Annual Report 2012

Annual Report 2012

Annual Report 2012

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

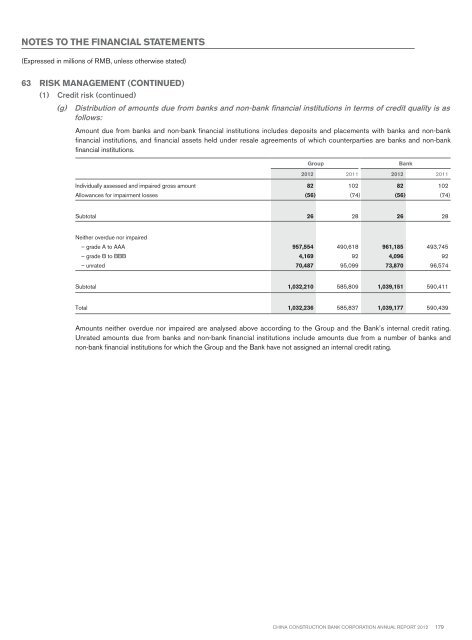

Notes to the financial statements(Expressed in millions of RMB, unless otherwise stated)63 Risk Management (continued)(1) Credit risk (continued)(g) Distribution of amounts due from banks and non-bank financial institutions in terms of credit quality is asfollows:Amount due from banks and non-bank financial institutions includes deposits and placements with banks and non-bankfinancial institutions, and financial assets held under resale agreements of which counterparties are banks and non-bankfinancial institutions.GroupBank<strong>2012</strong> 2011 <strong>2012</strong> 2011Individually assessed and impaired gross amount 82 102 82 102Allowances for impairment losses (56) (74) (56) (74)Subtotal 26 28 26 28Neither overdue nor impaired– grade A to AAA 957,554 490,618 961,185 493,745– grade B to BBB 4,169 92 4,096 92– unrated 70,487 95,099 73,870 96,574Subtotal 1,032,210 585,809 1,039,151 590,411Total 1,032,236 585,837 1,039,177 590,439Amounts neither overdue nor impaired are analysed above according to the Group and the Bank’s internal credit rating.Unrated amounts due from banks and non-bank financial institutions include amounts due from a number of banks andnon-bank financial institutions for which the Group and the Bank have not assigned an internal credit rating.China Construction Bank Corporation annual report <strong>2012</strong>179