Annual Report 2012

Annual Report 2012

Annual Report 2012

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

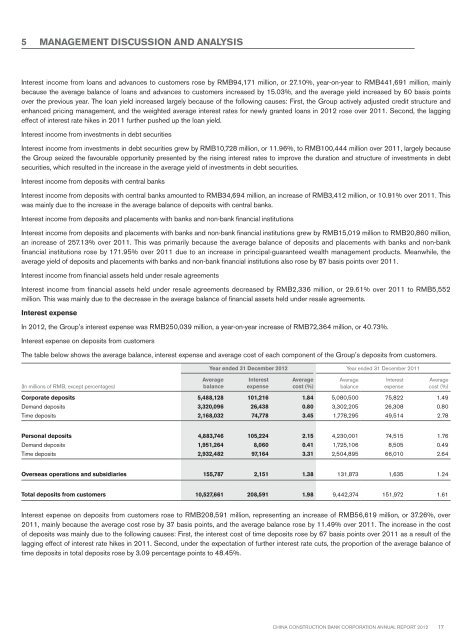

5 MANAGEMENT DISCUSSION AND ANALYSISInterest income from loans and advances to customers rose by RMB94,171 million, or 27.10%, year-on-year to RMB441,691 million, mainlybecause the average balance of loans and advances to customers increased by 15.03%, and the average yield increased by 60 basis pointsover the previous year. The loan yield increased largely because of the following causes: First, the Group actively adjusted credit structure andenhanced pricing management, and the weighted average interest rates for newly granted loans in <strong>2012</strong> rose over 2011. Second, the laggingeffect of interest rate hikes in 2011 further pushed up the loan yield.Interest income from investments in debt securitiesInterest income from investments in debt securities grew by RMB10,728 million, or 11.96%, to RMB100,444 million over 2011, largely becausethe Group seized the favourable opportunity presented by the rising interest rates to improve the duration and structure of investments in debtsecurities, which resulted in the increase in the average yield of investments in debt securities.Interest income from deposits with central banksInterest income from deposits with central banks amounted to RMB34,694 million, an increase of RMB3,412 million, or 10.91% over 2011. Thiswas mainly due to the increase in the average balance of deposits with central banks.Interest income from deposits and placements with banks and non-bank financial institutionsInterest income from deposits and placements with banks and non-bank financial institutions grew by RMB15,019 million to RMB20,860 million,an increase of 257.13% over 2011. This was primarily because the average balance of deposits and placements with banks and non-bankfinancial institutions rose by 171.95% over 2011 due to an increase in principal-guaranteed wealth management products. Meanwhile, theaverage yield of deposits and placements with banks and non-bank financial institutions also rose by 87 basis points over 2011.Interest income from financial assets held under resale agreementsInterest income from financial assets held under resale agreements decreased by RMB2,336 million, or 29.61% over 2011 to RMB5,552million. This was mainly due to the decrease in the average balance of financial assets held under resale agreements.Interest expenseIn <strong>2012</strong>, the Group’s interest expense was RMB250,039 million, a year-on-year increase of RMB72,364 million, or 40.73%.Interest expense on deposits from customersThe table below shows the average balance, interest expense and average cost of each component of the Group’s deposits from customers.Year ended 31 December <strong>2012</strong> Year ended 31 December 2011(In millions of RMB, except percentages)AveragebalanceInterestexpenseAveragecost (%)AveragebalanceInterestexpenseAveragecost (%)Corporate deposits 5,488,128 101,216 1.84 5,080,500 75,822 1.49Demand deposits 3,320,096 26,438 0.80 3,302,205 26,308 0.80Time deposits 2,168,032 74,778 3.45 1,778,295 49,514 2.78Personal deposits 4,883,746 105,224 2.15 4,230,001 74,515 1.76Demand deposits 1,951,264 8,060 0.41 1,725,106 8,505 0.49Time deposits 2,932,482 97,164 3.31 2,504,895 66,010 2.64Overseas operations and subsidiaries 155,787 2,151 1.38 131,873 1,635 1.24Total deposits from customers 10,527,661 208,591 1.98 9,442,374 151,972 1.61Interest expense on deposits from customers rose to RMB208,591 million, representing an increase of RMB56,619 million, or 37.26%, over2011, mainly because the average cost rose by 37 basis points, and the average balance rose by 11.49% over 2011. The increase in the costof deposits was mainly due to the following causes: First, the interest cost of time deposits rose by 67 basis points over 2011 as a result of thelagging effect of interest rate hikes in 2011. Second, under the expectation of further interest rate cuts, the proportion of the average balance oftime deposits in total deposits rose by 3.09 percentage points to 48.45%.China Construction Bank Corporation annual report <strong>2012</strong>17