summary The types of econ

- Page 231 and 232: 2 Background

- Page 233 and 234: Background 2.2 Contract requirement

- Page 235 and 236: Background Sunshine Coast Airport P

- Page 237 and 238: Approach and methodology 3.1 Overvi

- Page 239 and 240: Approach and methodology 3.2 Method

- Page 241 and 242: Approach and methodology 3.3 Method

- Page 243 and 244: Approach and methodology Components

- Page 245 and 246: Approach and methodology Components

- Page 247 and 248: Approach and methodology 3.4.4 Othe

- Page 249: Approach and methodology 3.5 Method

- Page 253 and 254: Results and discussion 10,000 Passe

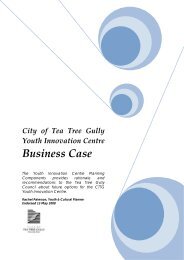

- Page 255 and 256: Results and discussion PV Revenue -

- Page 257 and 258: The NPVs for each of the precincts

- Page 259 and 260: Results and discussion 4.4 Economic

- Page 261 and 262: Results and discussion PV monetised

- Page 263 and 264: Results and discussion Indirect emp

- Page 265 and 266: Results and discussion 4.5 Consolid

- Page 267 and 268: Results and discussion 4.5.1 Result

- Page 269 and 270: Results and discussion The overall

- Page 271 and 272: Results and discussion Economic ind

- Page 273 and 274: Results and discussion Alternative

- Page 275 and 276: 5 Conclusions and recommendations

- Page 277: Appendices

- Page 280 and 281: Appendix B Key assumptions NOT FOR

- Page 282 and 283: Appendix D Demand Summary NOT FOR P

- Page 284 and 285: pwc.com.au © 2009 PricewaterhouseC

- Page 286 and 287: 0 2.5 5 10 15 20 Kilometers 1 cm =

- Page 288 and 289: appendix f Infrastructure Australia

- Page 291 and 292: INFRASTRUCTURE AUSTRALIA REFORM AND

- Page 293 and 294: ü Build on Australias global compe

- Page 295 and 296: Stage 1: Goal Definition national a

- Page 297 and 298: Stage 1: Goal Definition which is i

- Page 299 and 300: Stage 1: Goal Definition and operat

- Page 301 and 302:

Stage 2 and 3: Problem Identificati

- Page 303 and 304:

Stage 2 and 3: Problem Identificati

- Page 305 and 306:

Stage 4: Problem Analysis Outline t

- Page 307 and 308:

Stage 5: Option Generation The Bris

- Page 309 and 310:

Stage 5: Option Generation Convenie

- Page 311 and 312:

Stage 5: Option Generation vii. inc

- Page 313 and 314:

Stage 5: Option Generation charges

- Page 315 and 316:

INFRASTRUCTURE AUSTRALIA REFORM AND

- Page 317 and 318:

DETAILED APPRAISAL This section set

- Page 319 and 320:

Cost Estimation The capital and ope

- Page 321 and 322:

A risk assessment should be underta

- Page 323 and 324:

Non-Monetised Benefits and Costs Th

- Page 325 and 326:

Discounted airfares provided by low

- Page 327 and 328:

30m wide runway. SCA is one of four

- Page 329 and 330:

SCA is included in the regional pla

- Page 331 and 332:

SCRC’s draft economic development

- Page 333 and 334:

Key directions to guide the prepara

- Page 335 and 336:

It is estimated that the current te

- Page 337 and 338:

· $143m for other Master Plan proj

- Page 339 and 340:

Operating costs have not been indep

- Page 341 and 342:

The number of passenger hours saved

- Page 343 and 344:

Airline savings are calculated usin

- Page 345 and 346:

Incremental expenditure is calculat

- Page 347 and 348:

23 | P a g e KEY ASSUMPTIONS UNDERP

- Page 349 and 350:

Appraisal Summary Table 2 MONETISED

- Page 351 and 352:

Incremental returns from leased pre

- Page 353 and 354:

Savings from avoided out-bound dela

- Page 355 and 356:

As noted above, all outputs for the

- Page 357 and 358:

6 | P a g e Airline savings from av

- Page 359 and 360:

Sensitivity test # Variation Benefi

- Page 361 and 362:

Appraisal Summary Table 4 NON-MONET

- Page 363 and 364:

Appraisal Summary Table 5 INFORMATI

- Page 365 and 366:

DELIVERABILITY ASSESSMENT Criteria

- Page 367 and 368:

DELIVERABILITY ASSESSMENT time, as

- Page 369:

DELIVERABILITY ASSESSMENT 5.Does th