Annual Report 2012

Annual Report 2012

Annual Report 2012

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

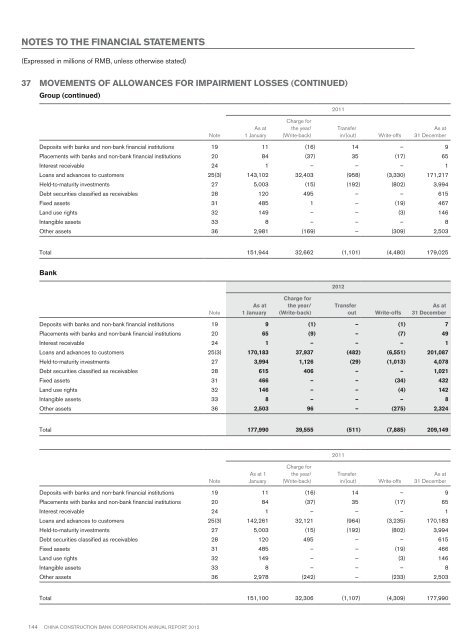

Notes to the financial statements(Expressed in millions of RMB, unless otherwise stated)37 Movements of allowances for impairment losses (continued)Group (continued)NoteAs at1 JanuaryCharge forthe year/(Write-back)2011Transferin/(out)Write-offsAs at31 DecemberDeposits with banks and non-bank financial institutions 19 11 (16) 14 – 9Placements with banks and non-bank financial institutions 20 84 (37) 35 (17) 65Interest receivable 24 1 – – – 1Loans and advances to customers 25(3) 143,102 32,403 (958) (3,330) 171,217Held-to-maturity investments 27 5,003 (15) (192) (802) 3,994Debt securities classified as receivables 28 120 495 – – 615Fixed assets 31 485 1 – (19) 467Land use rights 32 149 – – (3) 146Intangible assets 33 8 – – – 8Other assets 36 2,981 (169) – (309) 2,503Total 151,944 32,662 (1,101) (4,480) 179,025BankNoteAs at1 JanuaryCharge forthe year/(Write-back)<strong>2012</strong>TransferoutWrite-offsAs at31 DecemberDeposits with banks and non-bank financial institutions 19 9 (1) – (1) 7Placements with banks and non-bank financial institutions 20 65 (9) – (7) 49Interest receivable 24 1 – – – 1Loans and advances to customers 25(3) 170,183 37,937 (482) (6,551) 201,087Held-to-maturity investments 27 3,994 1,126 (29) (1,013) 4,078Debt securities classified as receivables 28 615 406 – – 1,021Fixed assets 31 466 – – (34) 432Land use rights 32 146 – – (4) 142Intangible assets 33 8 – – – 8Other assets 36 2,503 96 – (275) 2,324Total 177,990 39,555 (511) (7,885) 209,149NoteAs at 1JanuaryCharge forthe year/(Write-back)2011Transferin/(out)Write-offsAs at31 DecemberDeposits with banks and non-bank financial institutions 19 11 (16) 14 – 9Placements with banks and non-bank financial institutions 20 84 (37) 35 (17) 65Interest receivable 24 1 – – – 1Loans and advances to customers 25(3) 142,261 32,121 (964) (3,235) 170,183Held-to-maturity investments 27 5,003 (15) (192) (802) 3,994Debt securities classified as receivables 28 120 495 – – 615Fixed assets 31 485 – – (19) 466Land use rights 32 149 – – (3) 146Intangible assets 33 8 – – – 8Other assets 36 2,978 (242) – (233) 2,503Total 151,100 32,306 (1,107) (4,309) 177,990144 China Construction Bank Corporation annual report <strong>2012</strong>