Annual Report 2012

Annual Report 2012

Annual Report 2012

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

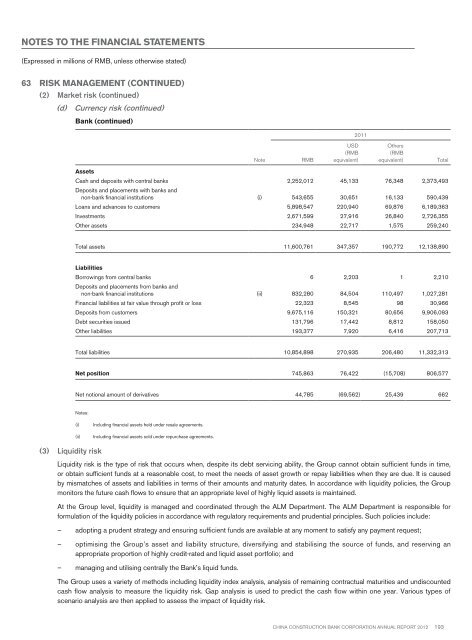

Notes to the financial statements(Expressed in millions of RMB, unless otherwise stated)63 Risk Management (continued)(2) Market risk (continued)(d) Currency risk (continued)Bank (continued)2011NoteRMBUSD(RMBequivalent)Others(RMBequivalent)TotalAssetsCash and deposits with central banks 2,252,012 45,133 76,348 2,373,493Deposits and placements with banks andnon-bank financial institutions (i) 543,655 30,651 16,133 590,439Loans and advances to customers 5,898,547 220,940 69,876 6,189,363Investments 2,671,599 27,916 26,840 2,726,355Other assets 234,948 22,717 1,575 259,240Total assets 11,600,761 347,357 190,772 12,138,890LiabilitiesBorrowings from central banks 6 2,203 1 2,210Deposits and placements from banks andnon-bank financial institutions (ii) 832,280 84,504 110,497 1,027,281Financial liabilities at fair value through profit or loss 22,323 8,545 98 30,966Deposits from customers 9,675,116 150,321 80,656 9,906,093Debt securities issued 131,796 17,442 8,812 158,050Other liabilities 193,377 7,920 6,416 207,713Total liabilities 10,854,898 270,935 206,480 11,332,313Net position 745,863 76,422 (15,708) 806,577Net notional amount of derivatives 44,785 (69,562) 25,439 662Notes:(i)(ii)Including financial assets held under resale agreements.Including financial assets sold under repurchase agreements.(3) Liquidity riskLiquidity risk is the type of risk that occurs when, despite its debt servicing ability, the Group cannot obtain sufficient funds in time,or obtain sufficient funds at a reasonable cost, to meet the needs of asset growth or repay liabilities when they are due. It is causedby mismatches of assets and liabilities in terms of their amounts and maturity dates. In accordance with liquidity policies, the Groupmonitors the future cash flows to ensure that an appropriate level of highly liquid assets is maintained.At the Group level, liquidity is managed and coordinated through the ALM Department. The ALM Department is responsible forformulation of the liquidity policies in accordance with regulatory requirements and prudential principles. Such policies include:– adopting a prudent strategy and ensuring sufficient funds are available at any moment to satisfy any payment request;– optimising the Group’s asset and liability structure, diversifying and stabilising the source of funds, and reserving anappropriate proportion of highly credit-rated and liquid asset portfolio; and– managing and utilising centrally the Bank’s liquid funds.The Group uses a variety of methods including liquidity index analysis, analysis of remaining contractual maturities and undiscountedcash flow analysis to measure the liquidity risk. Gap analysis is used to predict the cash flow within one year. Various types ofscenario analysis are then applied to assess the impact of liquidity risk.China Construction Bank Corporation annual report <strong>2012</strong>193