Annual Report 2012

Annual Report 2012

Annual Report 2012

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

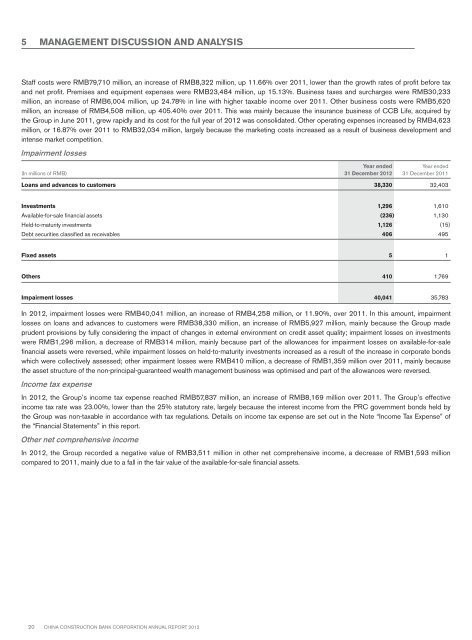

5 MANAGEMENT DISCUSSION AND ANALYSISStaff costs were RMB79,710 million, an increase of RMB8,322 million, up 11.66% over 2011, lower than the growth rates of profit before taxand net profit. Premises and equipment expenses were RMB23,484 million, up 15.13%. Business taxes and surcharges were RMB30,233million, an increase of RMB6,004 million, up 24.78% in line with higher taxable income over 2011. Other business costs were RMB5,620million, an increase of RMB4,508 million, up 405.40% over 2011. This was mainly because the insurance business of CCB Life, acquired bythe Group in June 2011, grew rapidly and its cost for the full year of <strong>2012</strong> was consolidated. Other operating expenses increased by RMB4,623million, or 16.87% over 2011 to RMB32,034 million, largely because the marketing costs increased as a result of business development andintense market competition.Impairment losses(In millions of RMB)Year ended31 December <strong>2012</strong>Year ended31 December 2011Loans and advances to customers 38,330 32,403Investments 1,296 1,610Available-for-sale financial assets (236) 1,130Held-to-maturity investments 1,126 (15)Debt securities classified as receivables 406 495Fixed assets 5 1Others 410 1,769Impairment losses 40,041 35,783In <strong>2012</strong>, impairment losses were RMB40,041 million, an increase of RMB4,258 million, or 11.90%, over 2011. In this amount, impairmentlosses on loans and advances to customers were RMB38,330 million, an increase of RMB5,927 million, mainly because the Group madeprudent provisions by fully considering the impact of changes in external environment on credit asset quality; impairment losses on investmentswere RMB1,296 million, a decrease of RMB314 million, mainly because part of the allowances for impairment losses on available-for-salefinancial assets were reversed, while impairment losses on held-to-maturity investments increased as a result of the increase in corporate bondswhich were collectively assessed; other impairment losses were RMB410 million, a decrease of RMB1,359 million over 2011, mainly becausethe asset structure of the non-principal-guaranteed wealth management business was optimised and part of the allowances were reversed.Income tax expenseIn <strong>2012</strong>, the Group’s income tax expense reached RMB57,837 million, an increase of RMB8,169 million over 2011. The Group’s effectiveincome tax rate was 23.00%, lower than the 25% statutory rate, largely because the interest income from the PRC government bonds held bythe Group was non-taxable in accordance with tax regulations. Details on income tax expense are set out in the Note “Income Tax Expense” ofthe “Financial Statements” in this report.Other net comprehensive incomeIn <strong>2012</strong>, the Group recorded a negative value of RMB3,511 million in other net comprehensive income, a decrease of RMB1,593 millioncompared to 2011, mainly due to a fall in the fair value of the available-for-sale financial assets.20 China Construction Bank Corporation annual report <strong>2012</strong>