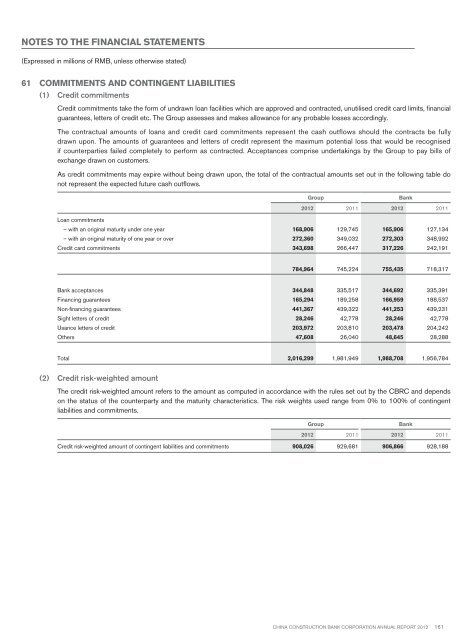

Notes to the financial statements(Expressed in millions of RMB, unless otherwise stated)61 Commitments and contingent liabilities(1) Credit commitmentsCredit commitments take the form of undrawn loan facilities which are approved and contracted, unutilised credit card limits, financialguarantees, letters of credit etc. The Group assesses and makes allowance for any probable losses accordingly.The contractual amounts of loans and credit card commitments represent the cash outflows should the contracts be fullydrawn upon. The amounts of guarantees and letters of credit represent the maximum potential loss that would be recognisedif counterparties failed completely to perform as contracted. Acceptances comprise undertakings by the Group to pay bills ofexchange drawn on customers.As credit commitments may expire without being drawn upon, the total of the contractual amounts set out in the following table donot represent the expected future cash outflows.GroupBank<strong>2012</strong> 2011 <strong>2012</strong> 2011Loan commitments– with an original maturity under one year 168,906 129,745 165,906 127,134– with an original maturity of one year or over 272,360 349,032 272,303 348,992Credit card commitments 343,698 266,447 317,226 242,191784,964 745,224 755,435 718,317Bank acceptances 344,848 335,517 344,692 335,391Financing guarantees 165,294 189,258 166,959 188,537Non-financing guarantees 441,367 439,322 441,253 439,231Sight letters of credit 28,246 42,778 28,246 42,778Usance letters of credit 203,972 203,810 203,478 204,242Others 47,608 26,040 48,645 28,288Total 2,016,299 1,981,949 1,988,708 1,956,784(2) Credit risk-weighted amountThe credit risk-weighted amount refers to the amount as computed in accordance with the rules set out by the CBRC and dependson the status of the counterparty and the maturity characteristics. The risk weights used range from 0% to 100% of contingentliabilities and commitments.GroupBank<strong>2012</strong> 2011 <strong>2012</strong> 2011Credit risk-weighted amount of contingent liabilities and commitments 908,026 929,681 906,866 928,188China Construction Bank Corporation annual report <strong>2012</strong>161

Notes to the financial statements(Expressed in millions of RMB, unless otherwise stated)61 Commitments and contingent liabilities (continued)(3) Operating lease commitmentsThe Group and the Bank lease certain property and equipment under operating leases, which typically run for an initial period of oneto five years and may include an option to renew the lease when all terms are renegotiated. As at the end of the reporting period, thefuture minimum lease payments under non-cancellable operating leases for property and equipment were as follows:GroupBank<strong>2012</strong> 2011 <strong>2012</strong> 2011Within one year 3,973 3,363 3,719 3,130After one year but within two years 2,976 2,640 2,846 2,503After two years but within three years 2,268 1,836 2,224 1,770After three years but within five years 2,699 2,130 2,678 2,113After five years 1,662 1,467 1,653 1,461Total 13,578 11,436 13,120 10,977(4) Capital commitmentsAs at the end of the reporting period, the Group and the Bank had capital commitments as follows:GroupBank<strong>2012</strong> 2011 <strong>2012</strong> 2011Contracted for 4,351 4,793 4,311 4,759Authorised but not contracted for 6,332 5,802 6,306 5,782Total 10,683 10,595 10,617 10,541(5) Underwriting obligationsAs at 31 December <strong>2012</strong>, there was no unexpired underwriting commitment of the Group and the Bank (2011: nil).(6) Government bonds redemption obligationsAs an underwriting agent of PRC government bonds, the Group has the responsibility to buy back those bonds sold by it should theholders decide to early redeem the bonds held. The redemption price for the bonds at any time before their maturity date is based onthe coupon value plus any interest unpaid and accrued up to the redemption date. Accrued interest payables to the bond holders arecalculated in accordance with relevant rules of the MOF and the PBOC. The redemption price may be different from the fair value ofsimilar instruments traded at the redemption date.The redemption obligations, which represent the nominal value of government bonds underwritten and sold by the Group and theBank, but not yet matured as at 31 December <strong>2012</strong>, were RMB49,022 million (2011: RMB72,205 million)(7) Outstanding litigation and disputesAs at 31 December <strong>2012</strong>, the Group was the defendant in certain pending litigation and disputes with gross claims of RMB2,735million (2011: RMB2,173 million). Provisions have been made for the estimated losses arising from such litigations based upon theopinions of the Group’s internal and external legal counsels (Note 47). The Group considers that the provisions made are reasonableand adequate.(8) Provision against commitments and contingent liabilitiesThe Group and the Bank assessed and made provisions for any probable outflow of economic benefits in relation to the abovecommitments and contingent liabilities in accordance with their accounting policies (Note 4 (13)).162 China Construction Bank Corporation annual report <strong>2012</strong>