Business Case for the SunShine CoaSt airport Master Plan

Business Case for the SunShine CoaSt airport Master Plan

Business Case for the SunShine CoaSt airport Master Plan

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Business</strong> <strong>Case</strong> <strong>for</strong> <strong>the</strong> Sunshine Coast Airport n <strong>Master</strong> <strong>Plan</strong> (November 2009)<br />

06.2 <strong>Master</strong> <strong>Plan</strong>-<br />

Related Precinct<br />

Analysis precinct<br />

analysis<br />

As part of its analysis, PwC also<br />

conducted an analysis of <strong>the</strong> <strong>airport</strong><br />

precinct to determine whe<strong>the</strong>r surplus<br />

revenues from o<strong>the</strong>r <strong>airport</strong> operations<br />

might be available to cross-subsidise<br />

<strong>the</strong> runway/RPT projects.<br />

It is estimated <strong>the</strong> current terminal<br />

(as it is expected to be configured<br />

following an intermediate $9 million<br />

expansion) will reach functional<br />

capacity by approximately 2023.<br />

This capacity constraint is primarily<br />

driven by peak stand constraints and<br />

associated passenger processing/<br />

baggage handling constraints. The<br />

<strong>Master</strong> <strong>Plan</strong>, <strong>the</strong>re<strong>for</strong>e, provides <strong>for</strong> a<br />

future expansion and relocation of <strong>the</strong><br />

existing terminal to meet <strong>the</strong> expected<br />

level of passenger demand.<br />

Additional facilities <strong>for</strong> long and shortterm<br />

car parking are also included in<br />

<strong>the</strong> <strong>Master</strong> <strong>Plan</strong>, located adjacent to<br />

<strong>the</strong> proposed new terminal building.<br />

Aviation support and o<strong>the</strong>r<br />

commercial facilities are planned in<br />

<strong>the</strong> surrounding <strong>airport</strong> precincts.<br />

These precincts are to be offered <strong>for</strong><br />

lease as vacant, serviced land – it is<br />

expected that o<strong>the</strong>r parties would<br />

fund building costs.<br />

The total capital cost of <strong>the</strong> <strong>Master</strong><br />

<strong>Plan</strong> precincts is approximately<br />

$142.8 million, including:<br />

■ ■ $18 million <strong>for</strong> <strong>the</strong> new car parking<br />

facilities,<br />

■ ■ $66.2 million <strong>for</strong> <strong>the</strong> new terminal<br />

facilities, including initial terminal<br />

development and second<br />

stage expansion (excluding <strong>the</strong><br />

aeronautical allocation of terminal<br />

costs) 8 ,<br />

■ ■ $3 million <strong>for</strong> fire and rescue<br />

facilities, and<br />

■ ■ $55.6 million <strong>for</strong> <strong>the</strong> commercial<br />

precincts.<br />

This equates to a present value total<br />

cost of $52.2 million. The addition of<br />

incremental operating costs brings<br />

<strong>the</strong> total present value cost of <strong>the</strong><br />

precincts to $55 million.<br />

The precinct analysis indicates<br />

that, <strong>for</strong> <strong>the</strong> terminal and car park<br />

developments, expected revenue<br />

from incremental passengers would<br />

be insufficient to provide any surplus.<br />

While <strong>the</strong> terminal and car park are<br />

expected to be self-funding from a<br />

financial perspective, a significant<br />

level of revenue will be derived from<br />

existing (or base case) passengers<br />

and thus is omitted from PwC’s<br />

incremental financial and economic<br />

analysis.<br />

Likewise, <strong>the</strong> commercial precinct<br />

analysis indicated that over <strong>the</strong> model<br />

period, no surplus would be available<br />

to SCA, based on expected net rental<br />

yields, although <strong>the</strong> magnitude of<br />

this surplus (or deficiency) is small in<br />

comparison to <strong>the</strong> funding required.<br />

The Net Present Values (NPVs) <strong>for</strong><br />

each of <strong>the</strong> precincts is provided in<br />

<strong>the</strong> following table:<br />

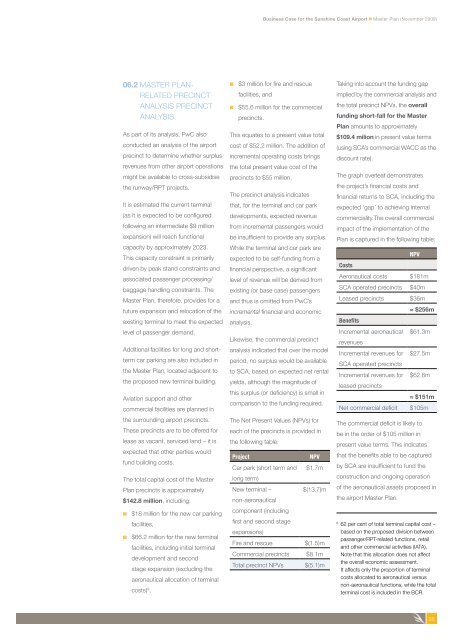

Project<br />

Car park (short term and<br />

long term)<br />

New terminal –<br />

non-aeronautical<br />

component (including<br />

first and second stage<br />

expansions)<br />

Fire and rescue<br />

Commercial precincts<br />

Total precinct NPVs<br />

NPV<br />

$1.7m<br />

$(13.7)m<br />

$(1.5)m<br />

$8.1m<br />

$(5.1)m<br />

Taking into account <strong>the</strong> funding gap<br />

implied by <strong>the</strong> commercial analysis and<br />

<strong>the</strong> total precinct NPVs, <strong>the</strong> overall<br />

funding short-fall <strong>for</strong> <strong>the</strong> <strong>Master</strong><br />

<strong>Plan</strong> amounts to approximately<br />

$109.4 milion in present value terms<br />

(using SCA’s commercial WACC as <strong>the</strong><br />

discount rate).<br />

The graph overleaf demonstrates<br />

<strong>the</strong> project’s financial costs and<br />

financial returns to SCA, including <strong>the</strong><br />

expected ‘gap’ to achieving internal<br />

commerciality.The overall commercial<br />

impact of <strong>the</strong> implementation of <strong>the</strong><br />

<strong>Plan</strong> is captured in <strong>the</strong> following table:<br />

NPV<br />

Costs<br />

Aeronautical costs $181m<br />

SCA operated precincts $40m<br />

Leased precincts $36m<br />

≈ $256m<br />

Benefits<br />

Incremental aeronautical $61.3m<br />

revenues<br />

Incremental revenues <strong>for</strong> $27.5m<br />

SCA operated precincts<br />

Incremental revenues <strong>for</strong> $62.6m<br />

leased precincts<br />

≈ $151m<br />

Net commercial deficit $105m<br />

The commercial deficit is likely to<br />

be in <strong>the</strong> order of $105 million in<br />

present value terms. This indicates<br />

that <strong>the</strong> benefits able to be captured<br />

by SCA are insufficient to fund <strong>the</strong><br />

construction and ongoing operation<br />

of <strong>the</strong> aeronautical assets proposed in<br />

<strong>the</strong> <strong>airport</strong> <strong>Master</strong> <strong>Plan</strong>.<br />

8<br />

62 per cent of total terminal capital cost –<br />

based on <strong>the</strong> proposed division between<br />

passenger/RPT-related functions, retail<br />

and o<strong>the</strong>r commercial activities (IATA).<br />

Note that this allocation does not affect<br />

<strong>the</strong> overall economic assessment.<br />

It affects only <strong>the</strong> proportion of terminal<br />

costs allocated to aeronautical versus<br />

non-aeronautical functions, while <strong>the</strong> total<br />

terminal cost is included in <strong>the</strong> BCR.<br />

28