Annual Report 2012

Annual Report 2012

Annual Report 2012

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

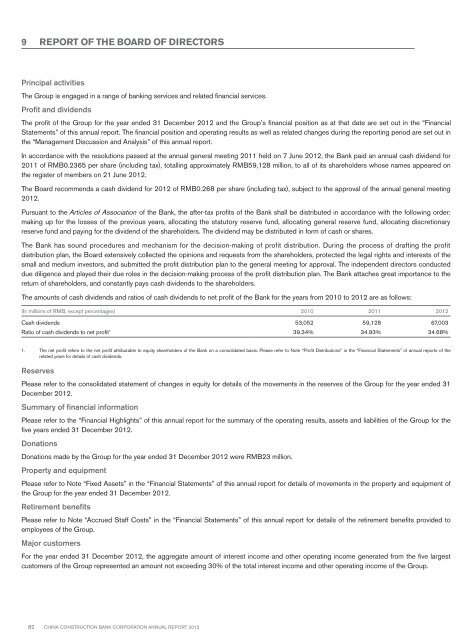

9 REPORT OF THE BOARD OF DIRECTORSPrincipal activitiesThe Group is engaged in a range of banking services and related financial services.Profit and dividendsThe profit of the Group for the year ended 31 December <strong>2012</strong> and the Group’s financial position as at that date are set out in the “FinancialStatements” of this annual report. The financial position and operating results as well as related changes during the reporting period are set out inthe “Management Discussion and Analysis” of this annual report.In accordance with the resolutions passed at the annual general meeting 2011 held on 7 June <strong>2012</strong>, the Bank paid an annual cash dividend for2011 of RMB0.2365 per share (including tax), totalling approximately RMB59,128 million, to all of its shareholders whose names appeared onthe register of members on 21 June <strong>2012</strong>.The Board recommends a cash dividend for <strong>2012</strong> of RMB0.268 per share (including tax), subject to the approval of the annual general meeting<strong>2012</strong>.Pursuant to the Articles of Association of the Bank, the after-tax profits of the Bank shall be distributed in accordance with the following order:making up for the losses of the previous years, allocating the statutory reserve fund, allocating general reserve fund, allocating discretionaryreserve fund and paying for the dividend of the shareholders. The dividend may be distributed in form of cash or shares.The Bank has sound procedures and mechanism for the decision-making of profit distribution. During the process of drafting the profitdistribution plan, the Board extensively collected the opinions and requests from the shareholders, protected the legal rights and interests of thesmall and medium investors, and submitted the profit distribution plan to the general meeting for approval. The independent directors conducteddue diligence and played their due roles in the decision-making process of the profit distribution plan. The Bank attaches great importance to thereturn of shareholders, and constantly pays cash dividends to the shareholders.The amounts of cash dividends and ratios of cash dividends to net profit of the Bank for the years from 2010 to <strong>2012</strong> are as follows:(In millions of RMB, except percentages) 2010 2011 <strong>2012</strong>Cash dividends 53,052 59,128 67,003Ratio of cash dividends to net profit 1 39.34% 34.93% 34.68%1. The net profit refers to the net profit attributable to equity shareholders of the Bank on a consolidated basis. Please refer to Note “Profit Distributions” in the “Financial Statements” of annual reports of therelated years for details of cash dividends.ReservesPlease refer to the consolidated statement of changes in equity for details of the movements in the reserves of the Group for the year ended 31December <strong>2012</strong>.Summary of financial informationPlease refer to the “Financial Highlights” of this annual report for the summary of the operating results, assets and liabilities of the Group for thefive years ended 31 December <strong>2012</strong>.DonationsDonations made by the Group for the year ended 31 December <strong>2012</strong> were RMB23 million.Property and equipmentPlease refer to Note “Fixed Assets” in the “Financial Statements” of this annual report for details of movements in the property and equipment ofthe Group for the year ended 31 December <strong>2012</strong>.Retirement benefitsPlease refer to Note “Accrued Staff Costs” in the “Financial Statements” of this annual report for details of the retirement benefits provided toemployees of the Group.Major customersFor the year ended 31 December <strong>2012</strong>, the aggregate amount of interest income and other operating income generated from the five largestcustomers of the Group represented an amount not exceeding 30% of the total interest income and other operating income of the Group.82 China Construction Bank Corporation annual report <strong>2012</strong>