Annual Report 2012

Annual Report 2012

Annual Report 2012

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

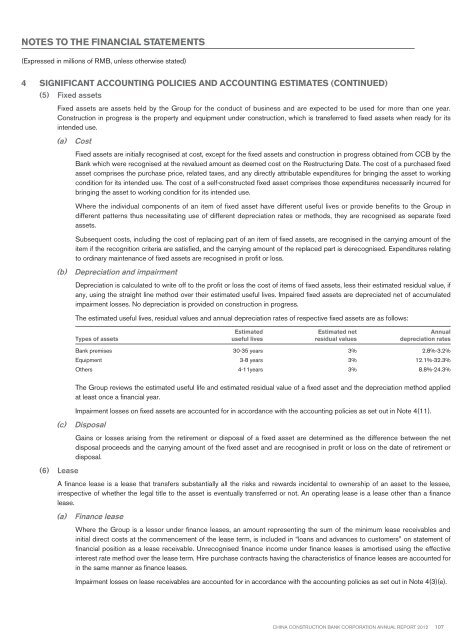

Notes to the financial statements(Expressed in millions of RMB, unless otherwise stated)4 Significant accounting policies and accounting estimates (continued)(5) Fixed assetsFixed assets are assets held by the Group for the conduct of business and are expected to be used for more than one year.Construction in progress is the property and equipment under construction, which is transferred to fixed assets when ready for itsintended use.(a)CostFixed assets are initially recognised at cost, except for the fixed assets and construction in progress obtained from CCB by theBank which were recognised at the revalued amount as deemed cost on the Restructuring Date. The cost of a purchased fixedasset comprises the purchase price, related taxes, and any directly attributable expenditures for bringing the asset to workingcondition for its intended use. The cost of a self-constructed fixed asset comprises those expenditures necessarily incurred forbringing the asset to working condition for its intended use.Where the individual components of an item of fixed asset have different useful lives or provide benefits to the Group indifferent patterns thus necessitating use of different depreciation rates or methods, they are recognised as separate fixedassets.Subsequent costs, including the cost of replacing part of an item of fixed assets, are recognised in the carrying amount of theitem if the recognition criteria are satisfied, and the carrying amount of the replaced part is derecognised. Expenditures relatingto ordinary maintenance of fixed assets are recognised in profit or loss.(b) Depreciation and impairmentDepreciation is calculated to write off to the profit or loss the cost of items of fixed assets, less their estimated residual value, ifany, using the straight line method over their estimated useful lives. Impaired fixed assets are depreciated net of accumulatedimpairment losses. No depreciation is provided on construction in progress.The estimated useful lives, residual values and annual depreciation rates of respective fixed assets are as follows:Types of assetsEstimateduseful livesEstimated netresidual values<strong>Annual</strong>depreciation ratesBank premises 30-35 years 3% 2.8%-3.2%Equipment 3-8 years 3% 12.1%-32.3%Others 4-11years 3% 8.8%-24.3%The Group reviews the estimated useful life and estimated residual value of a fixed asset and the depreciation method appliedat least once a financial year.Impairment losses on fixed assets are accounted for in accordance with the accounting policies as set out in Note 4(11).(c)Disposal(6) LeaseGains or losses arising from the retirement or disposal of a fixed asset are determined as the difference between the netdisposal proceeds and the carrying amount of the fixed asset and are recognised in profit or loss on the date of retirement ordisposal.A finance lease is a lease that transfers substantially all the risks and rewards incidental to ownership of an asset to the lessee,irrespective of whether the legal title to the asset is eventually transferred or not. An operating lease is a lease other than a financelease.(a)Finance leaseWhere the Group is a lessor under finance leases, an amount representing the sum of the minimum lease receivables andinitial direct costs at the commencement of the lease term, is included in “loans and advances to customers” on statement offinancial position as a lease receivable. Unrecognised finance income under finance leases is amortised using the effectiveinterest rate method over the lease term. Hire purchase contracts having the characteristics of finance leases are accounted forin the same manner as finance leases.Impairment losses on lease receivables are accounted for in accordance with the accounting policies as set out in Note 4(3)(e).China Construction Bank Corporation annual report <strong>2012</strong>107