Annual Report 2012

Annual Report 2012

Annual Report 2012

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

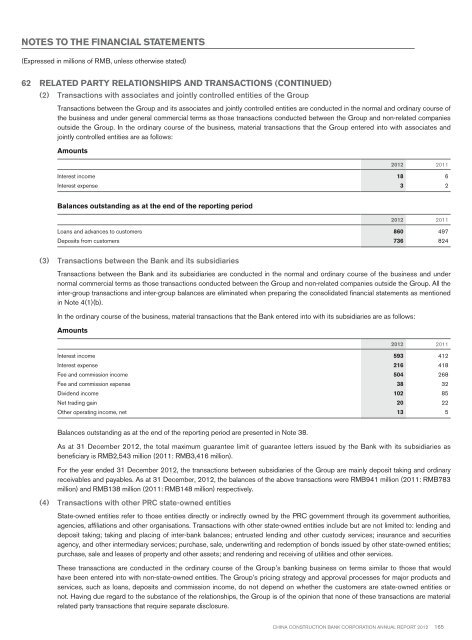

Notes to the financial statements(Expressed in millions of RMB, unless otherwise stated)62 Related party relationships and transactions (continued)(2) Transactions with associates and jointly controlled entities of the GroupTransactions between the Group and its associates and jointly controlled entities are conducted in the normal and ordinary course ofthe business and under general commercial terms as those transactions conducted between the Group and non-related companiesoutside the Group. In the ordinary course of the business, material transactions that the Group entered into with associates andjointly controlled entities are as follows:Amounts<strong>2012</strong> 2011Interest income 18 6Interest expense 3 2Balances outstanding as at the end of the reporting period<strong>2012</strong> 2011Loans and advances to customers 860 497Deposits from customers 736 824(3) Transactions between the Bank and its subsidiariesTransactions between the Bank and its subsidiaries are conducted in the normal and ordinary course of the business and undernormal commercial terms as those transactions conducted between the Group and non-related companies outside the Group. All theinter-group transactions and inter-group balances are eliminated when preparing the consolidated financial statements as mentionedin Note 4(1)(b).In the ordinary course of the business, material transactions that the Bank entered into with its subsidiaries are as follows:Amounts<strong>2012</strong> 2011Interest income 593 412Interest expense 216 418Fee and commission income 504 268Fee and commission expense 38 32Dividend income 102 85Net trading gain 20 22Other operating income, net 13 5Balances outstanding as at the end of the reporting period are presented in Note 38.As at 31 December <strong>2012</strong>, the total maximum guarantee limit of guarantee letters issued by the Bank with its subsidiaries asbeneficiary is RMB2,543 million (2011: RMB3,416 million).For the year ended 31 December <strong>2012</strong>, the transactions between subsidiaries of the Group are mainly deposit taking and ordinaryreceivables and payables. As at 31 December, <strong>2012</strong>, the balances of the above transactions were RMB941 million (2011: RMB783million) and RMB138 million (2011: RMB148 million) respectively.(4) Transactions with other PRC state-owned entitiesState-owned entities refer to those entities directly or indirectly owned by the PRC government through its government authorities,agencies, affiliations and other organisations. Transactions with other state-owned entities include but are not limited to: lending anddeposit taking; taking and placing of inter-bank balances; entrusted lending and other custody services; insurance and securitiesagency, and other intermediary services; purchase, sale, underwriting and redemption of bonds issued by other state-owned entities;purchase, sale and leases of property and other assets; and rendering and receiving of utilities and other services.These transactions are conducted in the ordinary course of the Group’s banking business on terms similar to those that wouldhave been entered into with non-state-owned entities. The Group’s pricing strategy and approval processes for major products andservices, such as loans, deposits and commission income, do not depend on whether the customers are state-owned entities ornot. Having due regard to the substance of the relationships, the Group is of the opinion that none of these transactions are materialrelated party transactions that require separate disclosure.China Construction Bank Corporation annual report <strong>2012</strong>165